Aligning our business with the SDG

As a responsible bank, we have developed a sustainability strategy that incorporates our environmental and social priorities into our business activities.

We identified the risks and potential impacts of = 3,104 loans

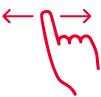

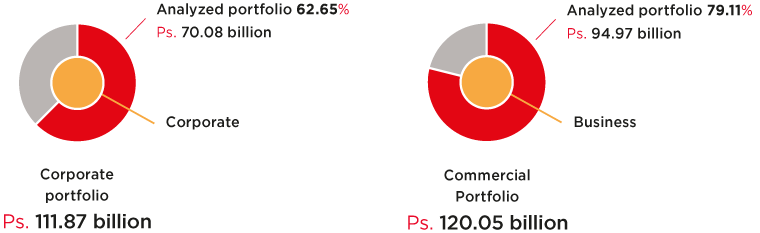

62.65% of the corporate portfolio

79.11% of the commercial portfolio

More than 1,800 employees training on Sustainability and socio environmental risk

in our first progress report to PRI

Analysis of Responsible Investment 89% of the AUM of Afore XXI and 95% of Operadora de Fondos

Ps. 9.8 bn on Sustainable Finance

Ps. 2.4 bn in green, social and sustainable bonds

102-13 / 102-19 / 102-20 / 102-21 / 102-29 / 102-30 / 102-46 / 102-47 / FS-8

At GFNorte, we want to contribute to achieving society’s goal of building a resilient future. For this reason, we are firmly committed to the United Nations Sustainable Development Objectives and the Paris Climate Agreement.

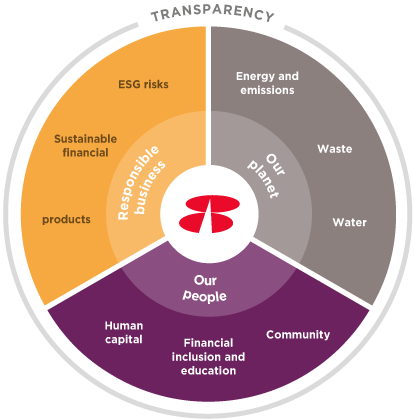

As a responsible bank, we have developed a sustainability strategy that incorporates our environmental and social priorities into our business activities, under a comprehensive transparency approach. This strategy is implemented by the Specialized Department of Sustainability and Responsible Investment, through the following model.

We incorporate environmental, social, and corporate governance (ESG) factors into our credit and investment portfolios. This enables us to manage the risks and impacts of our operations and identify potential business opportunities.

We promote social programs that involve our employees and the communities where we are present in applying practices that improve living conditions inside and outside of the institution.

We pursue initiatives to strengthen environmental culture within the institution, to measure and reduce our consumption of resources and our generation of waste.

These three pillars intersect on the fundamental aspects of human rights, climate change, and natural capital.

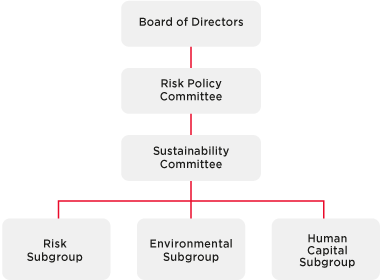

GFNorte is aware that solid corporate governance is built on principles, procedures, standards and good practices that incorporate all aspects of the business. Accordingly, in order to help the group to grow in terms of sustainability, we created a Sustainability Committee and strengthened our institutional policy framework.

The Sustainability Committee reports to Banorte’s Chief Executive Officer, and its goal is to empower our sustainability strategy, align it with the business vision and ensure that it permeates the entire organization. The Committee is made up of the directors of the Investor Relations and Financial Intelligence Risk, Credit, Human Resources, Communication, Legal, Comptroller, Audit and Sustainability departments. It operates through three sub-groups aligned with the pillars of our sustainability strategy, to promote new projects and involve all levels of the company.

The first year of work with the Risks, Environmental and Human Capital subgroups evidenced the Bank’s interest in sustainability issues and enabled us to accelerate the startup of important initiatives. We also detected areas of opportunity that will enable us to expand the involvement of members and bring about tangible results in the short term.

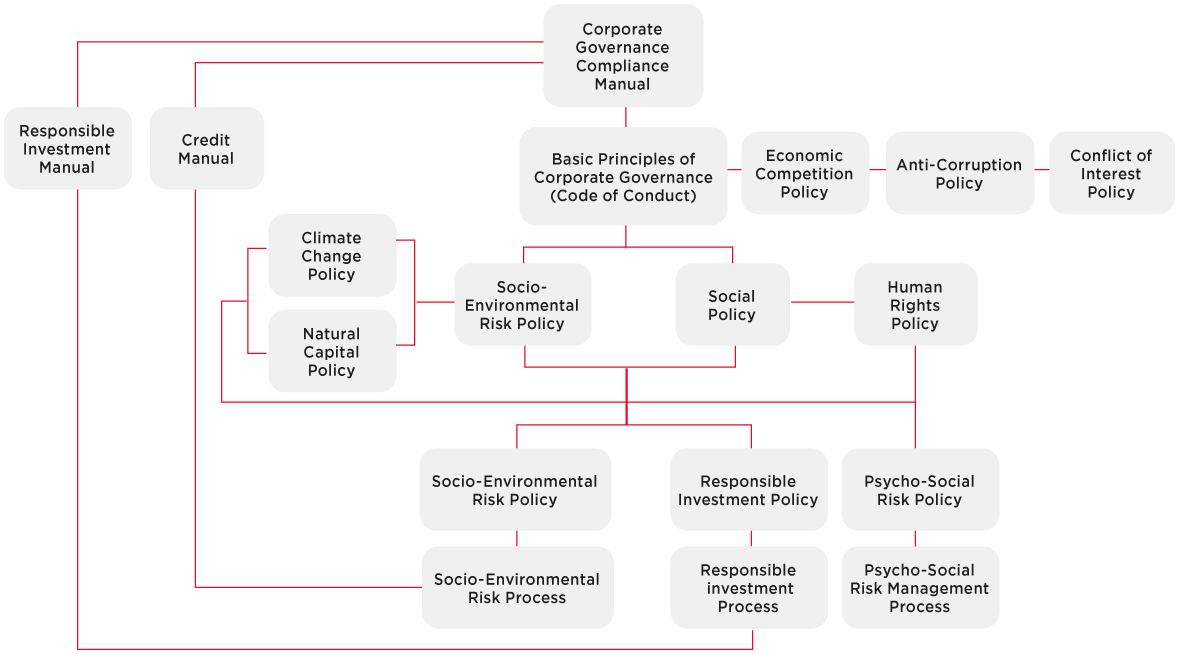

During the year, we also worked on complementing our institutional policies and bolstering the regulatory framework applicable to sustainability activities. These policies establish the commitments, references and guidelines that GFNorte must follow in the areas of the environment, society, socio-environmental risk, natural capital, human rights and climate change.

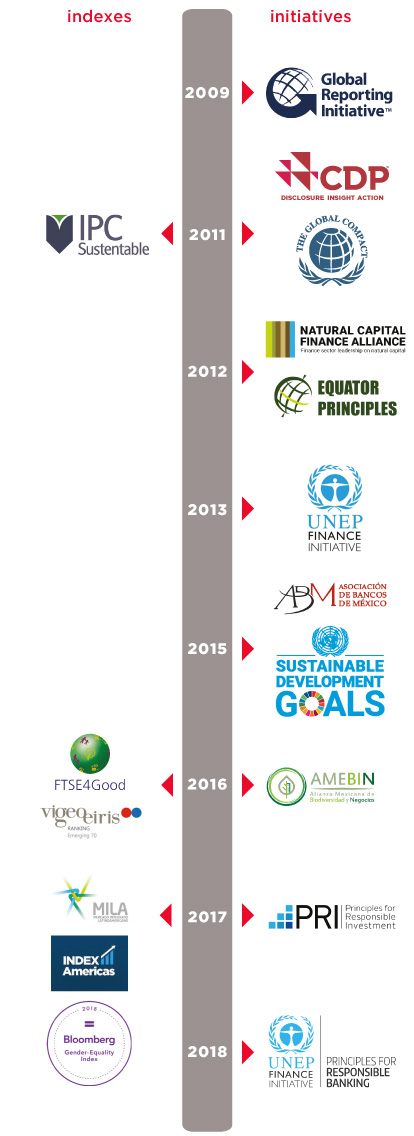

Since 2009 we have participated in significant sustainability initiatives and indexes, nationally and internationally. These guide our performance and offer us alternatives for meeting the demands of the global industry. We closely follow their directives and recommendations as part of our continuous improvement.

We believe the ratings we have earned appropriately reflect our efforts, and although they are a source of satisfaction to us, they also challenge us to demand more of ourselves year after year. Some of our results in 2018 and 2019 are shown below:

| Evaluator | 2019 | 2018 | Membership in Index |

|---|---|---|---|

| SAM Corporate Sustainability Assessment (CSA) | 61 / 100 | 65 / 100 | Dow Jones Sustainability Index MILA |

| MSCI | A | A | MSCI Mexico ESG Select Focus Index (MXN) |

| FTSE Russell | 3.9 / 5 | 3.6 / 5 | FTSE4Good Emerging Markets Latam FTSE4Good BIVA |

| CDP | B | C | |

| Bloomberg | 47.8 | 47.8 | Bloomberg Gender Equality Index (GEI) |

As founders and signing members of the Principles for Responsible Banking (PRB), we are committed to their implementation. Although we will not issue our first report until 2021, in 2019 we conducted an analysis of the status of our alignment with each of the six principles, in order to identify the areas where we can begin to work in 2020.

Our business strategy already incorporates a sustainability model, but we will be working to fortify it by incorporating the priority issues of the 2030 Agenda, the National Development Plan, internal economic projections and new materiality analyses.

As pioneers in the management of environmental and social risks, we will focus the first analysis of our contribution to the SDG on the areas of greatest financial impact for GFNorte. We will define meaningful indicators, develop methodologies for assessing positive impacts, and expand the scope of our socio-environmental risk analysis.

We are a bank whose priority is satisfying its clients and maintaining good relationships with suppliers. For this reason, we have increased our engagement with them to communicate the importance of good sustainability practices as a competitive strategy. We will develop initiatives together with our suppliers; we will increase our presence in regional meetings, and we will intensify our socio-environmental involvement with our clients.

We participate actively in various committees, boards and associations in the national and international financial industry, leading important sustainability initiatives for banking. In this area, we will work to strengthen our relationship with NGOs and government agencies in order to promote sustainable incentives.

By creating our Sustainability Committee, developing and updating policies, working with subgroups and formulating a comprehensive training plan, we will strengthen our corporate governance and responsible banking culture.

Our reporting practices are aligned with the methodologies of the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC) and the Global Compact. Furthermore, we follow the guidelines of the Equator Principles, the Responsible Investment Principles, and, starting in 2021, we will be reporting in accordance with PRB requirements.

In 2018, we carried out our first exercise in aligning our operations, products and services with the Sustainable Development Goals. We are focusing on Mexico’s social and environmental priorities toward the year 2030, as well as our own contribution to these as a financial group. To continue this exercise, last year we began to track the performance of the indicators reported.

Summary: Contribution to the SDG in 2019

| Degree of contribution | HIGH LOW |

||||

| Material Issues | |||||

| Competitiveness and Business Development |

Social and economic inclusion 4,903 hours of volunteer time 4,723 volunteers 6 Financial Education workshops |

Sustainable Business We are included in the world’s foremost Sustainability Indexes |

Energy Consumption 17.98 GJ/employee 1.97 tCO2e/mdp of net income 2.39 tCO2e/employee Energy per net income Ps. 14,815 GJ/mdp |

Proper Waste Management 1,030 metric tons of paper consumed 516.5 metric tons recycled 51 metric tons of paper avoided through digital initiatives |

Reforestation 183.68 tCO2e 7 ha 6,000 trees 23.38 CO2 eq 1 ha (Mg) over approximately five years in their adulthood |

| Product and service innovation |

Payroll and SMEs 7,706,311 payroll account 43,198 payroll companies 471,147 SMES 2,831,698 jobs generated |

Physical and Digital Infrastructure 14,182 correspondents 1,182 branches 8,919 ATMs 191,571 IB users 2,329,874 MB users |

Infrastructure Investment of Ps. 42,618 mdp in social development projects with a focus on water, urban complexes, education, energy, mobility, health and safety |

Financial products by gender 44% credit cards for women 37.82% SME loans to women 248,795 Mujer Banorte credit cards 30.93% remittance clients 131,500 Mujer Banorte debit cards |

Major Medical, Personal and Life Insurance 564,455 GMM policies 6,021,026 Personal Accident 5,183,083 Life insurance |

| Education and Development |

Salaries and benefits Reduction of the salary gap 1% gender gap - operational 10% gender gap - middle mgmt 10% gender gap - senior mgmt |

Employee Training by Gender 436,849 training hours men and 424,412 training hours women 36 hours average Investment Ps. 200 mdp |

Education and Training 14,000 training for preschool teachers 765 DILET directors 1,137 A Thousand Dreams to Fulfill stipends |

Banorte Adopts a Community 630 homes built |

Agricultural Finance and Banking 3rd in lending 208,454 Ha planted 46,860 small producers benefited |

| Socio-environmental assessment of transactions |

Environmental and Social Risk Management 3,104 loans analyzed (62.65% of corporate portfolio and 79.11% of commercial portfolio 11 projects evaluated under Equator Principles 13 under Performance Standards and 2 under SEMS Assessment |

Home and Casualty Insurance 194,152 insured homes 16,002 insured offices 1,421 hotels insured for property loss |

Renewable Energy 1,314 MW total generated Ps. 6,211 mdp assigned to projects 12 renewable projects financed Ps. 2,809 mdp assigned to performing loans in SME Eco-Loan portfolio |

Emerging Risk Mitigation 12 internal reports on status of sargassum in the Caribbean 1 report on Mexico’s single-use plastics ban |

|

| Ethics and Integrity |

Internal Policies We encourage a culture of respect in our corporate offices and in attending to our clients |

Corporate Governance We have solid corporate governance that guarantees ethical, responsible management of the business |

Integral Alliances We participate in initiatives that strengthen sustainability actions that support our business |

||

In 2018, we launched Sustainable Banorte, GFNorte’s institutional program aimed at strengthening sustainability culture through assertive communication that addresses the core issues of sustainability. Continuing this program, we carried out various campaigns, initiatives and events to actively involve our employees.

The Sustainability Ambassador Network was created in order to extend sustainability culture throughout the group, by appointing spokespersons on environmental, social, and responsible business issues. We currently have 515 ambassadors working in five administrative buildings in Mexico City and Monterrey, who server as liaisons for the Sustainability and Responsible Investment Department on topics such as:

Our first Sustainability Week was held to remind people about the sustainability pillars that govern our strategy, build awareness about how employees can contribute to sustainability in their activities, and generate individual commitments to sustainable development, as members of the organization and of society. Some of the activities were:

SDG Museum: The experience was designed to be similar to a museum visit, during which employees could learn through visual materials about the 2030 Agenda and the group’s practices regarding the Sustainable Development Goals. This helped them to recognize their role as members of a global society, to analyze their consumption behavior, and to commit to change on an individual level.

Our Planet, Our Business: With the support of the World Wildlife Fund, we participated in the launch of this Netflix chapters, whose aim was to raise awareness in the private sector about the importance of biodiversity and natural resources for businesses.

Fair Trade Fair: We held a corporate sale of hand-crafted products from communities neighboring Banorte’s corporate offices, as well as products whose sale had a positive social and environmental impact.

GFNorte believes that social, environmental and climate risks should be factored in to every business decision. We are seeing an increasing impact from these factors on economic growth, companies’ financial health, the natural environment and population. Because we are aware of our responsibility in the industry, we want to make sure that our employees, clients and peers are all aware of their importance.

Since 2012 we have been signing members of the Equator Principles and we have a Social and Environmental Risk Management System (SEMS), developed to analyze the risks and impacts of our lending in the corporate and commercial banking segments. SEMS is an integral part of the Bank’s lending process and it works based on the identification, categorization, evaluation and management of those risks.

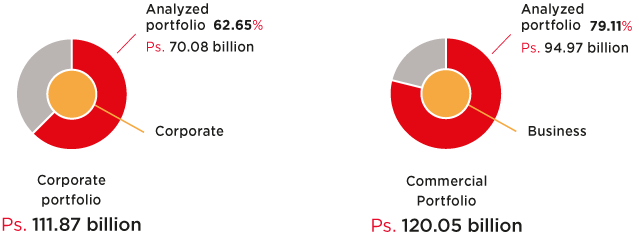

During this analysis, we identify the potential risks and impacts of our financing, and apply our exclusion list. We classify risks into categories: A for high risk, B for medium risk, and C for low risk, according to the magnitude of impact and possibilities for mitigation. We then evaluate the projects’ compliance with the Equator Principles, the IFC Performance Standards and the domestic legal framework (SEMS Assessment). Finally, we regularly follow up on projects, providing advice and contributing value to our clients.

2019 was a crucial year for risk management at GFNorte, because thanks to growing synergies between the Specialized Department of Socio-Environmental Risk Department and Risk, Credit and Business Departments, our Risk Policies Committee approved this department’s active participation as speaking member of the Central Credit Committee and National Credit Committee, demonstrating our commitment to sustainable economic development.

Figures reported exclude Infrastructure Banking.

These credits are classified as high (A), medium (B) or low (C) risk, according to the magnitude of impact and possibilities for mitigation.

Projects assessed in 2019

| Assessment framework | Category A | Category B | Category C | Total |

|---|---|---|---|---|

| Equator Principles | 3 | 8 | 0 | 11 |

| Performance standards | 0 | 10 | 3 | 13 |

| SEMS Assessment | 1 | 1 | 0 | 2 |

| Total | 4 | 19 | 3 | 26 |

Additionally, we analyzed 415 lesser-impact projects that were managed through recommendations of the IFC Industry-Specific Environmental, Health and Safety Guidelines.

We visited seven projects in the manufacturing, infrastructure, tourism and agriculture industries.We conducted an annual follow-up on 49 projects evaluated in preceding years through document reviews and reputational monitoring.

Training in the Credit and Business departments is a priority objective for strengthening a culture of socio-environmental risk management at GFNorte. We are confident that a stronger awareness and skill development can help prevent and mitigate risks. For this reason, we expanded the scope of our annual online and classroom training program, reaching more than 1,800 employees.

Infrastructure Project

Manufacturing company

Agricultural Project

Training on socio-environmental risks in 2019

Classroom |

320 hours | Lecture/workshop on socio-environmental risks in infrastructure projects, given by an independent expert | Sustainability Champions and allies in the Credit, Risk and Business Departments |

| 86 hours | Onboarding course on Banorte’s Social and Environmental Risk Management System | New hires in the Credit Department | |

Online |

1,436 hours | E-learning about socio-environmental risk management at Banorte | Risk, Credit and Business Departments |

By phone |

52 hours | Advice on identifying socio-environmental risks in loans, and follow-up on projects evaluated by SEMS | Credit and Business Departments |

Additionally, we increased the socialization of issues that impact the business, through communiqués published continually in our internal social media. Climate risks, like the massive propagation of sargassum seaweed in the Mexican Caribbean, transition risks like the new plastics law, and industry case studies, are just some examples of the topics directed at our close to 12,000 group employees.

This past year was marked by a series of events that offered stark testimony of the climate change crisis facing the world. Hurricanes, forest fires and species extinction are just some of the events we’ve seen affecting economic dynamics. In GFNorte, we are confident that banks can contribute to mitigation and adaptation to climate change through focused and concerted action together with our stakeholders.

103-1 / 103-2 / 103-3

We are convinced that by managing ESG factors when making investment decisions, we can generate long-term value for companies and markets, and prevent risks and detect opportunities in our portfolios.

With this in mind, in March 2017 we became the first financial group in Mexico to join in supporting the Principles for Responsible Investment (PRI), by which we made a commitment to integrate ASG factors into our portfolio analysis, to promote the initiative among our stakeholders, and to report on our performance.

In a similar vein, in 2019 we issued our first progress report, for which we earned an A+ rating in the strategy and governance module, positioning us as a leader in this field and ranking above the average for the Latin American market.

Our fund manager has a Responsible Investment Policy that provides a frame of reference for the order, commitments and strategy for incorporating ESG factors into our investment processes.

Given the current outlook for the Mexican market, we developed an internal methodology based on a transparency analysis of each securities issuer’s ESG factors as well as the disputes they are exposed to, which enables us to rate their level of reputational risk. During the year, the 30 most representative issuers in our portfolio (94.7% of the AUM in our equity portfolio) were assessed by both of these methodologies.

Additionally, among the products managed by Operadora de Fondos Banorte is an relative-value equity fund whose investment strategy is determined by a quantitative model which, among other factors, includes ESG factors in a positive screening process.

Furthermore, according to the GHG Protocol methodology for calculating scope 3 emissions, meaning those associated with investments, we calculate a total of 89,473.10 metric tons of CO2e, corresponding to 84.9% of investment in equity assets. These emissions correspond to public information as of fiscal year 2018, and include those issuers’ scope 1 and 2 emissions.

Finally, in conjunction with the 2 Degrees Investing Initiative (2Dii), Operadora de Fondos prepared an analysis of climate scenarios following the Task Force on Climate-Related Financial Disclosure (TCFD) recommendations in order to determine the portfolio’s exposure to transition risks, based on current and future estimated exposure to carbon-related activities. The analysis focused on assets in climate-sensitive sectors like fossil fuels, energy, automotive, aviation and mining.

In September of this year, the National Retirement Savings System Council (CONSAR) ordered retirement fund managers (Afores) to incorporate ESG factors into their equity investment analysis and strategies.

Our response was the development of an ESG Awareness strategy approved by our governance bodies, whose purpose is to classify the full universe of issuers in our investment portfolio using the internal ESG methodology. This methodology includes an analysis of risks in the management of the financed company or investment project, the risks and international trends in the industry, as well as its strengths and weaknesses.

Some of the issues incorporated into the ESG analysis are:

This analysis is complemented by information supplied by our ESG services supplier (an internationally prestigious firm), which takes into account transparency and feedback from the issuers themselves.

The scope of implementation encompasses 182 domestic issuers and fund managers (fixed-income, equity, structured and FIBRAs), accounting for approximately 89% of the fund manager’s AUM.

Furthermore, as part of our increased engagement with issuers, we have held a number of meetings to establish commitments and specific actions to incorporate sustainability guidelines into their processes. We were able to establish channels of communication with around 31% of issuers and managers.

To sustain our commitment to responsible investment, the duties of the Afore XXI Banorte Investment Committee include the following:

Last year Afore XXI Banorte became the first Mexican retirement fund manager to adopt the CFA Institute Asset Manager Code, which expresses the commitment, ethical and professional responsibilities the Afore will adopt in managing the equity and protecting its clients’ interests.

We have assigned a number of staff members to address the matter of incorporating ESG factors into investment analysis and decision-making processes:

We are also working to develop our team’s skills and know-how in this field. Among the courses given during the year were the following:

| Course | Institution |

|---|---|

| ESG Scores | RobecoSam |

| PRI, Fundamentals PRI | PRI |

| ESG: Trends, Opportunities, Solutions | Blackrock |

| The Alpha and Beta of ESG Investing | AMUNDI |

| Incorporating ESG factors into investment decisions | CCFV |

| ESG Ethics Course | Chartered Financial Analyst (CFA) |

As part of this activity, we participate in annual shareholders’ meetings for equity issuers where we own more than 10% of the capital stock, as well as in certain fixed-income issuers.

Some of the issues we address with these issuers are business plan management and content, comments on and analysis of financial results reported to the Mexican Stock Exchange, regulatory changes, and corporate governance issues.

GFNorte has been vocal in its support of ESG issues through various forums, events and workshops, including the following:

| Event | Ally |

|---|---|

| ESG in Credit Risk and Ratings | UN-PRI |

| Educational Workshop Focused on ESG/responsible investment in private markets investing | Partners Group |

| ESG Day Blackrock | Blackrock |

| Regional PRI event for LatAm 2019 | UN-PRI |

| Workshop ESG | RobecoSam |

| Climate change: Portfolio decarbonisation for top management and investors | CDP |

| MX Sustainable Finance | CCFV |

At the end of the year, we joined the PRI Advisory Committee for Latin America, whose goal is to support events and workshops in the region to educate and provide tools for strengthening responsible investment practices, representing PRI in local events, and learning about the strategy and work program.

At GFNorte, we want to extend financing to economic activities that contribute to sustainable development. We are convinced that there are tremendous opportunities for the capital markets in projects that preserve the environment and improve people’s quality of life.

We know that identifying and classifying financial support is fundamental to future economic trends, so we try to anticipate the risks and take advantage of the opportunities. In 2018 we created what we call our Sustainable Taxonomy, which establishes codes for 91 sustainable activities.

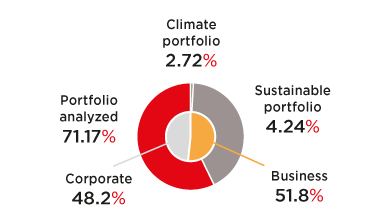

At the close of the year, the value of our sustainable portfolio in corporate and commercial loans was estimated at Ps. 9.82 billion, which was invested in various projects.

Our climate portfolio, which (for now) includes only renewable energy financing, totals Ps. 6.21 billion.

In line with global trends, the Mexican Bankers’ Association is promoting a project to create a Sustainable Taxonomy for all of the Mexican banking industry, and invited members of the Sustainability Committee to participate in this effort. GFNorte has joined in the pilot testing and shared our experiences, hoping to obtain feedback for our practices and help increase this type of financing.

We recognize the importance of clean energy as a primordial way to transition toward a low-carbon economy. We have complete confidence in the potential of Mexico’s renewable resources, which is why we continue to support financing for wind generation of electrical energy.

During the year, we closed on the financing of a 117 MW wind farm in northern Tamaulipas, a state with some of the strongest winds in Mexico and in Latin America. Another 117 wind power plant opened in the same state, bringing the total to four wind farms in that state, with a total capacity of 270 MW.

With this we now have 13 projects that generate 881 MW of wind energy, and 433 MW of solar energy.

In 2018, Banorte was one of the first banks to sign up with NAFIN’s Green SME programs to provide loans to small businesses looking to improve energy efficiency in their operations, or to use renewable energy. In total, these programs amount to Ps. 2.81 billion in performing loans, which is a substantial advance in consolidating our sustainable financing in the SME segment.

GFNorte is committed to sustainable investment and to supporting the transition toward a low-carbon economy. With this approach in mind it has been an active investor in the relatively young market for local green bonds and/or social bonds.

Afore XXI Banorte and Operadora de Fondos have a total of Ps. 2.39 million in assets under management in the green and/or social bond market, more than double the amount invested the year before in this type of asset (+111.21%).