102-18 / 102-20 / 102-22 / 102-23 / 102-24 / 102-26 / 102-27 / 102-28 / 102-29 / 102-30 / 102-35 / 102-36 / 405-1

Grupo Financiero Banorte is a global leader in best corporate governance and sustainability practices for financial institutions. This has earned us the recognition of Mexican and international organizations.

At GFNorte, managing corporate governance is the responsibility of the Board of Directors and the entire management team. Its purpose is to align our policies and governance bodies with best international practices, and ensure that they conform to existing laws and regulations and above all that their actions and decisions are consistent with our shareholders’ interests.

The Board of Directors is the governing body of Grupo Financiero Banorte charged with taking the actions necessary to ensure sound corporate governance, while safeguarding the interests of shareholders, customers, employees, suppliers and communities.

At GFNorte we make sure to always stay one step ahead. In 2018, we approved a policy to promote equality between men and women within the Board of Directors. This policy is included in the Nominating Committee’s operational and functional regulations, and includes provisions that promote dignity, equity, inclusion and diversity, to foster an inclusive working environment within the Board of Director based on respect and non-discrimination.

It should be noted that Board Member selection and compensation, as well as the conditions under which they perform their duties and activities, are determined exclusively according to criteria of merit and ability to fulfill the requirements of the position.

Grupo Financiero Banorte is a

global leader

in best corporate governance and sustainability practices for financial institutions. This has earned us the recognition of Mexican and international organizations.

To set the compensation for GFNorte Board Members, we hire an outside consulting firm specialized in this area, in order to align that compensation with international corporate practices.

The Internal Control System consists of a set of mechanisms and internal controls to ensure that GFNorte and its subsidiaries conform to applicable regulations, in addition to applying methodologies that make it possible verify their compliance. The Audit and Corporate Practice Committee keeps the Board informed of the status of this system at GFNorte and its financial subsidiaries as well as other corporations it controls, including any irregularities detected.

GFNorte pays special attention to internal control over its transactions, to the origination, processing and disclosure of accounting and financial information, to relationships with investors, customers and suppliers, and to compliance with applicable regulations.

GFNorte’s Code of Conduct establishes that members of the Board of Directors, officers and employees must ensure that their activities and businesses safeguard the natural resources of communities where they are present, and that environmental damage is repaired or mitigated to the extent possible when they become aware of a depletion of those resources.

The General Shareholders’ Meeting is the highest governing body of the Company, and its job is to review and, when appropriate, approve the Report of the Board of Directors and of the Chief Executive Officer each year, in accordance with the Law to Regulate Financial Groups. Furthermore, the latter report includes environmental and social aspects that are handled through the Sustainability Committee.

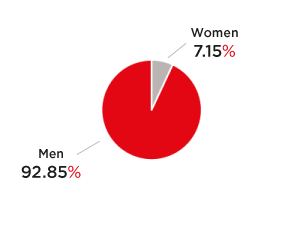

The Board of Directors currently has 14 members, one of whom is a woman. Of the total number, 10 are independent, i.e. 71%, which is well above the regulatory minimum of 25% and the 60% recommended by international corporate best practices. Each regular member has an assigned alternate, as provided by Mexican law.

The Board of Directors meets on a quarterly basis and in exceptional cases, at the request of the Chairman of the Board, 25% of the proprietary owners, or the Chairpersons of the Audit and Corporate Practices Committee.

Average attendance for Board of Directors is 92.85%

Board of Directors

| Regular Members | Board member since | ||

|---|---|---|---|

| 1 | Carlos Hank González | Related Chairman | October 2014 |

| 2 | Juan Antonio González Moreno | Related | April 2004 |

| 3 | David Juan Villarreal Montemayor | Related | October 1993 |

| 4 | José Marcos Ramírez Miguel | Related | July 2011 |

| 5 | Everardo Elizondo Almaguer | Independent | April 2010 |

| 6 | Carmen Patricia Armendáriz Guerra | Independent | April 2009 |

| 7 | Héctor Federico Reyes Retana y Dahl | Independent | July 2011 |

| 8 | Eduardo Livas Cantú | Independent | April 1999 |

| 9 | Alfredo Elías Ayub | Independent | April 2012 |

| 10 | Adrián Sada Cueva | Independent | April 2013 |

| 11 | David Peñaloza Alanís | Independent | Abril 2019 |

| 12 | José Antonio Chedraui Eguía | Independent | April 2015 |

| 13 | Alfonso de Angoitia Noriega | Independent | April 2015 |

| 14 | Thomas Stanley Heather Rodríguez | Independent | April 2016 |

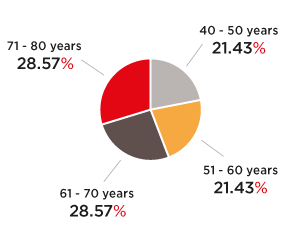

Breakdown of the Board of Directors by age range

Breakdown of the Board of Directors by gender

Among the duties of the Board of Directors is to establish rules regarding the structure, organization, composition, functions and authority, among other aspects, of internal committees as it seems necessary, and to appoint their members. Through these internal committees, and according to the sphere of responsibility of each, the Board of Directors keeps track of the main risks to which the Company and members of the financial group are exposed.

Accordingly, the Board has established support committees that are made up of independent members of the Board, and in some cases by executives of the institution itself, in keeping with the applicable regulations.

The Audit and Corporate Practices Committee meets 12 times a year, plus any extraordinary meetings that are necessary. The Risk Policies Committee also meets 12 times a year, plus one extraordinary meeting each year; the Human Resources Committee meets four times a year; and the Nominations Committee meets once a year, or when called by the Chairman.

Average attendance in each committee:

Grupo Financiero Banorte Senior Officers

| Name | Title |

|---|---|

| José Marcos Ramírez Miguel | Managing Director, Financial Group |

| José Armando Rodal Espinosa | Managing Director, Wholesale Banking |

| Carlos Eduardo Martínez González | Managing Director, Retail Banking |

| Fernando Solís Soberón | Managing Director, Annuities and Pensions |

| José Francisco Martha González | Managing Director, Means of Payment, Digital Banking and Technology |

| Rafael Arana de la Garza | Managing Director, Finance and Operations |

| Carlos de la Isla Corry | Managing Director, Risk Management and Credit |

| Javier Beltrán Cantú | Managing Director, Administration and Human Resources |

| Héctor Ávila Flores | Managing Director, Legal and Trust |

| Isaías Velázquez González | Managing Director of Audit |

| Carlos Alberto Rojo Macedo | Managing Director, Office of the Chairman of the Board |

| Sergio García Robles Gil | Presidential Advisor Regional Boards |

Senior management encompasses the positions of Chief Executive Officer, the executives reporting directly to him, and the positions reporting directly to them, in other words, the top three levels of the organizational hierarchy. At GFNorte, we have a specific variable compensation plan for this group, subject to meeting certain financial metrics established as targets in our 20/20 Vision.

These financial metrics are quantifiable and measurable over time, and include aspects such as return on equity and efficiency ratio.

In general, the variable compensation plan establishes specific financial targets to be met annually through the year 2020. At GFNorte we do not publicly disclose the compensation policy, the executive compensation plan, or the individual compensation of members of our senior management.