| Grupo Financiero Banorte |

2014 |

2013 |

2012 |

| Assets under management (millions of pesos) |

2,039,197 |

1,829,106 |

1,471,422 |

| Total assets (millions of pesos) |

1,097,982 |

1,006,788 |

916,567 |

| Banorte brand value (millions of dollars) (1) |

1,942 |

985 |

608 |

| Total deposits (millions of pesos) |

497,922 |

443,741 |

424,325 |

| Total loan portfolio (millions of pesos) |

486,062 |

438,693 |

409,914 |

| Shareholder’s equity (excluding minority interest) |

122,922 |

106,657 |

81,881 |

| Net profits (according to participation) |

15,228 |

13,508 |

10,888 |

| Profits per share (pesos) |

5.49 |

5.35 |

4.68 |

| Dividends declared per share (pesos) (2) |

0.9740 |

0.7852 |

0.732 |

| Paid dividends (pesos) |

1,218 |

2,911 |

1,240 |

| Book value per share (pesos) (excluding minority interest) |

44.4 |

38.5 |

35.2 |

| Shares outstanding (millions) (3) |

2,773.0 |

2,526.1 |

2,326.4 |

| Price per share (pesos) |

81.20 |

91.36 |

83.45 |

| ROE (%) |

13.2 |

14.2 |

14.3 |

| ROA (%) |

1.5 |

1.4 |

1.3 |

| Net interest margin adjusted for risk (MIN) (%) (4) |

3.5 |

3.4 |

3.4 |

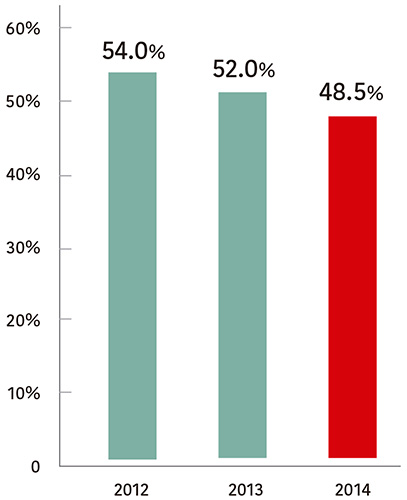

| Efficiency Ratio (%) (5) |

48.5 |

52.0 |

54.0 |

| Past due loan ratio (%) |

2.9 |

3.1 |

2.1 |

| Reserves Coverage (%) |

107.0 |

104.6 |

138.3 |

| Capitalization Ratio (%) |

15.26 |

15.12 |

14.75 |

| Full-time employees |

27,898 |

27,474 |

26,108 |

| |

|

|

|

| DELIVERY CHANNELS |

|

|

|

| Branches (6) |

1,269 |

1,288 |

1,316 |

| ATMs |

7,297 |

7,035 |

6,707 |

| Contact Center calls received (millions) |

69.2 |

66.6 |

41.2 |

| Point of Sale Terminals (POS) |

162,352 |

141,432 |

115,213 |

| POS transactions (millions) |

224 |

162 |

131 |

| POS Billings |

167,316.8 |

160,059 |

126,146 |

| POS Billings |

5,400 |

4,147 |

3,080 |

| Third-party correspondents |

1,847,000 |

1,571,000 |

1,336,782 |

| Number of internet clients |

826.9 |

708.0 |

613.4 |

| Number of internet clients (millions) |

247,141 |

192,245 |

136,014 |

| Mobile banking transactions (millions) |

43.6 |

22.1 |

10.0 |