Leading growth and generation value

This year more than ever, we were closely involved in meeting Mexicans’ needs, because we believe in a more inclusive, solidary form of banking—what we call social commitment.

3.7 million of Electronic Banking users

1,182 Branches

NPS 60

1.7 million of mobile banking clients

8,919 ATMs

Fully digital, paperless process for credit card origination

102-15 / 102-30 / 103-1 / 103-2 / 103-3

This year more than ever, we were closely involved in meeting Mexicans’ needs, because we believe in a more inclusive, solidary form of banking—what we call social commitment.

To support this new bank we are becoming, we acquired administrative services for outsourcing the operation, support and modernization of technology infrastructure services. The project has moved forward on a number of fronts and we’ve been able to improve processes, launch high-availability and high-resilience initiatives, and implement tools, an operating management model and automation.

Our process evolution has enabled us to accelerate our capacity to continue handling the huge volume of change at the application function level and to bring in new technological solutions. Because of the maturity and continuous adaptation of our processes, we maintained and exceeded established service levels for our business areas and clients, which was successful owing to the update and implementation of more than 200 operation processes and procedures.

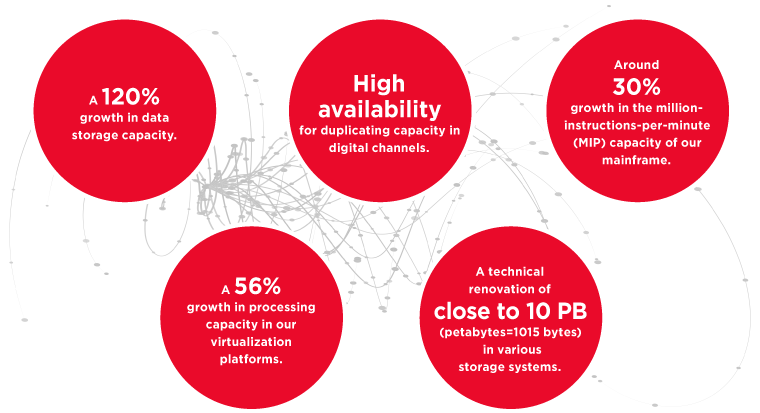

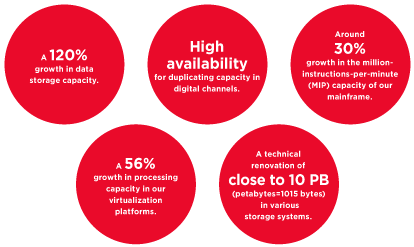

Some examples of the growth and availability models that have enabled us to incorporate clients to our channels under high standards are:

Furthermore, to be a more solidary bank, we launched various initiatives:

Apoyos Banorte, a product which is acquired on a mass-market, centralized basis at the request of government agencies, not offered in branches. Enrollment is very simple—by registering their debit card, users become part of a community of people in social programs, in which they can chat, send and receive money.

In 2020, we underscored our social commitment further by continuing to support the federal government’s social programs: beneficiaries have the option of downloading a mobile application to monitor their balance and activity and make transfers between other services.

As part of the social support program aimed at paying bimonthly benefits to 10 million Mexicans, we will develop a mobile self-service channel with lower operating costs and promote the use of digital channels that encourage a shift to cashless operation.

Likewise, we optimized receipt of deposits from the federal treasury account (CUT). As of the third quarter of the year, this type of account handled incoming deposits of Ps. 600 million.

We also implemented the CoDi® system, a platform developed by Banco de México (Banxico) that allows individuals and companies to make wire transfers between their accounts in real time using mobile devices and through the current SPEI payment infrastructure. According to Banxico’s website, Banorte is the bank with the best response time, a sign of our extensive infrastructure and development quality.

In our Banorte 2018 Annual Report, we pledged to stabilize the pace of work and prioritize technological solutions. This is what we did in 2019, and the result was a more efficient use of resources through strategic projects.

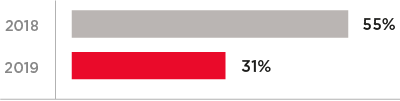

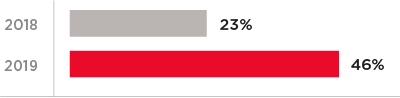

We divided our portfolio of projects into three areas:

projects that allow us to meet regulatory, security, technological and operating risk requirements, and to perform corrective maintenance and upgrades of existing systems.

projects that help keep us up to date in operating management and upgrades, through increasingly advanced technologies.

Projects that are part of our ongoing effort to reinvent the bank through digital technology solutions.

We allocated more to change and transformation this year than in 2018, without sacrificing our pursuit of security goals, because we know that no company is immune to cyberattack. Because of this, we have developed information security programs that reinforce protection of our most critical assets.

The SPEI connection incident that affected the entire national financial system in 2018—a cyberattack on software used by banks to transfer money in real time—shed stark light on the need to bolster the regulatory framework governing cybersecurity. These regulatory changes were published on November 27, 2019 in the Unified Banking Circular (UBC).

At the same time, facing a rising number of cybersecurity incidents in the financial system, regulators have stepped up IT verification and audit requirements, and are more rigorous in their reviews. External auditors are focusing on controls in place for the bank to mitigate cybersecurity risks. At Banorte, we have people devoted to attending to external regulators and auditors, which helped us to obtain positive results in the reviews conducted. We have also focused on addressing every one of the requirements and observations received.

Our Information Security area is audited each year by internal and independent experts to guarantee that we meet all the regulatory requirements to which we are subject.

Additionally, every year we create a compliance plan that entails a proactive review of internal processes and controls in order to confirm the efficacy of these controls or pinpoint areas of improvement.

Through implementation of a three-year internal program, we worked to increase the coverage and maturity not only of technical controls that allow us to be more proactive in detecting attacks, but also of our processes and the way we respond to a variety of threats.

The program has three goals:

| Maximize coverage of information assets protection (applications and infrastructure) | |

| Mature and/or enable advanced event monitoring and incident response processes. | |

| Mature and/or enable the continuous strategic application oversight and protection program, aligned with the business strategy and risks. | |

In an effort to improve the way we deal with critical incidents, we created a cyber-crisis management structure, made up of a team specializing in prompt corrective and/or preventive attention to high-risk problems:

With this specialized team, we strengthened our ties with other financial institutions and created a cyber-intelligence work group, recognized by the Mexican Bankers’ Association (ABM), for sharing information on cybernetic threats to the Mexican financial system.

In the event of a crisis, GFNorte has three lines of defense. These are:

With an eye to bolstering our strategy for crisis management response, we began a crisis drill program and, as an additional preventive measures, we took out cybernetic risk insurance.

We continue our ongoing investment in improving our ability to monitor and identify unusual activity in our internal network; at the first sign of alert we take immediate action to mitigate the risk of impact to our clients or our services.

With our employees we are continually reinforcing training on cybersecurity and we provide them with channels for communicating any type of technological incident, whether related to service operations or cybersecurity issues. This enables us to diagnose and promptly address any matter reported.

As for the human factor, through our membership as founding partners of the Monterrey Digital Hub (MDH), the primary purpose of which is to build digital talent in the region, we have a facilitator for the development of digital skills and digital evolution in general, enabling our teams to participate in events that promote creativity and develop digital skills, and creating a community for transferring knowledge and experience.

The Monterrey Digital Hub gives us access to cutting-edge technological solutions and promotes Banorte’s connections with Fintechs and entrepreneurs.

102-4 / 203-2 / FS-13 / FS-14

We serve more than 20 million clients through our business model, incorporating innovative digital models that allow us to continue meeting their needs.

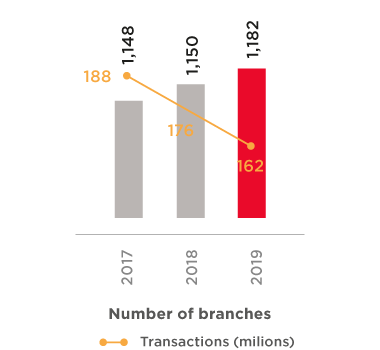

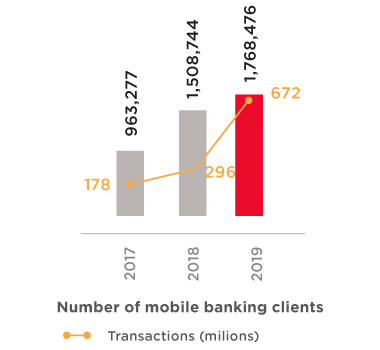

Means of delivery have evolved considerably in the last three years, and there are now many more clients using online and mobile banking.

Means of delivery

| 2017 | 2018 | 2019 | |

|---|---|---|---|

| Branches | 1,148 | 1,150 | 1,182 |

| Transactions (millions) | 188 | 176 | 162 |

| ATMs | 7,911 | 8,423 | 8,919 |

| Transactions (millions) | 642 | 675 | 715 |

| Correspondents | 26,131 | 28,227 | 14,181 |

| Transactions (millions) | 33 | 49 | 32 |

| Internet - number of clients | 2,383,218 | 2,224,293 | 3,172,622 |

| Transactions (millions) | 1,377 | 1,385 | 1,175 |

| Mobile banking-number of clients | 963,277 | 1,508,744 | 1,768,476 |

| Transactions (millions) | 178 | 296 | 672 |

| Point-of-sale terminals (POS) | 165,441 | 158,735 | 166,505 |

| Transactions (millions) | 320 | 417 | 586 |

| Billing (millions of pesos) | 244,918 | 311,178 | 373,587 |

| Contact center calls received (millions) | 184 | 46 | 52 |

We bring banking closer to clients in remote locations where access is limited, through a network of correspondents—retail chains independent of Banorte, with their own personnel and equipment—from which we offer a variety of services.

Correspondent banking has become a tremendous driver of financial inclusiveness for Mexico’s development.

Correspondents

| Channel | Number of offices | Number of Mexican municipalities covered | Percentage of Mexican municipalities covered |

|---|---|---|---|

| Banorte branch network* | 1,182 | 331 | 13.5% |

| Correspondent network* | 14,171 | 1,612 | 65.6% |

| Correspondents located in municipalities where there is no Banorte branch presence | 3,729 | 1,283 | 52.2% |

| Correspondents located in municipalities where there are no bank branches | 1,257 | 711 | 28.90% |

Total municipalities in México: 2,457. Source: www.inegi.gob.mx

Municipal coverage of banking infrastructure in the country. Source: www.cnbv.gob.mx/Paginas/PortafolioDeInformacion.aspx