We offer financial liquidity and investment solutions for social infrastructure development.

Grupo Financiero Banorte and Grupo Financiero Interacciones merged in July 2018 to strengthen the area of public sector financing. Today, we offer financial liquidity and investment solutions for social infrastructure development at all three levels of government— with direct financing to states and municipalities— as well as to contractors and suppliers.

We specialize in lending in which the repayment source will be public funds. Our products provide financial viability to infrastructure projects and government procurement, providing precise monitoring, and guaranteeing they are carried to completion.

We also lend certainty to government initiatives, creating synergies with the private sector.

As part of our high degree of specialization, we have a Market Intelligence Unit that conducts technical, economic, financial and political analysis of the sectors in which we participate in order to assertively promote our products and services and anticipate important business opportunities. This unit also supports the institutional relationship effort with current or potential customers.

We provide the following specialized products and services:

1. Direct financing (DIFI)

Financial solutions tailored to the needs of state and local governments that generate long term productive public investment to enable them manage temporary liquidity shortfalls —periods of under a year:

DIFI makes it possible for state and municipal governments to develop their communities through social impact projects; it also helps governments resolve seasonal fluctuations in revenue and expenditure. We provide legal and regulatory consulting based on our thorough knowledge of public finance market related legal and regulatory issues.

We have earned our customers’ trust thanks to our prompt attention, high degree of technical specialization, and thorough knowledge of Mexico’s Law on Financial Discipline to ensure healthy public finances.

In addition, we offer support and consulting services for reordering and strengthening finance at all three levels of government, at the same time as we support the development of basic and productive social infrastructure.

With our interest rate hedging products, we help shield state and municipal public finance from market volatility.

2. Contractor Financing (FICON)

We finance contractors engaged in public federal, state and municipal infrastructure projects in the form of:

The FICON model guarantees the correct execution and completion of public works on time and in due form. We design unique structures for each project in order to mitigate a variety of risks in the construction and execution process, in providing services, and in operations and maintenance.

We have a highly specialized technical area (UASPI) for assuring control and oversight of project management from start to finish. When necessary we issue preventative risk alerts for risk mitigation purposes.

3. Supplier financing (FIPRO)

We offer timely liquidity to suppliers to all three levels of government so that they can continue to attend to public sector needs:

FIPRO offers benefits to governments and suppliers alike. It entails no liabilities or costs for governments and their agencies. It makes possible payment planning in keeping with budgetary availability by incorporating a timeline for contractual payments. For their part, suppliers access the resources necessary to meet their contractual commitments.

The projects we finance have high social impact with significant benefits both for the public and private sectors. They address fundamental needs of communities by developing basic infrastructure.

Although Mexico’s political and economic environment can undergo sudden changes, we have the capacity to remain public administration’s natural ally for financial solutions, making us the main driver of their priority projects.

| 1. Direct Finance | ||

|---|---|---|

| Accredited entities | Number | Amount (millions of pesos) |

| States | 26 | 116,330 |

| Municipalities | 86 | 9,254 |

| Otros | 13 | 7,266 |

| OthersTotal | 125 | 132,850 |

| 2. CONTRACTOR FINANCING | |||

|---|---|---|---|

| Sector | Projects | Share (%) |

Amount (millions of pesos) |

| Mobility | 34 | 39.4% | 19,326 |

| Energy | 23 | 29.4% | 14,415 |

| Urban complexes | 15 | 12.9% | 6,308 |

| Security | 8 | 6.1% | 3,002 |

| Water | 7 | 5.7% | 2,809 |

| Education | 5 | 5.3% | 2,694 |

| Others | 5 | 0.7% | 350 |

| Health | 2 | 0.3% | 151 |

| Total | 99 | 100% | 49,055 |

|

Mobility: roads, paving, bridges, tunnels, international bridges and public transport. |

|

Water: treatment plants, collectors, potable water distribution and sanitation infrastructure. |

|

Urban complexes: administrative cities, integral public service centers and parking facilities. |

|

Education: museums, sports complexes and school infrastructure. |

|

Energy: electric power transmission and distribution lines, pipelines, luminaires, and infrastructure for petroleum extraction and clean electric power generation. |

|

Health: hospitals (general and specialty). |

|

Security: penitentiaries and barracks for those changed with maintaining public order. |

| 3. SUPPLIER FINANCING | |||

|---|---|---|---|

| Agencies/States | Suppliers | Resources (millions of pesos) | |

| Federal | 13 | 74 | 11,724 |

| Subnational | 18 | 174 | 6,522 |

| Commercial | 1 | 1 | 3,668 |

| Total | 32 | 249 | 21,914 |

We continue to support Mexico’s small and mid-sized enterprises (SME), because we know entrepreneurship is the key to a nation’s economic development.

That’s one reason our relationship to our customers is so important to us —to learn about their financial needs and be on the alert for special circumstances that arise in the national and local markets.

In order to promote local development, last year we continued to provide special conditions for SMEs in industries or regions of the country that were in need of special support. In 2018, the funding portfolio for these programs totaled 6.31 billion pesos1, through 2,800 loans1, with the addition of nine special industry support or economic reactivation programs to our shelf of support options for Mexican SMEs.

Additionally, and following the institutional line of support for entrepreneurship and social responsibility, in 2018 we began participating in Youth Credit programs, which offer financing for solar panel systems and individualized eco-credit loans.

1 Industry and emerging portfolio registered with Nafin/Bancomext in 2018.

| 2018 SME Support Programs | |

|---|---|

| SME Woman | Crediactivo Commercial Construction Loan for Diana |

| Construction industry loans | Banorte Eco-Business Loans for individual energy efficiency |

| Crediactivo Commercial loans | Economic and jobs support in the state of Querétaro |

| “Ven a Comer” (Come and Eat) loans | Economic and jobs support in the state of Oaxaca |

| Economic and jobs support for the state of Nuevo Leon | My SME Support Southwest (Michoacán) |

| SME Loans for youth | Pemex Vendors |

| Natural Disaster Support Loans for Other States | Economic and jobs support in Mexico State |

| Crediactivo Tourist Industry Loans | Crediactivo Improve Your Hotel and Gastronomy |

| Crediactivo Loans to Entrepreneurs | Natural Disaster Support Loans in Puebla 2017 |

| Crediactivo Loans for Large Companies | Crediactivo Commercial Loan for Tourist Industry |

| Economic and jobs support for the state of Sinaloa | My SME Support Southwest (Guerrero) |

| Leather and Footwear Industry Program | Economic and jobs support in the state of Sonora, Tourism Industry |

| Textile, Apparel and Fashion Industry | My SME Strengthening and Consolidation for businesses in state of Tamaulipas |

| My SME Support Southwest (Oaxaca) | Economic reactivation of Tabasco, phase II |

| Economic and jobs support in the state of Chihuahua | Economic support in border regions, state of Tamaulipas |

| Economic and jobs support in the state of Aguascalientes | My SME Support Southwest (Guerrero 2017) |

| SMEs in the Automotive Industry | Natural Disasters (Guerrero 2017) |

| Economic and jobs support in the state of Baja California | Economic support in border regions, state of Baja California |

| Economic and jobs support in the state of Durango | Economic reactivation in states of Guerrero, Oaxaca and Chiapas, new loans |

| SMEs in the Electric-Electronics industry | Natural Disaster Support Loans, Mexico City 2017 |

| Crediactivo Loan for Exporters | Economic support in border regions, state of Quintana Roo |

| Economic and jobs support in the state of Zacatecas, phase II | Economic and jobs support in the state of Sinaloa |

| Crediactivo Loan for Large Tourism Companies | Economic and jobs support in the state of Aguascalientes, phase II |

| Economic and jobs support in the state of Hidalgo | 2015 Natural Disasters, Hurricane Marty, Sonora |

| My SME Support Southwest (Campeche and Tabasco) | My SME Financing, National Crusade against Hunger and Violence |

| Crediactivo Loan for Foreign Trade | Financing to Support Strategic Industries, state of Guanajuato |

| Microsupport financing for small businesses (RIF) | Economic and jobs support in the state of Puebla |

| My SME Support Southwest (Chiapas) | Economic support in border regions, state of Coahuila |

| Grand Total Ps. 6,308,120,496 | |

We bring banking closer to our customers in towns with limited access to banks. Through our network of correspondents —retail chains separate from Banorte, with their own staff and equipment— we provide our customers a range of services such as payments, deposits, withdrawals or checking your account balances in real time just as if they had conducted such business directly in one of our branches.

We promote financial inclusion in Mexico through Banorte correspondents for two reasons:

Correspondents are great drivers of financial inclusion for Mexican development.

| CORRESPONDENTS | |||

|---|---|---|---|

| Channel | Number of offices | Number of municipalities in Mexico covered | Percentage of municipalities in Mexico covered |

| Banorte branch network | 1,150 | 328 | 13.3 |

| Agent network | 28,227 | 1,433 | 58.2 |

| Correspondents located in municipalities lacking Banorte branches | 4,311 | 1,110 | 45.1 |

| Correspondents located in municipalities lacking any bank branches | 880 | 539 | 21.9 |

Number of municipalities in Mexico: 2,459. Source: www.inegi.gob.mx

Poverty index data taken from: www.coneval.gob.mx

Learn more about growth in bank agent infrastructure in the Our Coverage section.

In support of Mexico’s development, we incentivize relations with domestic suppliers through our value chain.

This year, 96% of our suppliers (1,681) were domestic, and 95% provided some type of service to the institution.

| SUPPLIER INFORMATION | |||

|---|---|---|---|

| 2018 | 2017 | Change % | |

| Interaction with suppliers | |||

| Number of suppliers | 1,681 | 1,336 | 26 |

| Supplier origin | |||

| Foreign | 77 | 49 | 57 |

| Domestic | 1,604 | 1,287 | 25 |

| Total | 1,681 | 1,336 | 26 |

| Supplier class | |||

| Purchases | 144 | 12 | 1,100 |

| Services | 1,537 | 1,324 | 16 |

| Total | 1,681 | 1,336 | 26 |

| Supplier type | |||

| Definitive | 1,219 | 949 | 28 |

| Occasional | 462 | 387 | 19 |

| Total | 1,681 | 1,336 | 26 |

To ensure that integrity and sustainability permeate our entire operation, we disseminate healthy business practices through our value chain.

Since 2012, we have asked all our suppliers to sign contracts affirming that they are aware of and apply the 10 UN Global Compact Principles. We apply a questionnaire to new suppliers in keeping with the criteria laid out in the Global Compact’s Supply Chain Sustainability – A Practical Guide for Continuous Improvement (2nd edition), which allows us to detect risks associated with failing to comply with applicable laws, as well as learning of their corporate sustainability and social responsibility initiatives.

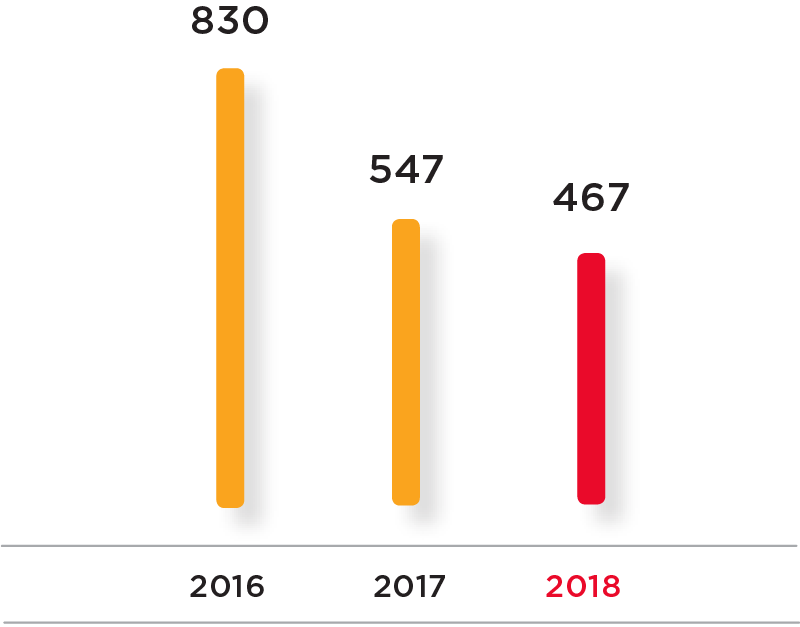

CONTRACTS WITH SUPPLIERS WHO STATE THEIR KNOWLEDGE OF THE 10 PRINCIPLES OF THE GLOBAL COMPACT

CONTRACTS WITH SUPPLIERS WHO STATE THEIR KNOWLEDGE OF THE 10 PRINCIPLES OF THE GLOBAL COMPACT

Fundación Banorte embodies our sense of shared responsibility for this country and for its people. We want to play a part in Mexico’s progress and ensure that the social investment of this Financial Group obtains the greatest possible return.

Accordingly, we have joined efforts with various allies, and allocated a substantial amount of funding to transform education for the 21st century through the “Banorte Educational Leaders” program, because we are convinced that this is the best tool for social mobility.

We have two other programs: 1,000 Dreams to Fulfill, through which we support the dreams of many young people; and Disaster Support, through which we help rebuild communities affected by natural disasters.

Social investment by Fundación Banorte in 2018 totaled Ps. 88 million, directly benefiting 359,417 Mexicans throughout the country. These results were made possible by the strategic alliances we have formed with non-profit organizations, academic and public institutions and authorities at all three levels of government.

We transform preschool education in the 21st century through network of learning, continuing education, multiplication of good practices and mentoring of preschool educational leaders. With this, we strengthen their role as agents of change and support girls’ and boys’ right to learn.

This program is currently active in Aguascalientes, Campeche, Hidalgo, Puebla, Sonora, Mexico City and Mexico State, and is held biyearly, in each semester of the school year. Out top achievements of 2018 were:

| Organizations supported: 6 |

|---|

| Amount: Ps. 18,969,816 |

| Direct beneficiaries: 9,949 people |

| Alliances: 21 |

We support Mexican youth who show academic, artistic, and sports talent, as well as those receiving special education, helping them fulfill their dreams. We provided each student with a stipend for a three-year period and encouraged them to continue their studies and maintain a level of excellence in their activities. In 2018:

| Scholarship type | Number of recipients |

|---|---|

| Academic excellence | 1,428 |

| Sports | 85 |

| Arts | 27 |

| Special education | 35 |

| Total | 1,575 |

| Organizations supported: 1 |

|---|

| Amount: Ps. 17,900,000 |

| Direct beneficiaries: 2,146 people |

We coordinated an action plan to help rebuild homes and restore means of support in nine communities of seven states of Mexico that had been affected by the September 2017 earthquakes. This action plan is part of the comprehensive “Banorte Adopts a Community” program which will support these communities for three years. In 2018:

| Organizations supported: 4 |

|---|

| Amount: Ps. 37,528,800 |

| Direct beneficiaries: 2,800 people |

We donate to philanthropic actions and counterpart funds to resolve issues affecting communities where we have a commercial or service presence, to those whose programs relate to Fundación Banorte’s strategies, or to the concerns of Group employees and senior management, as well as to union causes.

In 2018 we provided opportunities for educational access to poor and unprivileged youth and the homeless; we gave young people with intellectual disabilities opportunities for independent living; we supported access to educational and cultural institutions for more than 300,000 people and fostered dialogue with political candidates on the issues of infant and early childhood development and preschool education.

| Organizations supported: 9 |

|---|

| Amount: Ps. 13,632,116 |

| Direct beneficiaries: 344,522 people |

As we do every year, we provided advice and helped design and operate social assistance initiatives within GFNorte, raising awareness on matters of philanthropy and social commitment and encouraging participation by members of our own community.

With all the actions taken over the course of the year, we were able:

In 2019, we intend to continue generating social value for Grupo Financiero Banorte through systematic, high-impact social investment in the communities where we operate and with which we coexist. In our philanthropic work, GFNorte will continue to act as a key investor in quality preschool education for the 21st century, promoting the talent of the Mexicans of today and the future. We will also redouble our efforts in solidarity with communities as they recover from natural disasters or emergencies, and we will fortify our social practices so we can continue meet the expectations of our customers and our investors.

AyuDamos (We Give Help) is Banorte’s philanthropic trust, funded through voluntary donations by our employees, and to which Banorte Foundation makes a matching contribution for each peso donated.

It funds projects chosen by a selection committee comprised of volunteer employees that visit and review each and every one of the institutions. In this way we strengthen a culture of donation and social work among our employees.

In 2018, we decided to direct the trust’s first invitation to institutions with which we have established an alliance for the Banorte Adopts a Community program with the aim of strengthen actions in communities affected by the earthquakes of September 2017.

In the second invitation, the trust appropriated Ps. 3,315,456.00 to 16 institutions that submitted projects. The funds were distributed as follows:

| NUMBER | TERRITORY | ORGANIZATION | NAME PROJECT | AMOUNT |

|---|---|---|---|---|

| 1 | Peninsula | Échale a tu Casa* | We funded reconstruction efforts in San Francisco del Mar, Oaxaca. | Ps. 47,100.00 |

| 2 | Peninsula | Habitat for Humanity* | We funded reconstruction efforts in Tonalá, Chiapas. | Ps. 97,911.00 |

| 3 | Peninsula | Un Nuevo Amanecer en pro del Discapacitado, A.C. | We strengthened CAI Nuevo Amanecer’s early care services for children with high risk factors or disabilities | Ps. 300,000.00 |

| 4 | Peninsula | Hunab Proyecto de Vida, A.C. | Donation for building the environmental library “Profa. Irene Juárez Uribe” in Mérida, Yucatán. | Ps. 300,000.00 |

| 5 | South | Fundación Tosepan* | We funded reconstruction efforts in Santa Cruz Cuautomatitla, Puebla. | Ps. 300,000.00 |

| 6 | South | Échale a tu Casa* | We funded reinforcing reconstruction efforts in Tlayacapan, Morelos. | Ps. 42,316.00 |

| 7 | South | Fundación Hogares* | We funded reconstruction efforts in Jojutla, Morelos. | Ps. 131,380.00 |

| 8 | Mexico State | Échale a tu Casa* | We funded reconstruction efforts in Ocuilan, State of Mexico. | Ps. 14,749.00 |

| 9 | Mexico State | Échale a tu Casa | We repaired water lines for 22 families in the Reforma Agraria neighborhood in Ocuilan, State of Mexico. | Ps. 132,000.00 |

| 10 | Mexico State | Hogares Infantiles, A.C. | Donation of educational materials for children who attend the center. | Ps. 250,000.00 |

| 11 | Mexico State | Ministerio Vive, A.C. | Donation to contribute to the construction project “May your help change lives”. | Ps. 300,000.00 |

| 12 | Mexico State | Alianza para la Integración Comunitaria Utopía A.C. | Donation to the “Life champions, forgers of peace” program through educational, sports and physio-social skills interventions, promoting their social development and inclusion. | Ps. 300,000.00 |

| 13 | Mexico City | FUCAM, A.C.* | The women with a questionable diagnosis were transferred to clinics in the main cities to expand their diagnosis. | Ps. 100,000.00 |

| 14 | Mexico City | Tejiendo Alianzas, A.C.* | We funded reinforcement of complementary actions in all nine communities. | Ps. 450,000.00 |

| 15 | North | Instituto Nuevo Amanecer, A.B.P. | Donation to guarantee 1,142 physical therapies for those using the center. | Ps. 250,000.00 |

| 16 | North | Asociación Regiomontana de Niños Autistas, A.B.P. | We strengthened the recreational and pre-labor area of the autistic adolescents program. | Ps. 300,000.00 |

| Total= Ps. 3,315,456 | ||||

*Projects supported by the Banorte Adopts a Community program.

In line with our sustainability model and the “Our People” pillar, this program is one part of the Bank’s community intervention effort, promoting activities that contribute to teir development through actions with an enduring effect.

The volunteer work model is built on three axes:

Playing, Playing. This is our annual toy drive. Gifts are donated by Banorte employees from throughout the country, and costumed volunteers deliver them to community centers, civil society organizations and communities that are part of Banorte Adopts a Community program.

In 2018, we collected 30,825 presents consisting of school kits that contain professional notebooks, pencils, pens, and pencil cases as well as backpacks and toys.

This year we sent 501 school kits to communities affected by the 2017 earthquakes that also form part of the Banorte Adopts a Community program.

| Number of volunteers nationwide that participated in the initiative | 620 |

| Hours of volunteer work on this initiative (assuming four hours per employee) | 2,480 |

Working for my community. An initiative that promotes social organization by communities and employees in order to build community alliances, foster solidarity and encourage the active involvement of volunteers in community development and in actions with a lasting impact.

In 2018, we entered into an alliance with Fundación Hogares, I.A.P. to promote four days of volunteer work:

In each of these activities, our volunteers created bonds with the community and with Fundación Hogares personnel, and in that way helped raise awareness of social problems and community organization.

| Number of volunteers that participated in the initiative | 78 |

| Hours of volunteer work on this initiative (assuming six hours per employee) | 468 |

Volunteers from the Torre Sur corporate headquarters in Monterrey organized a drive to collect plastic bottle caps for the Alianza Anticáncer Infantil, A.B.P. center. They offered the children a workshop on cooking and movies, and delivered the bottle caps with which to purchase wheelchairs.

| Number of volunteers that participated in the initiative | 8 |

| Hours of volunteer work on this initiative (assuming three hours per employee) | 24 |

Natural disasters. The Banorte Adopts a Community program arose out of the 2017 earthquakes, and through it we have adopted nine communities in the states where homes needed to be rebuilt. The bank volunteers located near those communities undertook a series of activities that were to become part of the reconstruction program:

| Number of volunteers that participated in the initiative | 165 |

| Hours of volunteer work on this initiative (assuming 10 hours per employee) | 1,650 |

Financial Education. As a financial institution, we are committed to providing the community sensitivity and awareness-raising workshops on financial culture. For that reason, we gave summer workshops to 90 children between the ages of 6 and 15 years in the offices of the Mexico City Ministry of Public Security in the municipalities of Cuajimalpa, Iztacalco and Cuauhtémoc. The workshops dealt with mutual funds, economic analysis, Afore retirement fund administrators, and family finances.

| Number of volunteers that participated in the initiative | 13 |

| Hours of volunteer work on this initiative (assuming three hours per employee) | 39 |

Additionally, in five communities from Banorte Adopts a Community program, a workshop on family finance was given to 310 people.

| Number of volunteers that participated in the initiative | 15 |

| Hours of volunteer work on this initiative (assuming eight hours per employee) | 120 |

We established an alliance with Reforestamos México to reforest two wooded areas closest to Banorte’s two main corporate headquarters: Nevado de Toluca, in Mexico City, and Parque Nacional Cumbres, in Monterrey. Overall, we planted 2,600 trees over three hectares.

| Number of volunteers that participated in the initiative | 168 |

| Hours of volunteer work on this initiative (assuming 10 hours per employee) | 1,680 |

In the context of Mexico’s National Financial Education Week, five bank volunteers gave the talks to 500 people on topics like “Better safe than sorry,” “Mutual funds,” “Bitcoin and cryptocurrencies,” “Understanding saving and investment,” and “Saving for retirement.”

| Total volunteers that participated in the initiative | 5 |

| Total hours of volunteer work on this initiative (assuming two hours per employee) | 10 |

At present 1,072 employees participate in the Banorte Volunteer Corps. They have dedicated a combined 6,468 hours to volunteer work in support of the community, the environment and Financial Education for the public.