Key facts and figures

We continued to work toward the clear purpose of becoming the best financial group in Mexico and for Mexicans through our 20/20 Vision.

Net income

Ps. 36.5 bn

+14% vs. 2018

Ps. 763 mn Portfolio

Ps. 2.7 bn assets under management

Ps. 724 mn deposits

5.6% NIM

18.5% Capital Adequacy Index (Bank)

20.1% RoE

201-1

We continued to work toward the clear purpose of becoming the best financial group in Mexico and for Mexicans through our 20/20 Vision. We have successfully completed four of the five years covered by this strategy, but we continue to focus on our stakeholders.

Data Highlights

| 2017 | 2018 | 2019 | |

|---|---|---|---|

| Balance Sheet | |||

| Assets under management | 2,423,321 | 2,607,083 | 2,771,604 |

| Total portfolio | 628,080 | 790,455 | 775,448 |

| Total assets | 1,354,147 | 1,620,470 | 1,580,010 |

| Total deposits | 640,821 | 756,301 | 724,490 |

| Shareholders’ equity | 147,583 | 174,464 | 195,998 |

| Banorte capital adequacy (%) | 17.23 | 17.17 | 18.54 |

| Banorte brand value (USD million) | 1,441 | 1,418 | 1,745 |

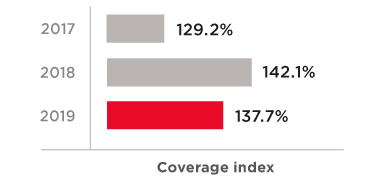

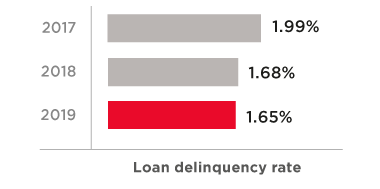

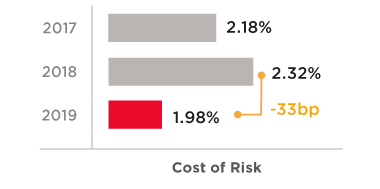

| Asset quality | |||

| Past Due Loan ratio (%) | 1.99 | 1.68 | 1.65 |

| Coverage ratio (%) | 129.16 | 142.08 | 137.74 |

| Cost of Risk (%) | 2.18 | 2.31 | 1.98 |

| Net income | 23,908 | 31,958 | 36,528 |

| Profitability | |||

| Return on equity (ROE) (%) | 16.98 | 20.28 | 20.06 |

| Return on assets (ROA) (%) | 1.86 | 2.18 | 2.30 |

| Net interest margin (%) | 5.47 | 5.63 | 5.62 |

| Efficiency ratio (%) | 41.94 | 39.03 | 39.06 |

* Figures in millions of pesos

GFNorte continues to report record-high results in net income, based on a diversification of its businesses. At the close of the year, there was growth in every metric established in the financial indicators, and we reaffirmed our commitment to continuing improvement.

Net interest income, excluding the insurance and pension businesses, grew by 8% in the year, resulting from portfolio growth—primarily consumer credit—and a reduction in wholesale funding costs and a better mix of deposits. Our NIM excluding insurance and pensions was 5.6%, an increase of 8bp over the previous year, thanks to funding cost controls and despite a drop in the benchmark rate.

Net interest income for the insurance and pension businesses grew by 5%, primarily because there were more clients and revenues from premiums (net) and a slower growth in the claims index.

Non-interest income grew by 10% over 2018. Stripping out extraordinary items from both periods, based on recurring figures, the growth was 15%, reflecting more operations and transactions and thus better revenues from client fees and commissions, as well as an improvement in trading revenues.

Non-interest expense rose by 8%, primarily due to the effect of a full year of results following the mid-2018 merger, as well as a growth in rental income which, beginning in 2019, includes the expense of leasing corporate buildings transferred under sale-and-leaseback arrangements in December 2018. The increase was also due to increased trading activity with clients, the natural rise in wages and the amortization of technology projects.

With this, the efficiency ratio closed the year at 39.06%, practically unchanged from 2018, but 34bp higher based on recurring figures.

Net income for the year totaled Ps. 36.53 bn, a 14% increase over 2018, measured in terms of recurring figures—a growth of 17% considering the extraordinary gross income of Ps. 1.66 bn from recognition of the conversion effects Banorte USA’s spinoff, representing part of the gains from its liquidation. The growth was due to strong performance both in operation of the Bank and in Insurance, Pensions and Retirements Funds. On the credit side, there was a reduction in reserve requirements due to strong performance in credit risk and the application of an in-house methodology for reserves and provisions in revolving consumer products and the commercial loan portfolio, which was authorized by the regulatory authority and was applied starting in 2019.

ROE was 20.1%, or 19.6% based on recurring figures, 28bp higher than in 2018. ROA was 2.3%, higher than in 2018; with recurrent figures the growth would be 2.2%, with a 16bp growth in the year.

The performing loan portfolio shrank by 2% in the year, and strong performance in the last quarter could not fully offset the negative effects of advance payments in the commercial, corporate and government loan portfolios in preceding quarters. Excluding the government portfolio, performing loans grew 2% in the year.

The consumer portfolio expanded by 7%, 11% in auto loans, 9% in mortgage loans and 8% in credit cards, which gives us a 14.8% share of the consumer and mortgage loan market.

The balance of performing loans to SMEs fell by 3% last year, reflecting a more rigorous selection of risk in a market climate of greater uncertainty.

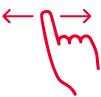

The past due loan ratio was 1.7%, lower than the year before thanks to a reduction in delinquency in the consumer portfolio and a substantial reduction in the balance of past-due loans in the corporate portfolio.

Time deposits grew 4% while demand deposits grew 6%, the result of strategies focused on increasing client account balances. Market preferences indicate that clients tend to favor interest-bearing deposits, given the prevailing level of real rates.

At the close of the year, the balance of reserves to cover past due loans was reduced by the release of a substantial amount of reserves assigned to government and housing developer portfolios. Of total write-offs, loan forgiveness and reductions, 71% were in the consumer credit portfolio, 10% in mortgages and 19% in the commercial portfolio.

The reserves coverage ratio was 137.7%, 4.3 percentage points lower than the year before.

Shareholders’ equity at the end of the year was 12.3% higher than in 2018. The most significant changes were:

Note that the negative results from mark-to-market valuations the previous year were reversed at the end of the year, when we closed the year with a gain of Ps. 1.58 bn, of which Ps. 6.73 mn came from the valuation of cash flow hedges, and Ps. 1.04 bn from the valuation of titles available for sale.

The bank’s capital adequacy ratio was 18.54% in 2019, with a tier 1 capital level of 12.73%. The leverage ratio was 10.84%.

207-1 / 207-2 / 207-3

Committed to transparency in all of its tax obligations, GFNorte’s fiscal strategy is embedded in our system of corporate governance, which establishes the policies, principles and values that guide us in his regard.

To verify compliance with the group’s tax obligations, we have various tax risk control procedures, and our head tax counsel is in regular contact with government agencies to keep them informed on a timely basis of GFNorte’s primary tax issues and measures adopted to manage tax risk.

Our current tax strategy involves:

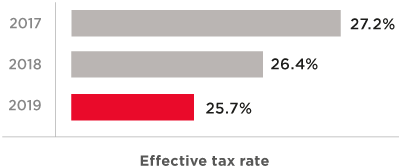

According to the Mexican income tax law, our income tax rate for 2018, 2019 and subsequent years is 30%.

The reconciliation of the legal income tax rate and the effective rate expressed a percentage of profit before income tax is as follows:

Comprehensive risk management approach

![]() Prospective vision

Prospective vision

Risk management in line with GFNorte’s goals and vision, applying prospective strategies, models, tools and policies that help us anticipate and mitigate risk.

![]() Desired risk profile

Desired risk profile

![]() Internal and regulatory compliance

Internal and regulatory compliance

![]() Corporate governance

Corporate governance

Main risks managed by Banorte

| Type of risk | How is it managed? | ||

|---|---|---|---|

| Quantifiable | Credit risk | Risk of losses due to income volatility, caused by the creation of reserves for asset impairment and potential losses for payment default by a borrower or counterparty. | The risk team defines strategies and procedures that cover origination, analysis, approval, administration, follow-up, recovery and collection. It is managed through policies, models and methodologies both for individual and for portfolio risk. |

| Market risk | Risk associated with revenue volatility caused by changing market conditions, which affect the valuation of positions in lending or borrowing transactions or give rise to contingent liabilities, like interest rates, spreads, exchange rates, price indexes, etc. | Managed through fundamental pillars, which include the use of models and methodologies like potential loss, retrospective analysis, sensitivity analysis and stress tests. | |

| Liquidity and balance-sheet risk | Liquidity Risk: Risk of losses from being unable to roll over liabilities or acquire new ones under normal conditions, because of the advance or forced sale of assets at unusual discounts to cover obligations. Balance-sheet risk: Risk resulting from impacts on net interest income, which is defined as the difference between revenues generated by interest and costs associated with liabilities and other financial costs.Depending on the balance sheet structure, changes in interest rates may have a positive or a negative impact under scenarios of rising or falling rates. |

Liquidity risk: Managed through fundamental pillars including key indicators like the liquidity coverage coefficient, repricing gaps and liquidity ratios, as well as stress testing. Balance-sheet risk: Managed through a model of repricing gaps. The sensitivity of net interest income to interest rate changes over a 12 month horizon is also calculated. |

|

| Operational Risk | Risk of losses originating from a discrepancies or failures in processes, personnel, internal systems or external events. Includes technological risk and legal risk. | Managed through a system that records events classified into various types of associated risks. Also monitored across the entire organization, tracking compliance with defined acceptable levels of tolerance. | |

| Concentration risk | Risk of losses attributed to a high and disproportional exposure to specific risk factors within a same category or across various risk categories. | Managed through risk diversification policies, optimizing the risk-return balance. | |

| Socio-environmental risk | Risk of events or exposures that have an adverse impact on the natural environment and/or communities, as a result of human activities and nature itself. Socio-environmental risk can give rise to credit, market, legal, operational and reputational risk. | The socio-environmental risks and impacts of corporate and business loans are analyzed through the Social and Environmental Risk Management System (SEMS), which identifies, categorizes, evaluates and tracks the financing over its life cycle. | |

| No cuantificables | Reputational risk | Risks associated with the potential loss from the development of an activity, caused by a worsening of perceptions by internal and external partitas regarding the company’s solvency and viability. | Managed by remaining in continuous communication with the market and monitoring trends and opinions on events relevant to the institution. |

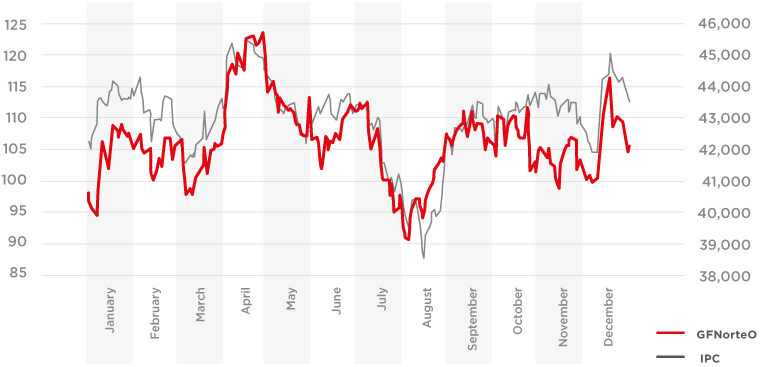

Despite the uncertainty surrounding the first year in office of the new presidential administration in Mexico and tensions in international markets, GFNorte stock gained 10.30% on the market last year, well above the return on the benchmark IPC index, which was 4.56%.

The company’s stock price closely tracked market trends for most of the year, declining from May to August, when the IPC reached a low of 38,574 points—its lowest since 2014—in response to a stagnation in global economic growth and uncertainty in world markets. The IPC gained 5.28% in the last quarter of the year.

Comparison of GFNORTEO and IPC in 2019

102-12 / 103-1 / 103-2 / 103-3 / 201-1 / 201-2

As one of Mexico’s most widely recognized publicly-traded companies, we are committed to applying the highest standards of corporate governance, information disclosure and communication with the investment community and our stakeholders.

GFNorte has a globally diversified shareholder base made up of individual and institutional investors. Throughout the Group’s process of institutionalization, we have developed various strategies to expand our shareholder base and remain an option for those seeking long- or short-term investment, or simply following our dividend policy.

As for shareholder compensation, on June 7, 2019 we paid out a dividend of Ps. 5.54 per share, after a change in the dividend policy was approved by shareholders in the May meeting, increasing the percentage of net income to be paid out from 40% to 50% of retained earnings from previous fiscal years.

Indicators

| 2017 | 2018 | 2019 | |

|---|---|---|---|

| Shares outstanding at close of year (million) | 2,773.73 | 2,883.46 | 2,883.46 |

| Trading volume (shares) | 6,344,430 | 7,477,514 | 6,909,501 |

| Value traded 1 | 703.46 | 855.82 | 732.72 |

| Highest quote 2 | 127.71 | 136.38 | 123.69 |

| Lowest quote 2 | 94.23 | 83.63 | 90.83 |

| Stock price 2 | 107.83 | 95.78 | 105.65 |

| Book value per share 2 | 52.55 | 59.75 | 67.18 |

| Diluted earnings per share 2 | 8.619 | 11.093 | 12.688 |

| Market cap 1 | 299,091 | 276,177 | 302,763 |

| Dividends per share 2 | 5.28 | 3.45 | 5.54 |

| Dividends paid 1 | 14,645 | 9,563 | 15,979 |

| Dividend yield | 3.72% | 3.60% | 5.25% |

Dividends per share in 2017 included: second payment on 2015 earnings totaling Ps. 1.23; 2016 earnings for Ps. 2.78; extraordinary dividend for the sale of INB, Ps. 1.26; and dividend payments of Ps. 3,421, Ps. 7,723 and Ps. 3,500, respectively.

1 Figures in millions of pesos.

2 Figures in pesos.

Continuing our program of GFNorte Level 1 American Depositary Receipts (ADRS) (GBOOY), where each ADR represents five shares, we closed the year with 4,739,384 ADRs outstanding; a 36% reduction from 2018.

We are a Financial Group that listens to and is concerned about its shareholders.

During the year, the Executive Department of Investor Relations, Sustainability and Financial Intelligence was active in a number of forums, as described below:

During the year, GFNorte was the second most heavily traded issuer in the Mexican Stock Exchange. This was reflected in its accounting for 9.7% of total trading on the Mexican market—a proportion that on some days rose to more than 20% of total market activity.

In the area of sustainability, GFNorte is included in the following market indexes:

|

|

|

|

|

|