New technologies mean a more diverse array of payment methods. Banorte is constantly innovating to extend these benefits to our clients.

3rd place

3rd place 4th place

4th place 4th place

4th placeSource: National Banking and Securities Commission.

To protect our clients’ money, we have introduced a PIN number as a new authentication factor in the use of credit and debit cards in point-of-sale terminals (POS), to replace the use of the physical signature. During the year we enabled more than 10,000 cards with PIN security and reduced fraud by more than Ps. 60 mn.

Grupo Financiero Banorte is a leader in the promotion of e-commerce payments in Mexico.

With a fraud rate of less than 1% in physical card transactions, we continue to monitor, adjust and reduce fraudulent activities in e-commerce, with the latest artificial intelligence and machine learning tools and platforms.

These efforts have improved our clients’ experiences at the point of sale, making them more confident about the constant use of their Banorte credit card. We achieved a year-over-year growth of more than 5% in transactions and supported a year-over-year growth of more than 30% in e-commerce spending, which we see as the path for Banorte credit cards to be the favorite payment method of its clients in coming years.

Adopting new technologies and offering self-service tools is a priority for addressing constant change and the needs of our clients. This past year we developed digital bank functions with an emphasis on mobile apps. We provided self-service tools to more than 4 million digital clients and offer innovative digital services like the ability to acquire new investment and credit products, and the use of payment methods like digital cards.

We strengthened our app with new options like:

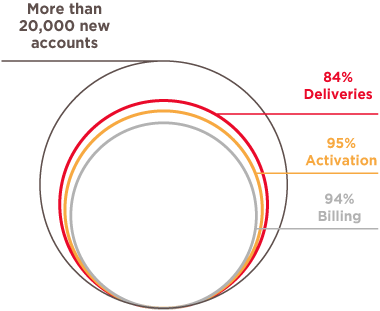

We added the ability to active a new card with just one click. The impact of this benefit, together with multi-channel communication strategies, is reflected in the volume of activations performed using digital banking.

To make it easier for clients to select a PIN to use in their credit and debit card purchases, we made it possible them to create a PIN for their card using digital banking.

Through this app, clients can draw on their credit line and deposit directly into their bank account simply, quickly and securely. Since the launch of this function this year, more than 70,000 withdrawals have been made through digital banking, and close to a third of these were migrated from teller’s window transactions.

With this implementation, and other efforts like increasing the number of Banorte ATMs and PIN adoption campaigns, we were able to reduce withdrawals at bank branches.

We saw a growth in both the volume and size of transactions, with more than 90,000 unique clients.

We introduced improvements that allow us to respond immediately to disputed charge claims, which can be resolved without additional documentation, and those regarding charges made with dual authentication factors.

We received around 20,000 disputed charge claims associated with our debit and credit cards, more than 80% of which were resolved immediately.

We promoted the growth of portfolio campaigns. In 2018 we were only offering credit line increases through digital banking, this year we added other campaigns, like balance transfers and convenience checks. Acceptance of credit line increases through digital channels accounted for more than 60% of the total. In acceptance of campaigns involving a monetary impact, close to 20% took place in supermarket channels.

In 2013, we became the first bank to offer a payment method designed for use in e-commerce, with the “Mobile Payment” tool. We continue to innovate in payment methods to keep cardless digital transactions secure, by strengthening our e-commerce payment tool, generating the digital card with a one-time password as a dual authentication factor. By generating a new value that changes with every transaction and can only be used once, this helps mitigate fraud risk.

We continued our strategy of diversifying alternative credit card placement channels for Banorte clients, prioritizing the client experience, by deploying digital banking functions (Online Banking and Banorte Móvil) that create paperless placement and total self-service.

We placed more than 20,000 new accounts through digital channels.

Placing new accounts via digital methods reduces account opening costs by more than 70% compared to an in-branch process, and we can transfer these savings to clients as a benefit integrated into the commercial offering.

We study the transactionality, timing and preferences of our clients’ use of their banking services, so we can bring them personalized offers that are significant to them and allow them to optimize the benefits of their account and make it their top choice as payment method.

With these models, first use of credit cards rose by more than 10% compared to the control group in the first 90 days after opening the credit card account. In the case of debit cards, the increase was less than 5% compared to the control group.

We have made a concerted effort to learn more about our clients’ preferences and needs regarding e-commerce.

Because we want to recognize our clients’ loyalty, we continue to promote the Banorte Total Reward program, a strategic axis in our credit card business and a tool with tremendous potential to differentiate us in the market.

For the first time at Banorte, starting in September we will make it possible for clients to pay for their purchase with credit card loyalty points directly at the point-of-sale terminal in selected merchants (instant award).

We worked on providing a complete value offering in keeping with the market’s needs, encouraging more people and companies to place their trust in us by choosing one of the deposit instruments we have developed for them.

At the close of the year, we had more than Ps. 600 billion in deposits, and this inspires us to work harder to make our products and services the top choice for Mexican families.

For individuals, we have a very complete array of deposit products, like Enlace Personal, which provides access to all the banks’ channels.

Additionally, taking into account the empowerment and role of women in society, we have a comprehensive offering of products and services aimed specifically at them, like the Banorte Mujer account, which gives them additional benefits at no cost: home, medical and legal assistance as well as major medical and life insurance.

Committed to protecting our clients’ information, we have campaigns to encourage users who still receive printed account statements to choose paperless delivery. This has meant a substantial reduction in costs and had a positive impact on the environment.

We also helped the government implement some of its new social programs by creating deposit accounts with generic debit cards so that it can transfer funds to program beneficiaries in an orderly and transparent manner. This opens access to financial services to more of the population, and helps making bank penetration an engine for economic development and migration to the formal sector in this country.

We optimize account opening times for corporations through the Portable Office platform, so that clients do not have to go to a branch to receive service.

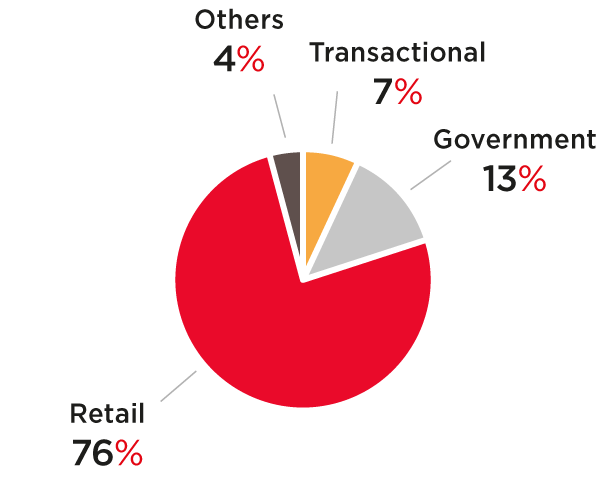

Balance breakdown

Our Merchant Acquirer business provides merchants with tools to receive payments with credit cards involving comprehensive collection systems and also enables us to increase deposits by acquiring products from our portfolio.

Our infrastructure includes a proprietary payment engine that processes close to 50 million transactions a month. We have more than 100,000 affiliated merchants nationwide, with around 160,000 devices based on various technologies. Banorte ranks 12th in Latin America and third in Mexico, according to the “Largest Merchant Acquirers Latin America 2018” ranking published by The Nilson Report.

We have made substantial progress in developing the “Acquirer Business Transformation” program, which encompasses more than 10 projects that will increase operating efficiency and administration in this business.

At GFNorte, we are betting on proprietary technology to meet the needs of Mexican retailers. We are also developing new e-commerce functions and incorporating new payment methods like CoDi®.

In recent years, we have maintained and improved processes for creating partnerships with Fintechs of all sizes, both domestic and international, supporting the aggregator model in Mexico from its beginnings, which is why we are number one in total sales volume in the nation in this area.

We currently have more than 20 allied aggregators and 15 integrators, which together accounted for around 20% of the monthly sales volume of our Acquirer business portfolio, a growth of 80% over the previous year. Our strategic partnerships have increased our growth and positioning in the Mexican market, attracting and retaining new affiliates and expanding the number of integral services offered.

Our infrastructure includes a proprietary payment engine that processes close to

50 million transactions

a month.