We prioritize customer satisfaction and experience, along with operating efficiency.

At GFBanorte, innovation is essential to the way we do business. We prioritize customer satisfaction and experience as well as operating efficiency. We develop disruptive, transformational initiatives that can impact our value proposition and business model, in order to continue the bank’s digital evolution. To this end, we focus on initiatives that have a direct impact on our customers and our business.

Our innovation goals extend to our internal control programs, where we are working to bolster systems and tools for identifying, measuring and controlling risks. To this end, in recent years we overhauled our systems for calculating expected and unexpected loss; our infrastructure for developing, executing and monitoring our internal provisioning and capital models; our system for managing credit lines and limits; our loan assignment scorings; and our money-laundering prevention models.

We are currently working on incorporating unconventional data and artificial intelligence tools in order to manage risk with increasing efficiency, to the benefit of our shareholders and customers. For example, we pilot tested new decision-making tools for evaluating credit and fraud risk, which use nontraditional mechanisms like online psychometric scores, validation of e-mail addresses with an e-mail research agency, machine learning techniques for loan approval models, and graph analytics for transactions.

We’ve also begun the process of obtaining certification from the National Banking and Securities Commission (CNBV) for our in-house provisioning and capital models.

We have a controlled analytics infrastructure for developing, executing and tracking these models in keeping with regulatory requirements.

To face the challenges involved in our 20/20 Vision program, we are redesigning our mass-market loan approval process, both for consumer loan customers and SMEs, in order to fine-tune risk assessment while adding new functions to the system that guarantee a swift, personalized response to each customer. The redesign includes multi-product sales through a simulator that customers can use to configure their own package of products, a broader base for cross-sale campaigns, and a personalized rate system, and other advantages.

Cross-selling is strengthened by our multi-channel sales platform, which gives customers the option of acquiring and operating a range of Banorte products and services on a self-service basis, through digital channels that are easy to use, quick, and secure, 24 hours a day, 365 days a year, regardless of where they are or what type of device they’re using.

This platform operates according to different technical components and business rules that functions to be reused in order to standardize operation through an omnichannel architecture. With this, customers are able to begin a process in one channel and complete it in another—a unique and seamless experience—regardless of the channel. Multi-channel sales also place us at the forefront of our market, ensuring excellence in the client experience.

We have also strengthened the engine for calculating portfolio risk indicators, achieving a more detailed segmentation of our clients, calculating personalized interest rates and re-designing strategies based on a better risk-return combination.

Among the improvements to the bank’s control infrastructure are the startup of a new system for managing credit lines and internal and regulatory limits, which will provide information on overall exposure by client, so the bank can regularly monitor this exposure, approve new lines and conduct online tracking of all withdrawals against existing wholesale lines of credit.

In mobile solutions, we have developed tools for banking transactions, both for the Android system and iOS (Banorte keyboard), in the context of any social network the customer is currently using —like WhatsApp or Facebook Messenger. This allows them to interact with the bank instantly, without having to change app to do so. This app is included in Banorte Móvil, and clients can decide where to use it.

Among our main areas of innovation are recently-developed virtual assistant tools, such as:

To generate exponential growth and create value for our clients, we have launched NBA, multichannel and multi-wave campaigns. Our Next Best Action (NBA) platform, developed in previous years, continues to grow, offering clients an increasing range of services and more channels to access them, directly from whatever channel they are already using.

Our future priorities:

Open banking changes the paradigms of traditional banking by opening and operating in a world where the value chain is increasingly fragmented, and the competitive climate more intense. Under this service model, clients are given power over their data, with the ability to share them with others outside of the banking sector in order to receive value-added services.

At GFNorte, we are adopting an open banking strategy to remain competitive and relevant in the digital economy, staying one step ahead of the digital transformation. We recognize this as an opportunity to create new sources of revenues, to offer non-traditional services and reduce time-to-market.

The success of open banking requires that we align strategies —corporate, digital and regulatory. This is not just a compliance issue, but an opportunity to improve banking services and products through an open, standardized Application Programming Interface (API).

In 2019 we will be launching our API development and administration platform to the community of external developers, making it possible for banking services to be opened and used by our own applications, or by others, always guaranteeing that the necessary security measures are in place to access and use them.

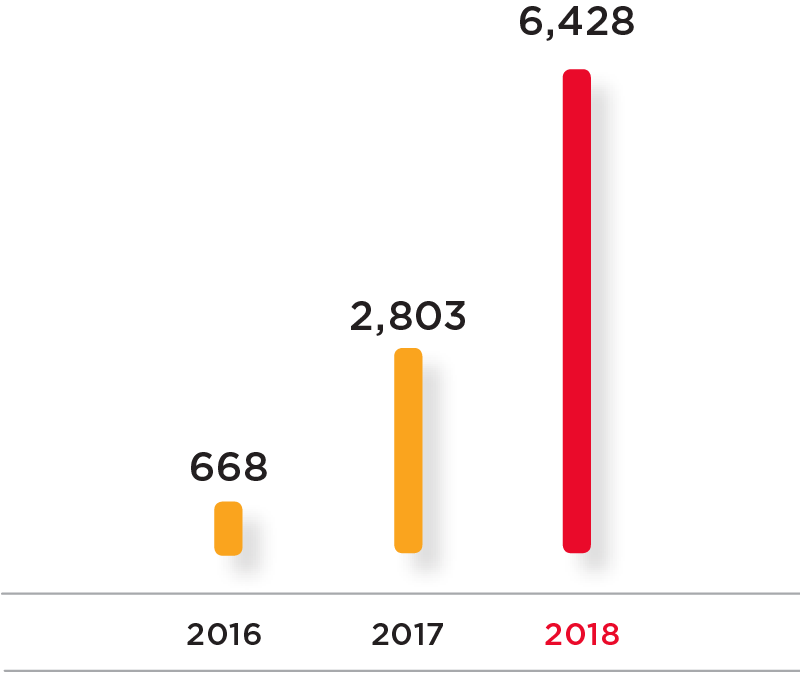

DIRECT EARNINGS

DIRECT EARNINGSWith this in mind, we are creating more accessible, useful solutions that meet client expectations, saving them time and money. APIs have become the foundation for the fast-moving digital economy.

To pave the way for further innovation, we developed a Collaborative Research Center with new tools and innovation trends, applicable to different industries, and have been able to work across traditional financial businesses to benefit the final customer, offering them digital solution ecosystems: An innovation hub.

In July 2018, we introduced an institutional program called Ingenio, aimed at Banorte’s employee base. The program involved workshops intended to identify the best path for inculcating a culture of innovation.

In this exercise, we invited millennials from all areas of the Group and all territories of Mexico to define innovation. Their response: “generating value services by identifying client needs, facilitating their access to financial products quickly and easily.”

The result of these workshops was the co-creation of a new dynamic within Banorte, which we call Ingenio Innovation Day. We invited 40 employees from all levels and bank branches in Mexico to work with a methodology of innovation, to address two of the main challenges proposed by the General Director of Retail Banking. Grouped into teams, participants generated more than 30 ideas and created seven actionable concepts that can help improve and resolve challenges.

Because Grupo Financiero Banorte is a publicly-owned corporation, it must effectively manage its behavior, discourse and image in society, aware of the impact these variables have on its corporate reputation.

Its efficacy in this task depends in turn on the alignment of business goals and institutional values from a comprehensive perspective, taking into account the group’s impact in all dimensions —as an economic agent, a member of society, a corporate citizen, and a responsible inhabitant of our planet.

Amid a challenging social and political climate, during which time Mexico underwent a true regime change, 2018 required Banorte to take an informed public position in this new context: a company that communicates openly with its stakeholders, and capable of projecting the Group’s natural commitment to the priorities, sentiments and aspirations expressed by the Mexican people in the July election.

We were born here, we live here, and this is where we’ll stay. This is the basic sentiment underpinning a new comprehensive strategy of communications and public relations for the Banorte Forum 2018, held in August, which provided the first space for dialogue between entrepreneurs and officials of the incoming federal administration.

As a core concept that would transmit the Group’s commitment to Mexico and this new phase in the country, we proposed the phrase: Banorte, an ally for Mexico’s future. The concept was translated in the forum’s identity, messages by spokespersons and external and internal communication. The results exceeded those of any previous forum: Ps. 68 million in return on investment in unpaid media coverage, eight newspaper headlines, 20 front pages and 226 million hits in social media, in addition to a live streaming link with 5,500 students of 29 universities.

This public impact was made possible by our successful strategy of reaching out to the newly elected administration in July 2018: six members of the new cabinet were given an opportunity in the forum to present their view of the country and exchange viewpoints with the audience and executives.

The success of a merger depends largely on its ability to offer all stakeholders timely, sufficient information on the process.

The merger of Grupo Financiero Interacciones with Banorte posed a challenge not only in the sheer size of the operation, but also in its communications: the public needed hard facts, at the right time, consistent with existing regulations, but also needed to hear about the reasons for the deal. What did Interacciones bring investors, employees and clients? What did it contribute to the country in general? We designed a strategy which, consistent with current laws and regulations, made the transaction transparent and explained it to all audiences: in a country like Mexico, with huge areas of opportunity in terms of infrastructure, the value of Interacciones’ expertise in financing to this sector —particularly at the state and municipal level— represented a unique added value to Banorte.

We designed various communication tools to achieve this goal, developing a solid narrative grounded in international statistics; press releases closely coordinated with the Investor Relations team, info-graphics and an internal website to explain the process to employees, which in turn would be displayed in posters in elevators and individual postings on social media.

With more than 80% of employees informed of the rationale for the merger, and an extensive coverage in the media, communication on the merger fulfilled its purpose.

Banorte is a highly responsible organization, committed to this country. In 2018, we demonstrated this commitment through the successful implementation of the Banorte Adopts a Community program, an initiative to help the country rebuild following the September 2017 earthquakes.

This is a comprehensive three-year program focused on nine affected communities in seven states of Mexico, where a budget of Ps. 170 million has been allocated. Thanks to our work with allies from the social sector, like Cinemóvil Toto, Fundación Helvex, FUCAM, Maseca, the San Carlos National Museum and Videxport, 282 homes were delivered, 82 more than originally promised. There were also visits to communities to carry out health, culture, nutrition and education activities, through which we generated more than 13,600 impacts on the nine adopted communities.

The future of banking is digital. The financial sector competes aggressively to provide the best digital products and services to clients, and Banorte has focused all its resources on offering customers the best digital experience in the market.

At the start of 2018, however, a singular challenge arose: many Banorte employees still had not accessed the Banorte Mobile App, creating an insuperable barrier to access for many clients who were seeking a full digital experience.

This gave rise to the design and development of a new communication strategy focused on incorporating more than 90% of our employees to the app, making them true digital advisors. Through a process of constant, high-impact, multi-channel communication, together with the development of digital tutorials and an ongoing training process, the app was finally installed and active in nine out of every ten employees’ cell phones, and all of those who received training will also have the informational tools needed to become advisors to our clients.

Clearly, the growth in the number of customers who adopted this digital tool during the year was made possible by the solution of various technical issues, but also largely by the digital know-how of Banorte’s team members.

Reputational management means projecting the symbolic capital of the organization, and protecting it in a challenging context.

In 2018 we worked actively to manage crises that had the potential to seriously affect the Group’s reputation, as when services within the national wire transfer system (SPEI) were disrupted in May, or other external events, like cancelation of the New Mexico City Airport project, the debate over bank fees, and proposed initiatives that would impact the retirement savings system.

In all these cases, one of our basic operational principles has been to safeguard the group’s reputation through prudent but transparent communication, to avoid rumors or the generation of voids that might be filled with incorrect information. Faced with these momentary challenges, Banorte chose to distribute appropriate information on these events through internal and external media and social networks, contributing to our stewardship of the group’s intangible capital.

Mexico has embarked on a new phase. As the newly elected administration has pointed out, this regime change places a greater emphasis on ourselves as a nation, beyond individuality: an accent on integrity, with a mandate for transparency; a pursuit of inclusiveness, while still working for growth; and support for development in the global context, but staying aware of our roots, that which makes us unique.

This new vision requires Banorte to be even closer to every Mexican. It is time to show why we are Mexico’s household bank, and what our role is in this “us” made up of citizens and companies.

In 2019, we are faced with the challenge of projecting both pride in being Mexican—a unique characteristic of our institution—and our position as an ally to every Mexican, their dreams and their efforts, in a new phase in which Banorte intends to become—as expressed in its 20/20 Vision—Mexico’s best financial group.

Over the course of 2018, we continued the process of strengthening our brand positioning, an effort begun in 2017 with the “Strong Mexicans” campaign, in which we re-focused Banorte’s image and underscored elements of innovation, “Mexicanness” and strength.

In terms of communication, 2018 brought great challenges relating to the impact of the high-impact electoral process Mexico experienced. During this period, we kept our messages and communications relevant, reaffirming our belief in the country and its organizations, and being careful in how we held our clients’ attention and obtained results from the business.

We also contributed to the discourse regarding Mexico’s solidity and development, focusing messages on the new capacities and functions of Banorte Mobile, promoting deposits, the merger with Interacciones and the Bank’s new status as the second largest financial group in Mexico.

All of this, together with the operating excellence for which we are known, led Brand Finance to name Banorte Mexico’s most valuable banking brand, worth USD 1.42 billion. This made us the 163rd most valuable brand in the world, three notches higher than in 2017.

This recognition inspired us to redouble our efforts to develop the brand in terms of proximity to our clients, and technologies that response to their financial needs, as well as to communicate at the right time and through the channels to which customers are most receptive, to achieve continuous, efficient communication.

Expectations are very high in Mexico at the moment, and we cannot risk sending the wrong message. We will continue to work to attract clients and encourage their loyalty in a new digital age, offering communication on many levels and through many platforms that serve all our audiences.