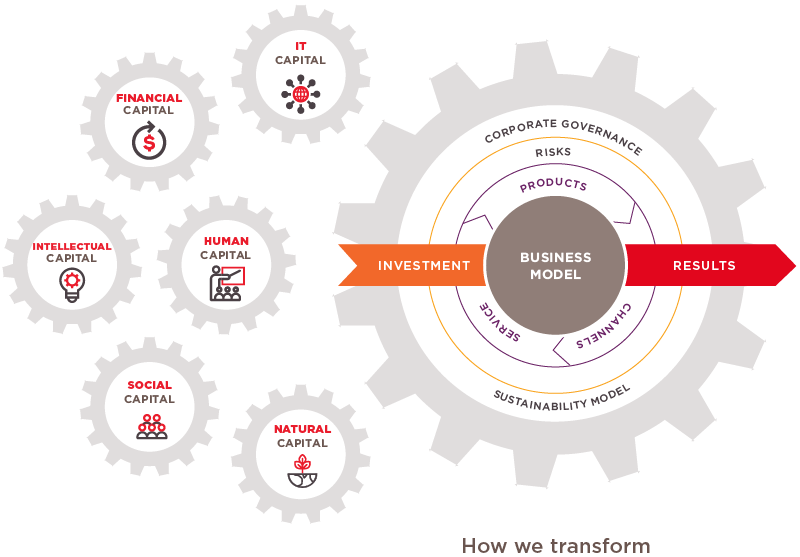

For GFNorte, generating value means growing our business, while helping to improve the social and environmental context of our country.

Our business model is centered around customer service. For this reason, we focused our 20/20 Vision strategic plan on becoming the best financial group in Mexico, and for Mexicans.

This model is based on six core capitals: Financial, Infrastructure and Information Technologies, Intellectual, Human, Social, and Natural; we invest in all of these to transform them and generate value for our clients.

We measure the contribution from each of these capitals to value generation in our business, and at the same time, we make sure they are responsibly managed. Just as we use and strengthen our financial, infrastructure, technological and intellectual capital, we are aware of our responsibility to develop and care for our human, social and natural capital.

In the chart below we show our main business lines, the associated risks, and the main results achieved in 2018. We also show the investment in each of the capitals, with their main impact indicators.

| VALUE CREATION MODEL | ||||||

|---|---|---|---|---|---|---|

| Our Capitals | STAKEHOLDERS | Main indicators of added value for our stakeholders | ||||

*IT: Infrastructure and Technology |

|

|

Employees |  |

FINANCIAL CAPITAL

INTELLECTUAL CAPITAL

SOCIAL CAPITAL

|

IT CAPITAL

HUMAN CAPITAL

NATURAL CAPITAL

|

|

Investors | |||||

|

Industry and finance authorities | |||||

|

Clients | |||||

|

Suppliers | |||||

|

Media |

|||||

|

Nonprofits | |||||

|

Communities | |||||

|

Government entities | |||||

| GFNORTE | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

BUSINESS LINES

DESCRIPTION

PRODUCTS AND SERVICES

|

ASSOCIATED RISKS | MAIN INDICATORS | ||||||||

|

|

|

|

|

|

|||||

Banking Banking |

Retail Banking | Offers a wide range of financial products and services to individuals, SMEs, Preferred Clients and state and municipal governments. | Deposits: Demand accounts, term savings accounts, funds, payroll Credit: Credit cards, auto loans, payroll loans, mortgage loans Channels: Banorte branches, ATMs, correspondents, point-of-sale terminals, mobile banking. SME banking: Financial products and services for small and mid-sized enterprises. | • | • | • | • | • | • | Banking sector: Net interest margin (NIM): 6.3% Return on equity (RoE): 25.7% Return on assets (ROA): 2.3% Cost to income ratio: 41.4% |

| Wholesale Banking | Specializes in providing comprehensive financial services to business and corporate clients through various types of specialized financing. | Company and Corporate Banking: comprehensive financial solutions for business and corporate clients through various types of specialized financing, including structured loans, syndicated loans, financing for acquisitions and investment plans. Transactional Banking: Comprehensive service model for promotion, implementation and post-sale service of transactional solutions and services. Government Banking: Banking, financial and comprehensive advisory services to all levels of government: federal, state and municipal, for developing the major projects that will transform Mexico. International Banking: Services and products for corporate, business, institutional and SME clients with international and foreign trade needs, as well as correspondent services for foreign financial institutions. | ||||||||

Long term savings Long term savings |

Annuities and Pension | We provide a wide array of products to guarantee present and future peace of mind for our clients. | Afore XXI Banorte: Mexico’s largest retirement fund manager, with advantages in terms of scale: lower operating costs and the potential to strengthen areas of operation, investment and service. Pensiones Banorte: A company that manages pensions derived from social security; a leader in the market. Insurance: A wide range of protection and planning services like life insurance, auto insurance, homeowner’s insurance and medical insurance, among others. | • | • | • | Afore XXI Banorte: Net income: Ps. 2,558 Shareholders’ equity: Ps. 24,541 Total assets: Ps. 26,437 Assets under management: Ps. 747,082 Return on equity (ROE): 10.7% Pensiones Banorte: Net income: Ps. 818 Shareholders’ equity: Ps. 3,845 Total assets: Ps. 123,177 Return on equity (ROE): 23.8% Insurance: Net income: Ps. 4,059 Shareholders’ equity: Ps. 23,096 Total assets: Ps. 51,478 Return on equity (ROE): 20.0% |

|||

Brokerage Brokerage |

Securities Sector | We offer products and services consistent with each client’s investment profile through Casa de Bolsa Banorte and Operadora de Fondos, with a broad range of financing options. | Securities Brokerage and Fund Management: Comprehensive products and services for individuals and corporations, including brokerage, financial advice, portfolios structuring and management, asset management, investing banking and sale of mutual funds, debt and equity instruments. | • | • | • | • | Securities Sector: Net income: Ps. 1,070 Shareholders’ equity: Ps. 3,884 Assets Under Management: Ps. 878,033 Return on equity (ROE): 31.8% |

||

SOFOM and other Finance Companies SOFOM and other Finance Companies |

Non-bank banks and Auxiliary Credit Institutions | The companies that make up this sector are Arrendadora y Factoraje Banorte (leasing and factoring); Almacenadora Banorte (warehousing) and Sólida Administradora de Portafolios (collections). | Arrendadora y Factoraje: Leasing and factoring services Almacenadora Banorte: warehousing, inventory management, commercialization and logistics Sólida Administradora de Portafolios: The asset recovery arm of the Financial Group. Responsible for managing, collecting and recovering credits originated by the bank which have entered delinquent status. | • | • | • | • | Leasing and Factoring: Net income: Ps. 861 Shareholders’ equity: Ps. 4,957 Total assets: Ps. 36,216 Return on equity (ROE): 17.0% Warehousing: Net income: Ps. 17 Shareholders’ equity: Ps. 243 Total assets: Ps. 1,154 Return on equity (ROE): 7.2% Sólida: Net income: Ps. (797) Shareholders’ equity: Ps. 3,178 Total assets: Ps. 9,515 |

||

Figures in millions of pesos.