Developing cutting-edge products

We prioritize customer satisfaction and experience, along with operating efficiency.

Innovation culture:

Customer-centric

Associations and collaborations

Individuals: training and development

Customer experience

AGILE methodology: with multifunctional teams

Information technology architecture

based on services (API)

103-1 / 103-2 / 103-3

We prioritize customer satisfaction and experience, along with operating efficiency.

This year we introduced a multichannel sales platform that allows clients to acquire and manage Banorte products and services on line under a quick, safe and secure self-service model. The service is available 24 hours a day, 365 days a year, regardless of where they are or what type of electronic device they are using.

The multichannel sales platform uses the most modern component architecture available, providing flexible banking operations and an omnichannel experience for the customer, who can start the opening or service process in one channel and complete it in another of their choice or convenience.

The following processes are currently available:

We also introduced a Unified Customer File to manage the documentation the bank holds on its customers for all digital processes, making the account opening process easier.

We are continually seeking out innovative strategies to offer customers new business models. Through the Office of the General Director of Innovation, we created various strategic alliances, among them one with a startup accelerator and Silicone Valley Fintech, which gives us access to the global Fintech system to learn about and exploit new ideas and applied technology to benefit our clients.

We launched the first digital assistant in Mexican banking, which offers not just information but access to monetary transactions through an alternative form of web-based self-service and a new customer experience. We are continually improving this system based on interaction with customers.

In order to get to know our customers better, GFNorte has an AI-based tool for tracking companies on the web, which helps us identify business opportunities and be alert to any adverse circumstances.

In the area of artificial intelligence, we are currently focused on the following:

Furthermore, to offer new experiences through the use of artificial intelligence, we integrated two of the market’s top virtual assistants as new media/channels for our customers to look up information and, soon, monetary transactions. This gives clients with web-enabled devices the ability to view information on their product and services using their voice, and reduces traffic in both our call center and in our physical branches, while enabling us to continue innovating customer service.

In our control areas we are also constantly exploring innovative technologies, calculation methodologies and the use of alternative information. For example, we developed approval and early alert models with machine learning techniques, tested delivery route optimization algorithms, and explored graph technology for money-laundering and fraud prevention, among other topics.

We are members of one of the world’s largest blockchain consortiums, which gives us access to cutting-edge platforms that explore the implementation of business solutions based on blockchain technology—another way we innovate our service offering for customers.

We participated in global controlled-environment pilot testing together with more than 160 other institutions. These tests were to learn about functionalities for expediting and simplifying international commerce, both in credit cards, in open accounts and transactional banking. The intent is to give our customers more confidence in the security and traceability of their transactions.

We also participated in evaluating digital identity tools that promise to simply customer identity management, given them control over their own identity in digital media.

In keeping with the Law to Regulate Financial Technology Institutions, GFNorte is moving forward with preparation of its API platform, to meet the requirement that financial institutions share open financial data, aggregate data and transactional data with third parties, while protecting the client’s right to use their information as it best suits them, while applying security and control measures necessary for access and consumption of these data.

Also, we strengthened our innovation culture through the “Banorte Ingenuity” Program, which has been in place since 2010 and is an innovation platform close to our employees, inviting them to apply their ingenuity to resolve biyearly challenges with innovative ideas, which are later made into prototypes and tested to see how feasible they would be to implement.

As part of our drive to incorporate technological innovations and update existing technology, we made considerable progress in the impact of analytics campaigns on customer development. This was leveraged by a quantitative and behavioral knowledge of clients gained through application of three basic tools:

With this we achieved greater speed and impact in the development of digital channels for delivering offers to customers.

Artificial intelligence has made our product placement models more precise and enabled us to fine-tune customer communication. We have also begun to use it for assessing risks.

The adoption of experimental techniques to improve offers, communications and choice of channels meant a change toward a customer-centric culture of continuous improvement.

103-1 / 103-2 / 103-3

With our customer-centric service model, we join efforts to create solutions aligned with our strategy of being the best bank for service and attention, and we share our common commitment to creating memorable experiences for our customers.

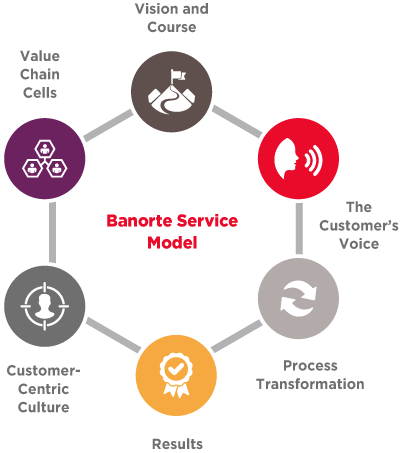

Our Banorte Service Model rests on six pillars, with the customer at the center.

This model applies to the entire organization, and its goal is to transform everything from back office processes to personalized attention by executives in the front office.

The Customer’s Voice

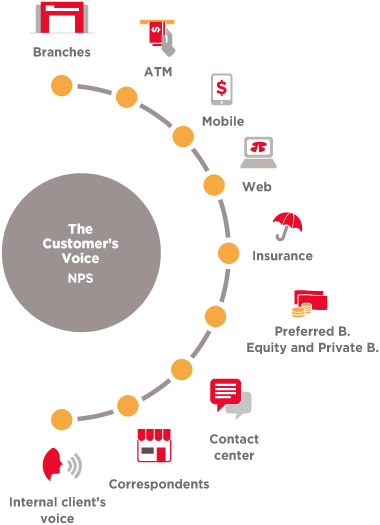

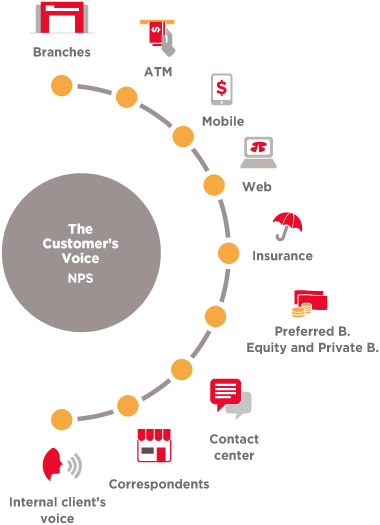

We are well aware that creating memorable experiences for our customers means first listening to them. That’s why we strengthened our Customer’s Voice in Real Time program, adding new listening channels at branches, ATMs, contact centers, digital channels, insurance offices and high-value customers, among others.

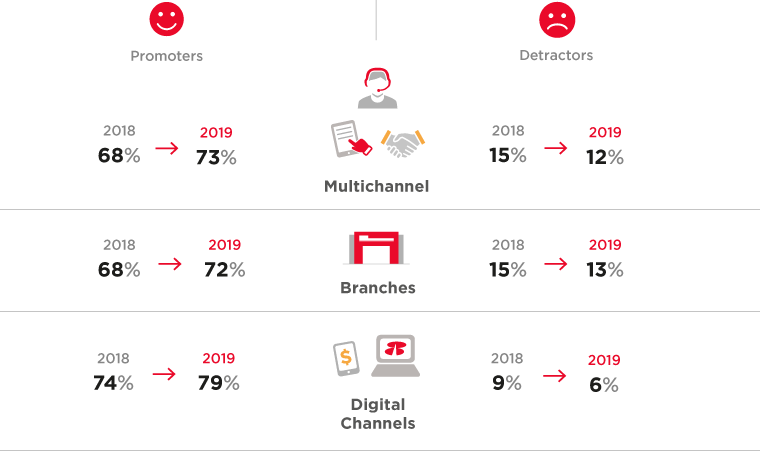

This program involves gathering opinions from customers in real-time surveys, applying NPS technology to determine how satisfied they are and how well they would recommend our products, services and channels.

The index is based on one fundamental question: how likely are you to recommend Banorte? On a scale of 0-10, where 9 and 10 are promoter customers, 7 and 8 are passive clients, and 0 to 6 are dissatisfied customers.

We received more than 6 million customer response on the service we provide. We responded to customer services through a value chain headed by more than 15,000 branch executives and contact centers.

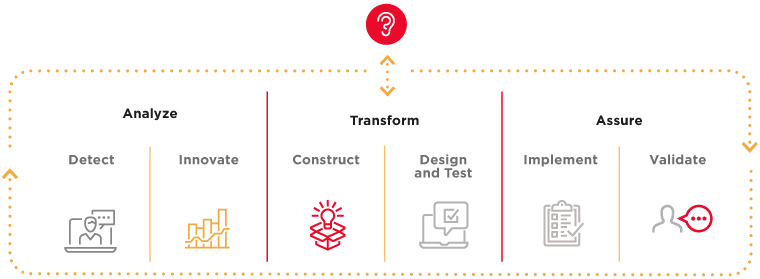

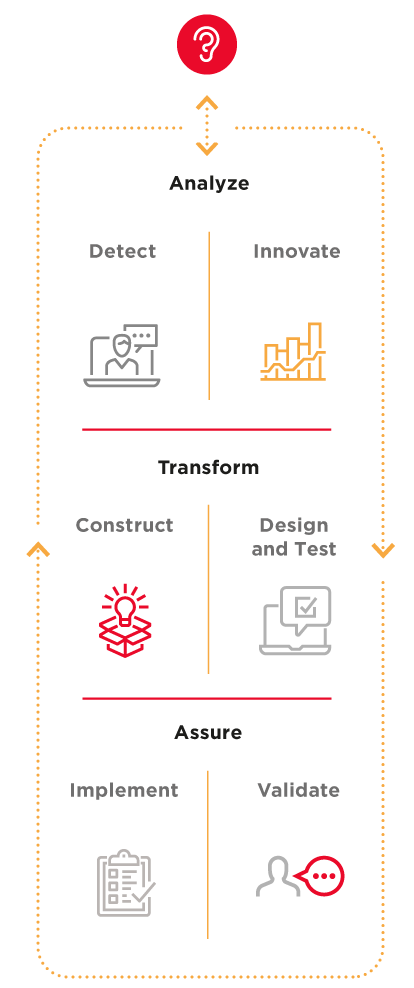

Transforming experiences

The voice of our customers and employees enables us to focus on process transformation and new experience design through a three-phase methodology: Analyze—detect and analyze the pain points in the experience; Transform—design and build the experiences; and Assure—implement and validate the new experiences with clients.

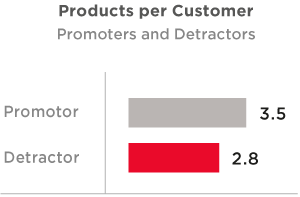

This methodology has enabled us to transform experiences and increase the number of promoter customers and index of products per customer, while reducing the number of detractor customers.

Armed with the voice of the customer as our starting point and based on market research, best competitive practices and in-depth studies, we designed new experiences in workshops together with customers to sketch out the new experiences they expect from Banorte.

These studies enable us to continuously improve branches, ATMs, digital channels, credit cards, car loans, mortgages, payroll loans, contact centers and inquiries, among other services.

We went beyond the customer experience to connect with their emotions, move their senses and create unforgettable memories that will keep us top of mind in their future decisions to develop long-term businesses.

From the customer’s perspective, this means taking into account what they most value: consistent and timely responses at key points of interaction, and based on our knowledge of them, specialized offers and services consistent with their profile.

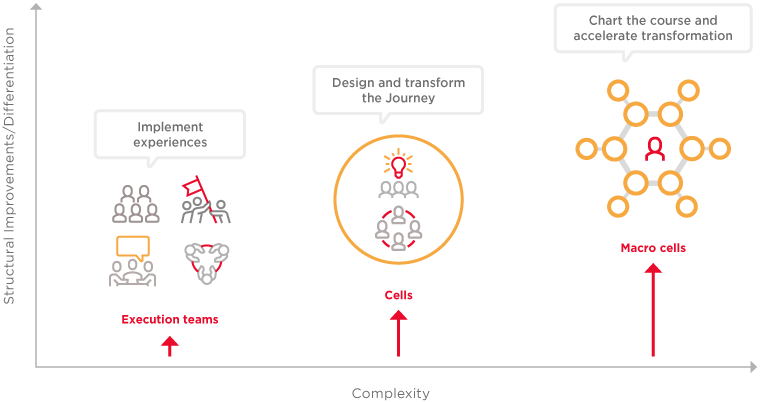

To transform experiences and emotions, we bring together the entire organization and all our talent in multidisciplinary teams called Cells.

These Cells chart a course for the effort and transformation; most of the initiatives are focused on improving customer experiences.

To guide the Cells’ efforts, we prioritize projects and initiatives that maximize benefits for customers and the business. The highest-impact experiences are recorded in digital banking, which is highly important because it is a self-service channel, which empowers the customer in their omnichannel experience.

At the institutional level, we received projects evaluated by our central project office, and 70% of the initiatives evaluated and prioritized had a direct impact on the customer.

Once the Cells have completed their work, we guarantee the experience and quality of developments before applying them to the customer, and to assure it, we have a customer experience testing lab. During the year we tested more than 2,000 cases of various projects relating to branch processes, account origination, mobile banking redesign, biometrics, deposit and credit placements, and others.

We offer customers a fully digital, paperless process of credit card origination in mobile and online banking, with a 92% activation success rate. We closed the year with more than 400,000 new digital card customers.

With just one click, our customers can perform account statement lookups, track delivery of their credit card, transfer payroll loan accounts, mutual funds, term investments, inquiries, cash transfer from credit card to checking account, CoDi®, and others.

To fortify customer service at ATMs, we offer them self-service and credit products consistent with their profile, and we continue to focus on discouraging the printout of tickets for account inquiries and withdrawals. Thanks to this initiative, the cleanliness and image of our ATMs received positive ratings from our customers.

With the consolidation of our preferred service model, our high-value clients gave us an NPS score of 78 points.

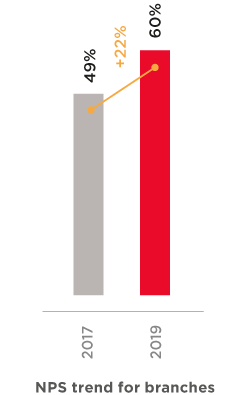

Our branch network increased its recommendation rate by more than 20%, reaching a record high of 62 points in November.

We reinforced the branch service model through offline workshops and digital tools; during the year more than 14,000 employees across the country received training.

Queue Manager (QM)

Our Queue Manager (QM) makes the difference between attention and service. We are the only bank that can differentiate our customers and users by segment. We served more than 75 million turns. Speed of attention is one of the most important aspects for customers, and we continue to optimize our branch service times.

We identify our customers’ emotions

We have allied with leading artificial intelligence firms, sharing algorithms and experiences, and speeding up learning for our robots.

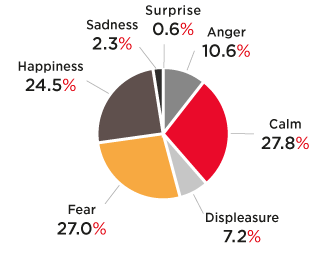

In Customer Experience, through artificial intelligence, we have been able to learn more about our customers’ emotions, both in social networks and in the interactions or transactions they have with us. Identifying whether a customer is happy, sad, surprised, angry or calm, helps us define actions for boosting the positive emotions.

We identify our customers’ emotions

Strength is the freedom to live life fully and make the most of our time, which is our most valuable possession.

This has been our core message in communications with our clients and in our advertising campaigns in 2019, and it highlights Banorte’s role as a facilitator in the lives of our clients.

At Banorte, as always, we reiterate our commitment to being there for Mexicans at the most important moments of their lives: buying a home or a car, or using their credit card to go on vacation with their family, or borrowing to grow their own businesses.

We know that going to the bank isn’t necessarily their favorite activity, but it’s at those times when—whether or not they see it—Banorte is there for them.

Our job is to be as close as possible to our clients, without them noticing; when they need us, we’re there. This is the best service we can give to all Mexicans. It’s the way we can make them stronger, either through Mobile Banking or through or more than 1,100 branches, 9,000 ATMs, 13,000 correspondents and more than 27,000 people working to serve them.

Our communication stresses the elements of proximity, attention and service, with the backing of our solidity and commitment to Mexico, and to every Mexican.

These efforts drove a 23% increase in our brand value and moved us up 26 notches in the ranking published by Brand Finance, reaching a total of USD 1.74 billion dollars—Mexico’s most valuable banking brand.

We will continue to communicate Banorte’s values and capabilities for serving and being in the lives of more Mexicans. Committed to their development, at every moment.