We are convinced that sustainability is a crucial factor for the development of the financial industry and the prosperity of our country.

GFNorte recognizes the role financial institutions must play in the transition toward a sustainable global economy. For this reason, we integrate sustainability into our business strategy as the guiding principle for achieving our goals, while protecting our natural and social capital.

We are convinced that sustainability is a crucial factor for the development of the financial industry and the prosperity of our country. Therefore, we intend to grow by helping to build a resilient future, creating value, avoiding risk, and working for a positive change in the world around us.

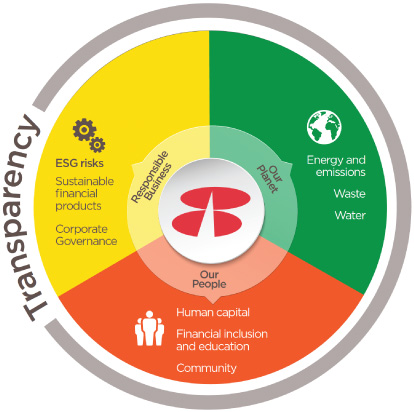

We strive to work with total responsibility and transparency, to innovate in the products and services we offer, to minimize our impact on the environment, and together with the community, to migrate toward a model of growth that can contribute value for all our stakeholders. Accordingly, our sustainability strategy is sustained by three basic pillars:

We incorporate environmental, social, and corporate governance (ESG) factors into our credit and investment portfolios; this enables us to manage the risks and impacts of our operations and identify potential business opportunities, as well as new products and services.

We promote social programs that involve our employees and the communities where we are present in applying practices that improve living conditions inside and outside of the institution.

We pursue initiatives to strengthen environmental culture within the institution, to measure and reduce our consumption of resources and our generation of waste.

As engines of economic development, we are responsible for focusing attention on issues that pose unprecedented challenges globally and for our country. For this reason, we reiterate our commitment to respect for human rights, mitigation and adaptation to climate change, and conservation of biodiversity.

Human rights. Mexico is one of the countries that has been visited by the most international observers in recent years due to the number of reported cases of human rights violation against vulnerable people and communities. Aware of this situation, Banorte has diagnosed, evaluated and ensured respect for human rights in our own operations, in line with the directives of the International Declaration on Human Rights.

Climate change. This is one of the most serious issues of the 21st century, and Mexico is one of the most vulnerable countries, because its territory, population and economy are particularly exposed to adverse effects. We therefore believe it is essential to involve ourselves in mitigation and adaptation efforts, low carbon emission alternatives, and the generation of renewable energy.

Biodiversity. Although Mexico is the fourth most bio-diverse country in the world, more than half of its native species are categorized as endangered due to man-made causes. It is crucial that our activities and projects include efforts to protect animal and vegetable species, habitats and ecosystems, to be able to protect the balance and natural wealth of this country.

The area in charge of putting this sustainability strategy into practice in this Group is the Specialized Department on Sustainability and Responsible Investment, which reports to the Executive Department of Investor Relations, Sustainability and Financial Intelligence.

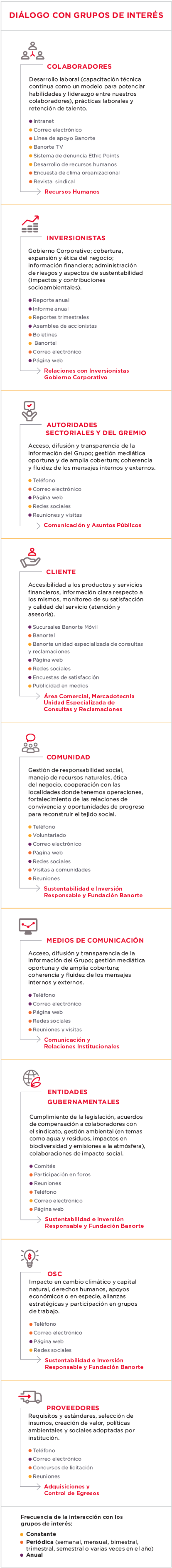

Our stakeholders are vital to the pursuit of our goals. We therefore maintain a constant and open dialogue with them to stay informed of their needs and expectations, encourage their involvement and meet mutual commitments. The frequency of these interactions depends on the channels established with each group, although our approach is always to meet their needs.

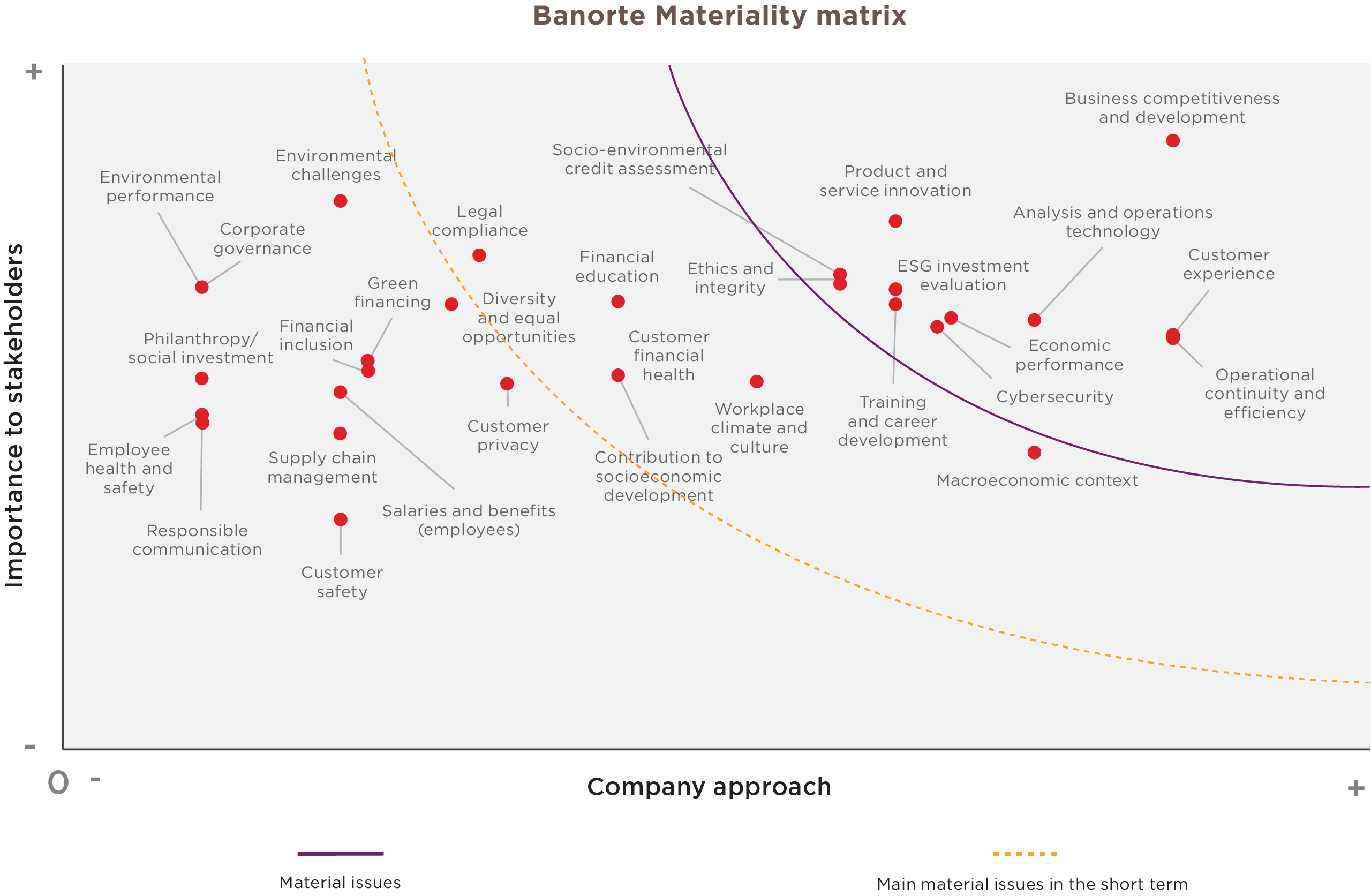

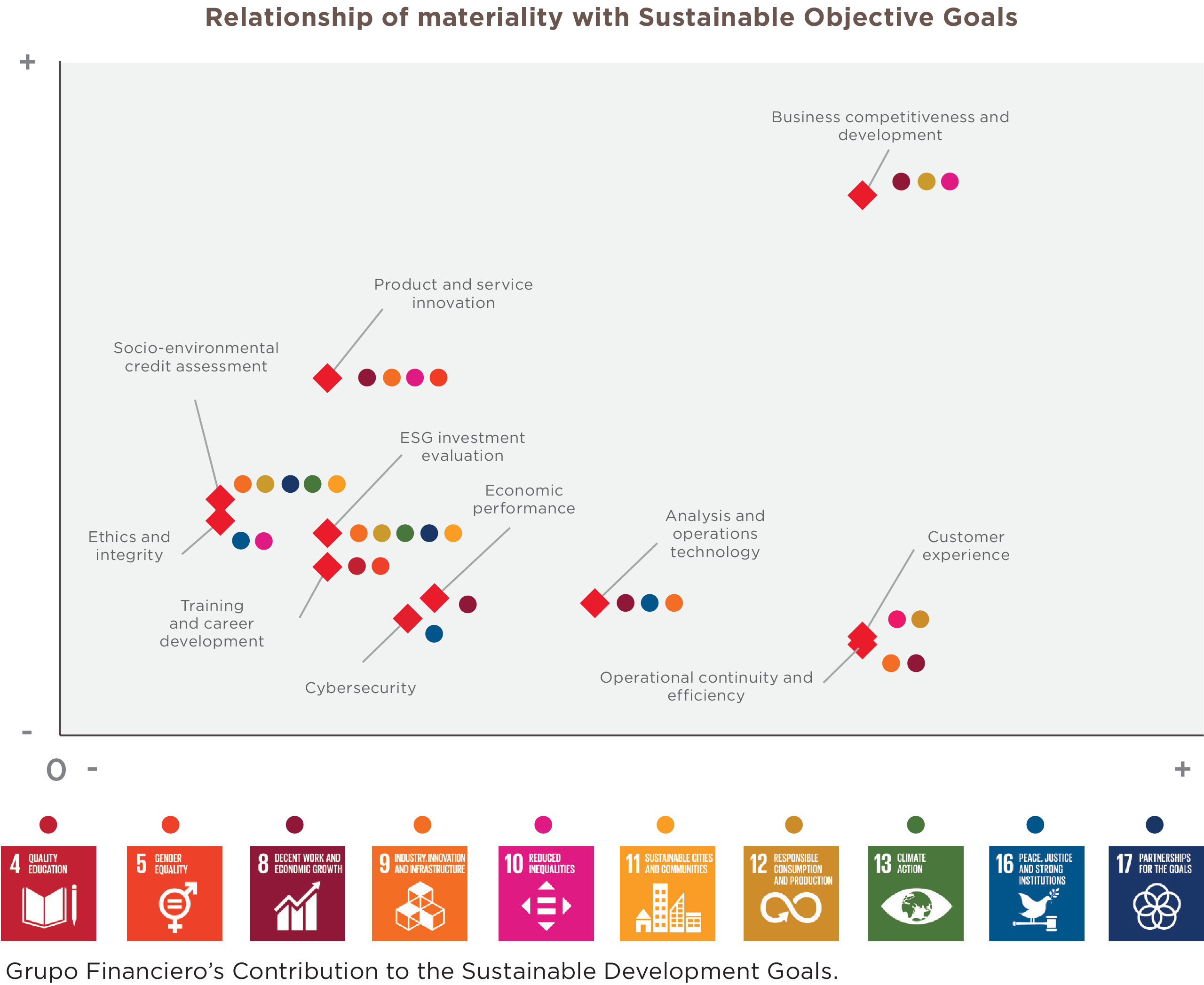

At Banorte, we are concerned with assessing our own capacity to create value and minimize impacts. To this end, in an effort to support continuous improvement, we updated our materiality exercise in 2018 to involve key agents that are among our stakeholders.

A materiality analysis is a strategic tool for understanding the evolution of sustainability in our industry. In this exercise, we consulted with employees, clients and leaders in the field through surveys and interviews that were prepared based on the Banorte value creation model.

We also analyzed industry documents to obtain an overview of the financial industry, the issues identified by our peers, our mentions in the press, and the priorities for Mexico contained in the 2030 Agenda.

The extensive analysis conducted in keeping with recommendations for identifying and prioritizing issues suggested by the Global Reporting Initiative (GRI) yielded 30 material issues, which we addressed in this document through information on actions, initiatives and projects carried out in each of them, as well as the way in which they align with the United Nations Sustainable Development Goals and the Principles for Responsible Banking.

By aligning our operations, products and services with the Sustainable Development Goals (SDG) proposed by the United Nations Program for Development (UNPD), we seek to focus our attention on Mexico’s social and environmental priorities toward the year 2030.

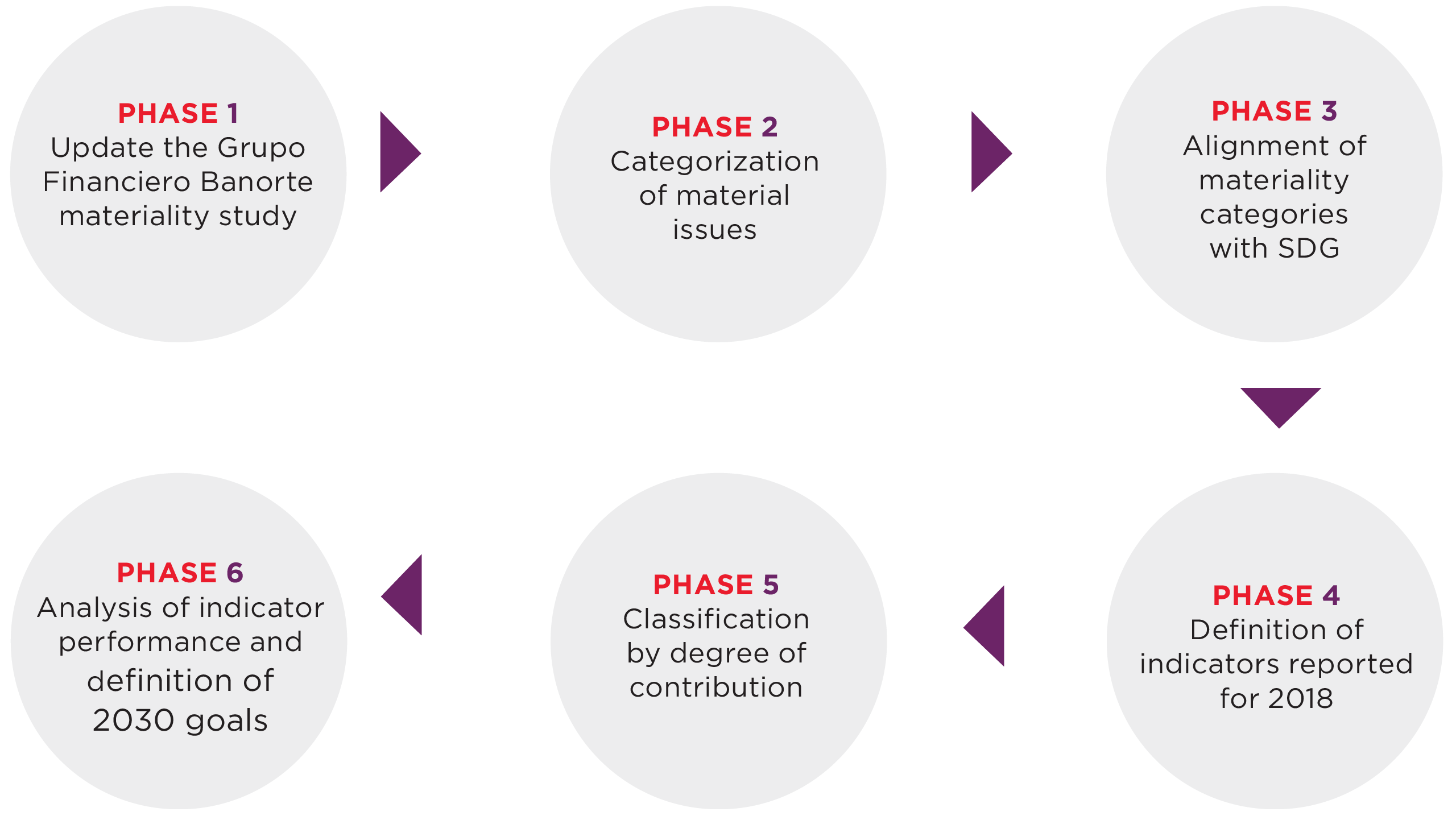

To form a basis on which to improve our actions in this regard, we conducted our first analysis of our contribution to the SDG, in terms of the group’s materiality analysis and operational indicators.

The methodology used to determine our contribution to the SDG is based on the following frameworks and tools:

This methodology consist of six phases:

| BANORTE CONTRIBUTION TO SUSTAINABLE DEVELOPMENT GOALS | |||||

|---|---|---|---|---|---|

| Degree of contribution | HIGH LOW |

||||

| Material issues | |||||

| Competitiveness and Business Development |  TARGET 10.2 Empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status. TARGET 10.2 Empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status. |

TARGET 8.4 Improve global resource efficiency in consumption and production and endeavor to decouple economic growth from environmental degradation. TARGET 8.4 Improve global resource efficiency in consumption and production and endeavor to decouple economic growth from environmental degradation. |

TARGET 13.3 Improve education, awareness-raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction and early warning. TARGET 13.3 Improve education, awareness-raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction and early warning. |

TARGET 12.5 Substantially reduce waste generation through policies on prevention, reduction, recycling and reuse. TARGET 12.5 Substantially reduce waste generation through policies on prevention, reduction, recycling and reuse. |

TARGET 15.2 By 2020, promote the implementation of sustainable management of all types of forests, halt deforestation, restore degraded forests and ubstantially increase afforestation and reforestation globally. TARGET 15.2 By 2020, promote the implementation of sustainable management of all types of forests, halt deforestation, restore degraded forests and ubstantially increase afforestation and reforestation globally. |

|

Customer experience Corporate volunteering Financial education |

Sustainable business |

Reduced energy and emissions |

Appropriate waste management Furthermore, we have 1,311,350 customers who use a smartphone token, avoiding the production and use of physical tokens. |

Reforestation |

|

| BANORTE CONTRIBUTION TO SUSTAINABLE DEVELOPMENT GOALS | |||||

|---|---|---|---|---|---|

| Degree of contribution | HIGH

LOW |

||||

| Material issues | |||||

| Product and service innovation |  TARGET 8.5 Achieve full and productive employment and decent work for all women and men. TARGET 8.5 Achieve full and productive employment and decent work for all women and men. |

TARGET 10.2 Empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status. TARGET 10.2 Empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status. |

TARGET 9.1 Develop quality, reliable, sustainable and resilient infrastructure, including regional and trans-border infrastructure, to support economic development and human well-being. TARGET 9.1 Develop quality, reliable, sustainable and resilient infrastructure, including regional and trans-border infrastructure, to support economic development and human well-being. |

TARGET 5A Give women access to financial services. TARGET 5A Give women access to financial services. |

TARGET 3.8 Achieve universal health coverage, including financial risk protection and access to quality essential health-care services. TARGET 3.8 Achieve universal health coverage, including financial risk protection and access to quality essential health-care services. |

Payroll and SME loans |

Physical and digital infrastructure |

Infrastructure and Development |

Gender-based financial products |

Major medical insurance |

|

| Education and Development |  TARGET 8.5 Achieve full and productive employment and decent work for all women and men. TARGET 8.5 Achieve full and productive employment and decent work for all women and men. |

TARGET 5.5 Ensure women’s full and effective participation and equal opportunities. TARGET 5.5 Ensure women’s full and effective participation and equal opportunities. |

TARGET 4C Substantially increase the supply of qualified teachers, including through international cooperation for teacher training in developing countries. TARGET 4C Substantially increase the supply of qualified teachers, including through international cooperation for teacher training in developing countries. |

TARGET 1.5 Build the resilience of the poor and those in vulnerable situations and reduce their exposure and vulnerability to climate-related extreme events. TARGET 1.5 Build the resilience of the poor and those in vulnerable situations and reduce their exposure and vulnerability to climate-related extreme events. |

TARGET 2.3 Double the agricultural productivity and incomes of small-scale food producers, respecting the environment and biodiversity in each region. TARGET 2.3 Double the agricultural productivity and incomes of small-scale food producers, respecting the environment and biodiversity in each region.TARGET 2A Increase investment, including through enhanced international cooperation. |

Salaries and benefits Furthermore, aware of the pay gap between men and women, every year we report salary data broken down by gender, and we are working to gradually reduce the disparity. So far we have reduced the gender gap to 1% in administrative positions; 8.8% in middle management and 10.4% in executive positions, aware that the greater the wage parity between men and women, the stronger our country’s economic growth will be. |

Gender focus in employee training |

Education and training |

Banorte Adopts a Community |

Agricultural Banking |

|

| BANORTE CONTRIBUTION TO SUSTAINABLE DEVELOPMENT GOALS | |||||

|---|---|---|---|---|---|

| Degree of contribution | HIGH

LOW |

||||

| Material issues | |||||

| Socio-environmental assessment of lending and investment activities |  TARGET 11.4 Strengthen efforts to protect and safeguard the world’s cultural and natural heritage. TARGET 11.4 Strengthen efforts to protect and safeguard the world’s cultural and natural heritage. |

TARGET 13.1 Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries. TARGET 13.1 Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries. |

TARGET 7B By 2030, expand infrastructure and upgrade technology for supplying modern and sustainable energy services for all in developing countries. TARGET 7B By 2030, expand infrastructure and upgrade technology for supplying modern and sustainable energy services for all in developing countries. |

TARGET 14A Increase scientific knowledge in order to improve ocean health and to enhance the contribution of marine biodiversity. TARGET 14A Increase scientific knowledge in order to improve ocean health and to enhance the contribution of marine biodiversity. |

|

Management of environmental and social risks |

Homeowners’ and casualty insurance |

Renewable energies |

Emerging risk mitigation |

||

| Ethics and integrity |  TARGET 10.3 Ensure equal opportunity and reduce inequalities of outcome, including by eliminating discriminatory laws, policies and practices and promoting appropriate legislation, policies and action in this regard. TARGET 10.3 Ensure equal opportunity and reduce inequalities of outcome, including by eliminating discriminatory laws, policies and practices and promoting appropriate legislation, policies and action in this regard. |

TARGET 16.6 Develop effective, accountable and transparent institutions at all levels. TARGET 16.6 Develop effective, accountable and transparent institutions at all levels. |

TARGET 17.09 Enhance support for national plans to implement all the Sustainable Development Goals. TARGET 17.09 Enhance support for national plans to implement all the Sustainable Development Goals. |

|

|

Code of Conduct |

Corporate Governance |

Comprehensive alliances

|

|||

In 2018, 28 banks of the world took the initiative, together with the United Nations Environmental Program for Financial Initiatives (UNEP FI) to develop what are called the Principles for Responsible Banking. Banorte is the only Mexican bank, and one of only three Latin American banks, in this founding group. These Principles were the subject of a global consultation in November 2018, and seek to define banks’ role in society and economies of the 21st century. The document will be signed by all the world’s banks in September 2019 at the United Nations headquarters in New York.

These Principles seek to align banks with the goals of society, as expressed in the United Nations Sustainable Development Objectives and the Paris Agreement. They establish a baseline for what it means to be a responsible bank, and provide a guide to action on how to achieve it. They promote the ambition and issue a challenge to banks to continually contribute to building a sustainable future. The Principles will help banks to take advantage of opportunities present in the changing society and economies of the 21st century by creating value for society and stakeholders, bolstering the confidence of clients, investors, employees and society at large.

The Principles for Responsible Banking provide a unique framework for the banking industry that incorporates sustainability at the strategic, portfolio and transactional level, and throughout all business areas. The key to these Principles lies in their establishment and publication of targets aligned with the goals of society and relevant national frameworks, in areas where they have the greatest positive impact. We will be reporting publicly on our impacts and contributions to these global targets, and how we involve our stakeholders.

For more information about these Principles, visit: https://www.unepfi.org/banking/bankingprinciples/

We understand the importance that matters of the environment, social involvement and corporate governance (ESG) have acquired for the investing public in recent years, as part of the development of a sustainable financial system. Accordingly, their inclusion in processes and decision-making is indispensable for generating long-term value, preventing material risks and protecting the interests of our clients, beneficiaries and investors.

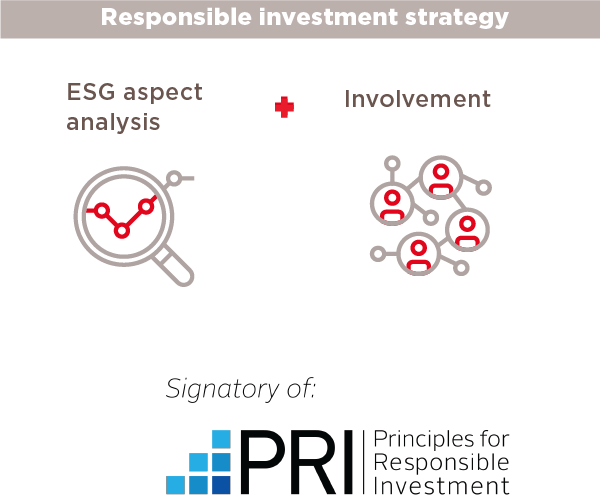

As signatories of the Principles for Responsible Investment (PRI), in 2018, together with the Sustainability Area, we developed an internal policy to establish a frame of reference, guidelines, commitments and methodology for incorporating ESG issues into our investment operations.

Furthermore, we defined an investment strategy based on the analysis of ESG factors and involvement with issuers whose purpose is to actively manage risks and opportunities, working together with the companies in our portfolios.

In line with the principle of promotion, effort and cooperation for acceptance and implementation of the PRI within the Mexican financial industry, in 2018 Administradora de Activos Banorte, Afore XXI Banorte and the Investor Relations, Sustainability and Financial Intelligence area, expressed their interest in and commitment to the PRI, participating in various forums:

At Afore XXI Banorte, we see ESG risks and opportunities as externalities which while not included in traditional financial analysis, have an increasing influence on the return of various asset classes. We understand that because these are variables that can affect companies’ cash flow and financial stability, they must be evaluated and incorporated into the investment process.

For this reason, and recognizing its fiduciary duty, Afore XXI Banorte has pledged to incorporate ESG factors into our investment analysis and decision-making process, and to promote the dissemination of ESG information among the investing public and in the various financial markets.

We implemented a comprehensive ASG evaluation model based on PRI and an internationally renowned data platform to complement our analysis. We were therefore able to generate quantitative and qualitative information to support the estimation of financial risks for the investment in which we participate.

Our first exercise to analyze our local investment portfolio focused on 125 domestic issuers and fund administrators (fixed-income, equity, structured and FIBRAS) as well as the agents through which approximately 8% of AUM1.

1 AUM: Assets under management, which according to public information from CONSAR as of December 31, 2018, totaled Ps. 744.4 billion.

GFNorte recognizes the importance of environmental and social aspects for the global financial industry in terms of risk. We understand that economic growth depends on natural and social capital and that prevention, mitigation, restoration and/or compensation of the impacts we have is a determining factor in countering climate change, resource scarcity and social inequality.

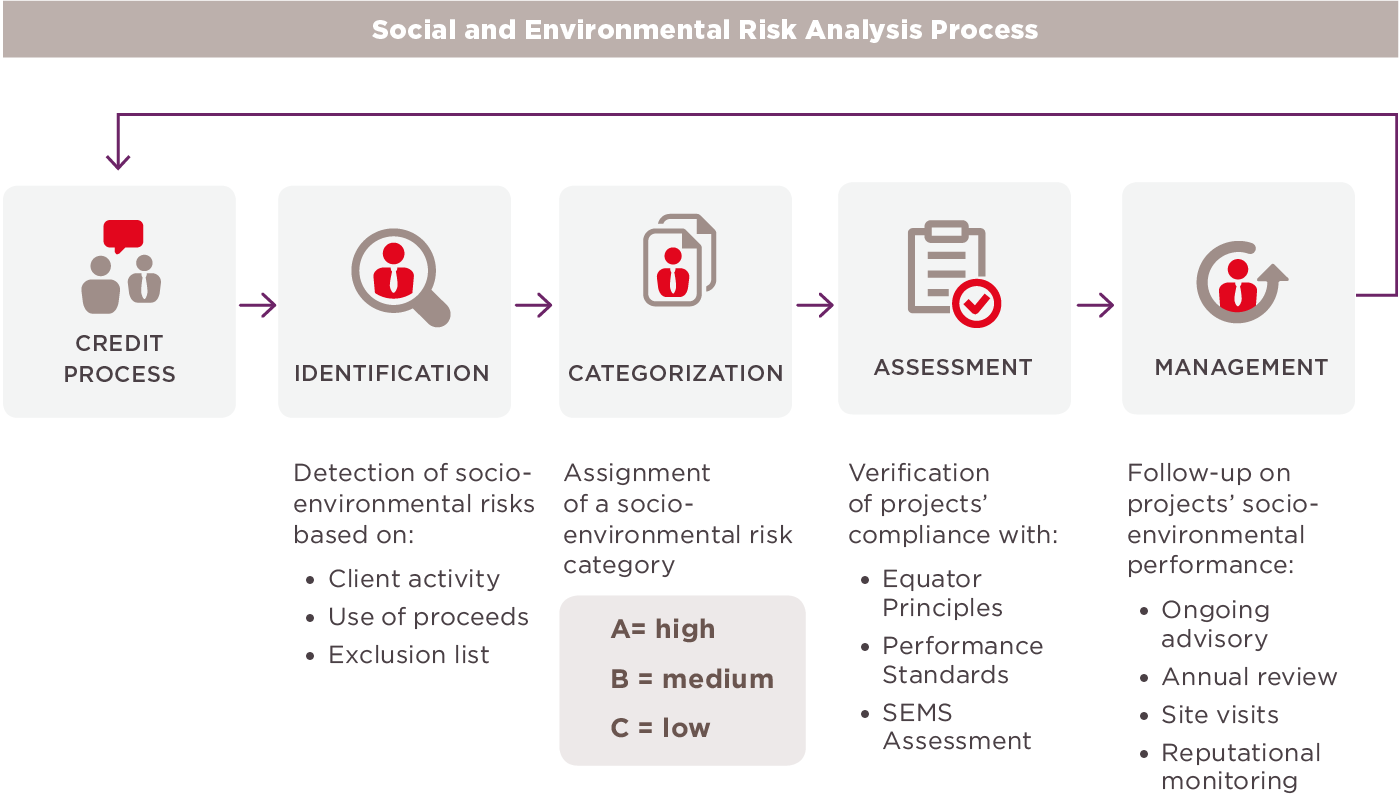

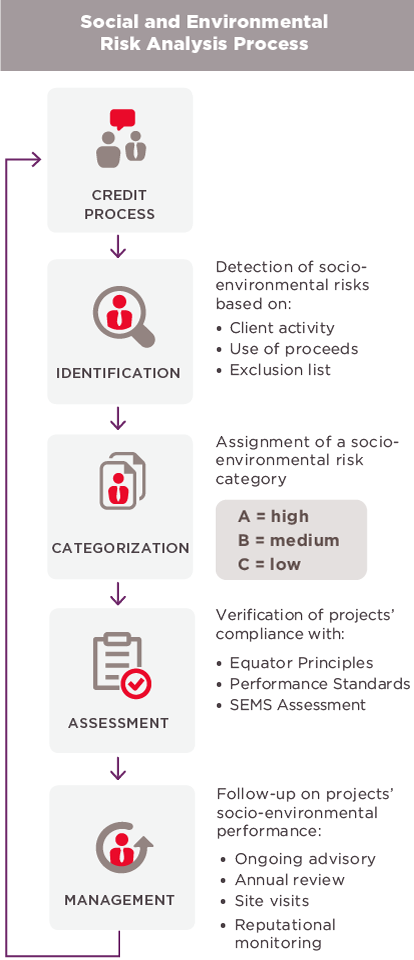

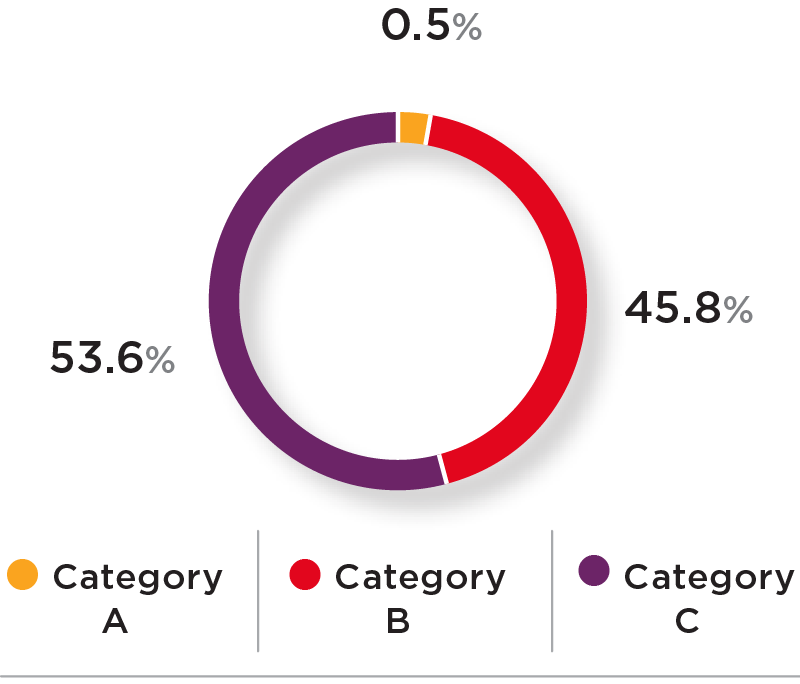

Our Social and Environmental Risk Management System (SEMS) analyzes the environmental and social risks involved in the activities we finance, through a process of identifying, categorizing, assessing and managing these risks. The SEMS operates in parallel to our usual credit procedures and currently applies to the Corporate and Business Banking portfolio.

Based on the Equator Principles and IFC Performance Standards, we verify that the projects we finance appropriately manage priority environmental and social issues.

The SEMS is handled by the Socio-Environmental Risk Area (SERA), made up of professionals with training and experience in environmental and social issues. Furthermore, the system is supported by the Sustainability Champions, a group of employees from the Credit and Business Area that serve as a liaison between the SERA and the regional areas of the Bank to promote the appropriate management of non-financial risks in the Group.

To serve our stakeholders, SERA invites e-mails at: sems@banorte.com

| ENVIRONMENTAL ISSUES | SOCIAL ISSUES |

|---|---|

|

|

Equator Principles: 7 projects

Performance Standards: 15 projects

SEMS Assessment: 9 projects

Most of our evaluations were conducted in the construction, agriculture and forestry sectors.

Additionally, we analyzed 464 lesser-impact projects that were managed through recommendations of the IFC Industry-specific Environmental, Health and Safety Guidelines.

Our site visits in 2018 confirmed the interest of the Credit and Business areas in managing non-financial risks, as well as our strong relationship with clients and their commitment to applying best practices for their respective industries.

In 2018, the arrival of an explosion of Sargasso seaweed on Mexican’s Caribbean beaches raised a nationwide alert about the environmental, economic and health hazards this imbalance represents.

Concerned about responding to this issue, Banorte developed practical guidelines for preventing and managing the spread of Sargasso, which it made available to clients in the tourism and agricultural industries.

The guidelines were distributed through the immediate action of our Peninsula Credit Department, the Specialized Tourism Area and the Socio-Environmental Risk Area.

| PROJECTS EVALUATED IN 2018 | |||

|---|---|---|---|

| Category A | Category B | Category C | |

| Equator Principles | 1 | 3 | 3 |

| Performance Standards | 3 | 11 | 1 |

| SEMS Assessment | 2 | 7 | 0 |

RiSKS

RiSKS

|

In person | 120 employees |

Risk Directors Credit and Business Executives |

3 times a year 1 hour |

Issues

|

|

Virtual | 11,610 employees |

All of GFNorte Sustainability Champions | Biweekly publications | |

|

Phone | 365 employees |

Credit and Business Executives | Weekly calls |

Awareness-raising and skill development for our employees, primarily in the Credit, Risk and Business areas, is a primordial part of our culture of managing environmental and social risks at Banorte.

As part of our goal of promoting the creation of sustainable markets, empowering people, and improving the impact our operations have on the environment, in 2018 we incorporate important financial instruments and products that confirm our commitment as a responsible business.

We participate in financing projects to generate electrical energy from renewable sources. Since 2012, we have financed 11 projects with a total capacity of 1,190 MW, which represented an investment of 1.09 billion dollars —479 million of it from Banorte.

| Wind energy 647 MW  |

Solar energy 433 MW  |

Natural Gas Cogeneration 110 MW  |

Our planet today urgently requires an infrastructure that can support a shift toward a cleaner, more intelligent future. This creates many opportunities for financial market participants, and one of the brightest points on the horizon is the market for green, social and sustainable bonds, which give investors greater confidence to invest in climate change related projects.

Throughout 2018 GFNorte participated as underwriter for the issuance of AGUA 17-2X sustainable bonds (reopening) totaling one billion pesos (out of a total issue amount of Ps. 2.4 million, which obtained a national-scale rating of “mxAA-/AA(mex)” from Standard & Poor’s Global Ratings and Fitch Ratings, respectively. The proceeds of this issue will be invested primarily in developing countries (80%) to which the company provides services, and the rest in the United States and Canada (20%). Water and wastewater treatment projects will take up 78.1% of the investment, and the remaining 13.7% will go to clean water supply solutions.

Furthermore, our Corporate Debt Analysis Area published a document called “Green Bonds Tutorial - A New Era for the Bond Market,” which explained to market participants the salient features of green bonds. It also described the evolution of this type of instruments internationally, and the efforts made so far in the domestic market, including the benefits and opportunities for issuers and investors. In this way, we contributed to building a national market for green bonds on the Mexican Stock Exchange.

Operadora de Fondos and Afore XXI Banorte had Ps. 1.13 billion pesos in assets under administration in sustainable, green and social bonds.

The proceeds of these issues will be applied largely to projects that help improve environmental conditions, and to projects that drive the country’s social development. Some examples are:

Beginning on July 5, 2018, Banorte joined the Green SME Programs created by Nacional Financiera (the national development bank) to promote financing to small and mid-sized enterprises who want to operate with energy efficiency and renewable energy. We were one of the first banks to join in the government initiative through Eco-Credits for Energy Efficiency and Interconnected Solar Energy system projects.

The Eco-Credit program to support Energy Efficiency finances overall energy efficiency projects as well the acquisition or replacement of old equipment for newer and more efficient models (lighting, refrigerators, air conditioning, boilers).

The program to support Interconnected Solar Energy Systems is intended to finance the acquisition and installation of solar systems under the distributed clean energy scheme.

At the end of 2018, we placed the first Eco-Credit, for Ps. 564,750, which for us was a big step forward toward consolidating our sustainable financing activities.

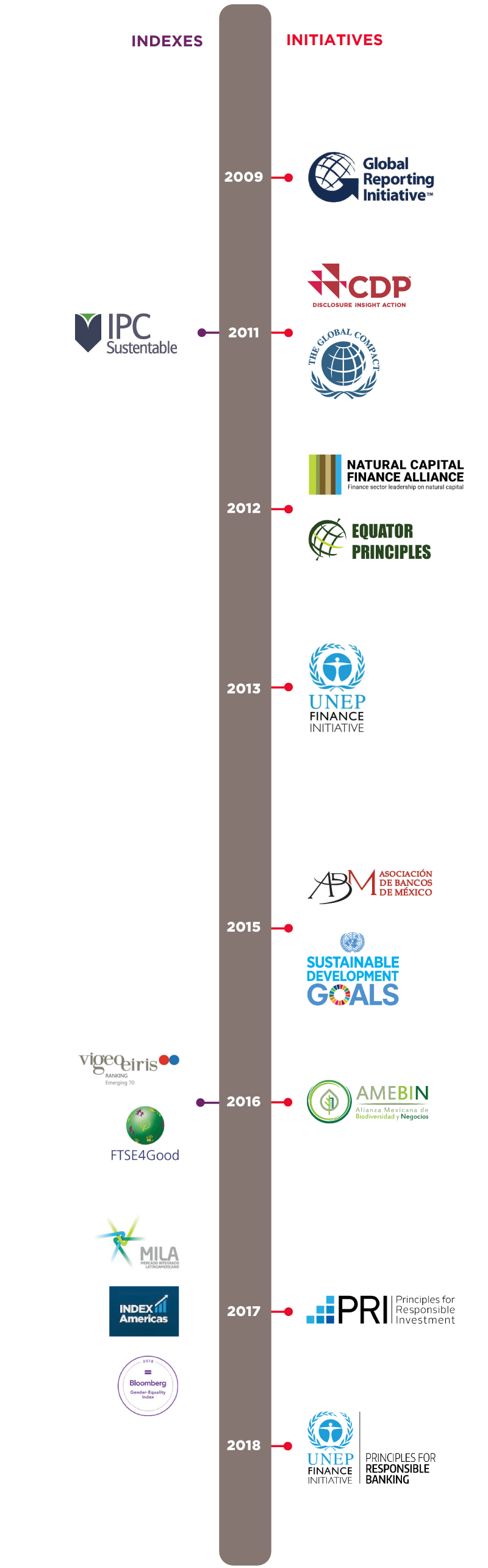

As part of our commitment to participate in various initiatives, we also work to promote good practices for the financial industry and projects involving priority issues, while remaining abreast of national and international priority issues.

The depth and scope of execution, like the dissemination of our practices, has positioned us as a leading company in the area of sustainability, distinguished with numerous recognitions and inclusion in various national and international indexes.

In 2018 we earned the following distinctions: