Human talent development is the key to fulfilling our business strategy.

In Human Resources, the challenge is maintaining an efficient organizational culture, focused on business results and headed by the leaders of the institution. That’s why values like integrity, trust, respect and loyalty are fundamental pillars to continue expanding on our successes, aligned with our vision of being “a great ally to grow strong with Mexico.”

Our employee development has been crucial in the results Banorte has achieved today. The pursuit of a balance between results-oriented culture and generating a value proposition that meets the personal and professional expectations of our employees has become one of our strategic goals.

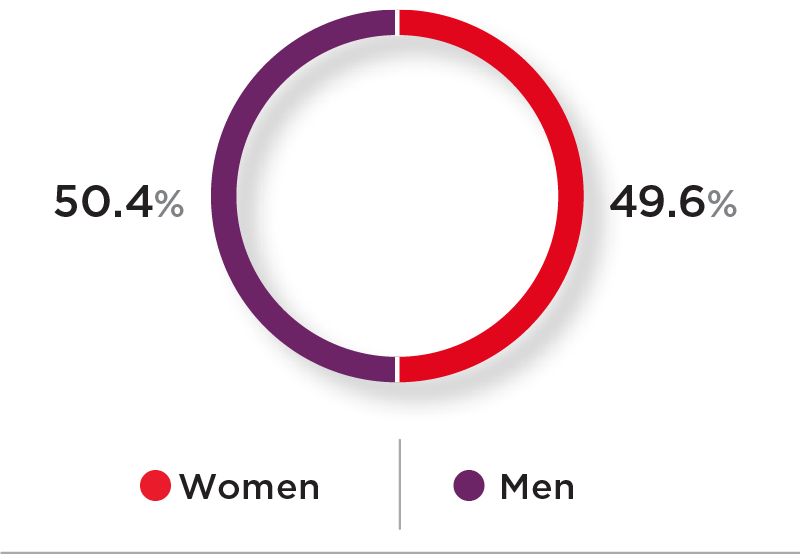

We have more than 30,000 employees, balanced evenly by gender: 50.4% are men and 49.6% are women.

| GRUPO FINANCIERO BANORTE NUMBER OF EMPLOYEES AS OF DECEMBER 31, 2018 |

||||||

|---|---|---|---|---|---|---|

| Company | Permanent | Independent | Total | |||

| 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | |

| Banking sector | 23,137 | 21,875 | 3 | 3 | 23,140 | 21,878 |

| -Bank | 20,155 | 19,250 | 3 | 3 | 20,158 | 19,253 |

| -Warehousing | 46 | 52 | 0 | 0 | 46 | 52 |

| Leasing and Factoring | 149 | 110 | 0 | 0 | 149 | 110 |

| Aspe | 2,787 | 2,463 | 0 | 0 | 2,787 | 2,463 |

| Companies in the US | 184 | 174 | 0 | 0 | 184 | 174 |

| -Uniteller | 162 | 152 | 0 | 0 | 162 | 152 |

| -Banorte Securities | 22 | 22 | 0 | 0 | 22 | 22 |

| Savings and Annuities | 7,217 | 7,854 | 7 | 9 | 7,224 | 7,863 |

| -AFORE | 5,220 | 5,823 | 1 | 5 | 5,221 | 5,828 |

| -Insurance | 1,843 | 1,831 | 6 | 4 | 1,849 | 1,835 |

| -Pensiones | 154 | 200 | 0 | 0 | 154 | 200 |

| Annuities | 30,538 | 29,903 | 10 | 12 | 30,548 | 29,915 |

Data on permanent employees in the Annuities and Pension Sector includes outsourcing employees.

| WORK FORCE BY AGE RANGE AND GENDER | |||||

|---|---|---|---|---|---|

| Gender | Age range | 2018 | 2017 | 2016 | % Chg. 2018 vs. 2017 % |

| Women | < 30 years | 5,744 | 5,371 | 4,909 | 6.9 |

| 30 - 50 years | 5,059 | 4,790 | 4,721 | 5.6 | |

| > 50 years | 750 | 678 | 626 | 10.6 | |

| Total Women | 11,553 | 10,839 | 10,256 | 6.6 | |

| Men | < 30 years | 5,570 | 5,325 | 5,007 | 4.6 |

| 30 - 50 years | 4,737 | 4,532 | 4,521 | 4.5 | |

| > 50 years | 1,280 | 1,182 | 1,183 | 8.3 | |

| Total Men | 11,587 | 11,039 | 10,711 | 5.0 | |

| Total | 23,140 | 21,878 | 20,967 | 5.8 | |

Data corresponds to Banking Sector.

| WORKFORCE BY EMPLOYMENT CATEGORY AND GENDER | ||||

|---|---|---|---|---|

| General employment category | Women | Men | ||

| Employees | % | Employees | % | |

| Directors | 131 | 0.7 | 491 | 2.1 |

| Middle Management | 2,527 | 9.9 | 3,419 | 14.8 |

| Operating | 8,895 | 39.0 | 7,677 | 33.5 |

| Total | 11,553 | 49.6 | 11,587 | 50.4 |

Data corresponds to Banking Sector.

In Insurance and Annuities, we also have a balanced workforce: 55.4% men and 44.6% women.

| WORK FORCE BY EMPLOYMENT CATEGORY AND GENDER | ||||

|---|---|---|---|---|

| General employment category | Women | Men | ||

| Employees | % | Employees | % | |

| Directors | 3 | 0.2 | 31 | 1.6 |

| Middle Management | 209 | 10.7 | 341 | 17.4 |

| Operating | 663 | 33.8 | 714 | 36.4 |

| Total | 875 | 44.6 | 1,086 | 55.4 |

Data correspond to Insurance and Annuities sector.

BREAKDOWN OF THE WORKFORCE

BREAKDOWN OF THE WORKFORCEOne of the biggest challenges on the Human Resources agenda in 2018 was the integration of Grupo Financiero Interacciones. Nevertheless, we were able to integrate personnel from that group into critical and functional roles, according to structure of our organizational model.

We continued to use the Success Factors platform, managing talent through four modules:

Aware that safeguarding the institution’s competitive future means having the right leaders to develop and apply business strategies, we succeeded in identifying talent with the qualities need to occupy top management positions. This is an ongoing process that involves following up closely with each executive in order to strengthen skills and overcome development gaps identified in performance evaluations.

We created a new long-term incentive plan to strength compensation, continuing our strategy of attracting and retaining key executives.

We activated a Development Opportunities Model to keep our employees informed of vacancies within the company so they could apply for those that best fit their qualifications and experience. With this, we provide a platform for developing internal talent and promote meritocracy.

We worked on designing a process for onboarding new employees, creating an experience that allowed us to rapidly integrate new talent to their duties and the institutional culture, shortening the learning curve.

Last year we began participating in one of the new government’s flagship programs, “Youth Building the Future,” under which youth signed up for this program can come to our offices and be trained in aspects of financial education, while providing support for administrative and branch activities. Our goal is to bring in 500 young people in 2019. We are confident that this program will give Mexican youth an opportunity to develop better skills and knowledge, and strengthen talent attraction in our industry.

For GFNorte, a key factor in hiring new talent is knowing the skills, ability and know-how of each applicant, always on a fair and equitable basis, avoiding any kind of discrimination.

| EMPLOYEE COMPENSATION | |||

|---|---|---|---|

| 2018 | 2017 | % Chge. | |

| Executives | 3,327,008,319 | 2,858,419,708 | 16.4 |

| Employees | 2,112,854,501 | 1,927,512,137 | 9.6 |

| Total | 5,439,862,820 | 4,785,931,845 | 13.7 |

Banking sector; amounts expressed in pesos.

In keeping with general parameters in our industry, we are continually working to offer employees a comprehensive and competitive salary and benefits package.

For our senior management, whose responsibilities are associated with market, credit or regulatory risk, we pay out annual bonuses and have a retention plan whose characteristics vary. The annual bonus is subject to fulfillment of certain goals and performance of risk and human resources metrics, which include regulatory compliance. Forty percent of the bonus is variable, and it is paid out over a three-year period. This compensation scheme motivates our top executives to make decisions based on profitability, vision, and the creation of long-term value.

| AVERAGE SALARY BY EMPLOYMENT CATEGORY AND GENDER | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| General employment category | Average salary | Difference between average salary for men and women |

||||||||

| Women | Men | Amount | Ratio % | % Chge. | ||||||

| 2018 | 2017 | % Chge. | 2018 | 2017 | % Chge. | 2018 | 2017 | |||

| Directors | 122,871 | 115,178 | 6.7 | 137,142 | 125,743 | 9.1 | 14,271 | 89.6 | 91.6 | -2.2 |

| Middle Management | 32,127 | 30,429 | 5.6 | 35,212 | 33,087 | 6.4 | 3,086 | 91.2 | 92.0 | -0.8 |

| Operating | 13,188 | 12,598 | 4.7 | 13,317 | 12,664 | 5.2 | $129 | 99.0 | 99.5 | -0.4 |

Banking sector; amounts expressed in pesos

| AVERAGE SALARY BY EMPLOYMENT CATEGORY AND GENDER | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| General employment category | Average salary | Difference between average salary for men and women |

||||||||

| Women | Men | Amount | Ratio % | % Chge. | ||||||

| 2018 | 2017 | % Chge. | 2018 | 2017 | % Chge. | 2018 | 2017 | |||

| Directors | 167,745 | 185,443 | -9.5 | 185,671 | 178,097 | 4.3 | 17,926 | 90 | 104 | -14 |

| Middle Management | 35,629 | 34,507 | 3.3 | 36,471 | 36,166 | 0.8 | 842 | 98 | 95 | 2 |

| Operating | 13,534 | 12,728 | 6.3 | 13,447 | 12,696 | 5.9 | - 87 | 101 | 100 | |

Insurance and Annuities sector; amounts expressed in pesos

For the tenth year in a row, we successfully implemented the Product Certification program throughout our branch network, ensuring that executives offer comprehensive solutions to our clients.

In 2018, more than 600 GFNorte executives attended leadership training and skill development programs at prestigious domestic and international institutions.

Institutional regulatory training programs were a priority in 2018, as they are every year, and we intensified training on the topic of data security and supported the roll-out of key transformation projects for GFNorte.

| INVESTMENT IN TRAINING AND DEVELOPMENT | |||

|---|---|---|---|

| 2018 | 2017 | % Chge. | |

| Scholarships | 9.9 | 9.8 | 1.0 |

| Travel expenses for training | 41.7 | 33.2 | 25.6 |

| Courses and conferences | 121.4 | 108.6 | 11.8 |

| Total | 173.0 | 151.6 | 14.1 |

Banking sector; amount expressed in millions of pesos.

| AVERAGE HOURS OF TRAINING BY GENDER | ||||

|---|---|---|---|---|

| Gender | 2018 | 2017 | 2016 | % Chge. |

| Women | 31 | 37 | 30 | -16 |

| Men | 32 | 33 | 29 | -3 |

| Average | 32 | 35 | 29 | -8 |

Data correspond to Banking sector.

| AVERAGE HOURS OF TRAINING BY EMPLOYMENT CATEGORY | ||||

|---|---|---|---|---|

| Employment category | 2018 | 2017 | 2016 | % Chge. |

| Director | 45 | 34 | 29 | 32.4 |

| Subdirector | 32 | 40 | 30 | -20.0 |

| Manager | 28 | 37 | 28 | -24.3 |

| Administrative | 19 | 31 | 23 | -38.7 |

Data correspond to Banking sector.

| AVERAGE HOURS OF TRAINING BY GENDER | |||

|---|---|---|---|

| Gender | 2018 | 2017 | % Chge. |

| Women | 14 | 14 | 0 |

| Men | 17 | 13 | 31 |

| Average | 16 | 14 | 14 |

Data correspond to Insurance and Annuities sector.

| AVERAGE HOURS OF TRAINING BY EMPLOYMENT CATEGORY | ||||

|---|---|---|---|---|

| Employment category | 2018 | 2017 | 2016 | % Chge. |

| Director | 42 | 23 | 12 | 83 |

| Subdirector | 49 | 33 | 13 | 48 |

| Manager | 27 | 13 | 30 | 107 |

| Administrative | 12 | 13 | 9 | -8 |

Data correspond to Insurance and Annuities sector.

We are continually working to offer comprehensive salary and benefit packages to our employees that are competitive in our industry. The compensation we pay our employees includes benefits, most of which are above the minimum required by law.

| MAIN BENEFITS | |||

|---|---|---|---|

|

Annual bonus |  |

Grocery vouchers |

|

Savings fund |  |

Social Security subsidy |

|

Paid vacation and vacation bonus |  |

Comprehensive Health System |

|

Cash loans |  |

Insurance |

|

Auto loans |  |

Loans for sports facilities |

|

Mortgage loans |  |

Pension plan and retirement savings |

We expanded the functions of our telephone service center to provide control, tracking and evaluation of employee hospitalizations covered by the major medical insurance policy provided by Seguros Banorte.

In September 2018, the Banorte Medical Unit (UMB) formally opened its doors to employees in the city of Monterrey, incorporating the specialties of Family Medicine, Geriatrics, Pediatrics and Gynecology. It is open from Monday to Friday, 8:00 a.m. to 8:00 p.m., and Saturdays from 8:00 a.m. to 2:00 p.m.

We signed agreements with nine hospitals in the cities of Guadalajara, Puebla, Tijuana, Tampico, León, Villahermosa and Campeche, improving the quality of care and security for our employees and their beneficiaries.

We established and applied a protocol for dealing with an unexpected outbreak of tonsillitis in the city of Monterrey (61 cases in three office buildings), introducing prevention and control mechanisms and keeping the illness from spreading to other cities and workplaces.

A flu vaccine campaign was carried out, with 7,000 doses applied to employees and their family members across the nation.

Personnel in our corporate offices were trained the Life Medical Support program, and units were installed for dealing with situations of cardiac arrest (DEAS).

A total of 8,899 medical appointments were given in corporate offices in Mexico City, Monterrey and Guadalajara, 5,444 of which were nutritional consultations, 1,072 were medical checkups and 2,482 were physical activations.

We pilot tested the National Program for Emotional Wellness in the Workplace (Pronabet), which was joined voluntarily. We were the first financial institution to join the program, which is based on the Ministry of Labor and Social Planning Official Standard 035.

We began the first phase of a cancer screening program; its purpose is to promote early detection of breast, lung, prostate, cervical-uterine and colon cancers. The program was carried out in corporate offices (the KOI building in Monterrey).

During this exercise, four cases were detected among 816 participants, and were promptly treated.

Cardio-metabolic scans were also conducted in 13 corporate offices (4,019 employees), obtaining a global health rating of 7.8 on a scale of 1 to 10.

On the basis of these results, a follow-up program was designed for high-risk employees, and by the close of the year, 51% of these cases had been addressed.

In corporate dining rooms a program called “Green Trays” was introduced, which aims to improve the quality of our employees’ diet.

Banorte was recognized by the Mexican Workplace Wellness Council as a Responsibly Healthy Organization, and obtained level 4 out of 7 in the category of Behavior Modeling.

Our technological platform was strengthened in order to improve operability, security and service levels.

We offer cafeterias for employees —five in Mexico City and three in Monterrey, in addition to two executive dining rooms, where we provide a variety of menus that include healthy options, and offer a 45% subsidy on the cost of the food.

Each month we serve around 70,000 meals, the cost of which is deducted from the paychecks of employees who opt for this service.

All our dining rooms are certified with H Distinction from the Ministry of Tourism, which means they meet the highest standards of cleanliness and hygiene.

As stipulated by Federal Labor Law, and respecting workers’ right to free association, Banco Mercantil del Norte, S.A., Institución de Banca Múltiple, Grupo Financiero Banorte, signed a collective bargaining agreement with the National Union of Banorte workers in 1992.

This union has been structurally autonomous since the time of its creation, and has a National Executive Committee whose members are elected by unionized workers.

Since the signing of this collective bargaining agreement, annual reviews are carried out during the National Congress, and are ratified in the presence of union delegates, then later presented to the Federal Conciliation and Arbitration Board.

The collective bargaining contract incorporates the rights and obligations of 6,383 banking sector employees affiliated with the union, representing 31.4% of that sector’s workforce.

| AVERAGE EMPLOYEE TURNOVER BY AGE RANGE AND GENDER | |||||

|---|---|---|---|---|---|

| Gender | Age range | 2018 | 2017 | 2016 | % Chge. 2018 vs. 2017 |

| Women | < 30 years | 13.3 | 15.8 | 10.7 | -15.8 |

| 31 - 50 years | 6.8 | 7.0 | 6.5 | -2.5 | |

| > 51 years | 0.8 | 1.7 | 0.4 | -56.4 | |

| Total Women | 20.9 | 24.5 | 17.6 | -14.9 | |

| Men | < 30 years | 15.8 | 13.5 | 13.1 | 17.1 |

| 31 - 50 years | 7.2 | 6.4 | 7.2 | 12.7 | |

| > 51 years | 1.6 | 0.7 | 0.9 | 140.3 | |

| Total Men | 24.6 | 20.5 | 21.2 | 19.7 | |

| Total | 22.7 | 22.5 | 19.5 | 0.7 | |

Data correspond to Banking sector.

| AVERAGE EMPLOYEE TURNOVER BY AGE RANGE AND GENDER | |||||

|---|---|---|---|---|---|

| Gender | Age range | 2018 | 2017 | 2016 | % Chge. 2018 vs. 2017 |

| Women | < 30 years | 2.1 | 2.9 | 4.0 | -27.6 |

| 31 - 50 years | 0.2 | 0.4 | 5.5 | -50.0 | |

| > 51 years | 3.8 | 3.7 | 0.4 | 2.7 | |

| Total Women | 6.1 | 7.0 | 9.9 | -12.9 | |

| Men | < 30 years | 2.3 | 2.8 | 3.7 | -17.9 |

| 31 - 50 years | 1.0 | 0.9 | 6.0 | 11.1 | |

| > 51 years | 4.8 | 5.9 | 0.9 | -18.6 | |

| Total Men | 8.1 | 9.6 | 10.5 | -15.6 | |

| Total | 7.1 | 8.3 | 10.2 | -14.5 | |

Data correspond to Insurance and Annuities.

Responding to the demands of a highly competitive market, which has been transforming business models in traditional banking, our institution has positioned itself as the second largest bank in the Mexican financial industry. We are proud of this distinction, and it inspires us to continue working to achieve the goals this organization has set for itself.

For this reason, redesigning our value proposition for personnel has become critical, while the generational challenge is now a reality for our institution. The mix of three generations working together requires us to evolve every one of our processes, evaluating the experiences and moments that matter in the lives of every co-worker, and facilitate new mechanisms for attracting and retaining talent.

Digital transformation and the identification of new work skills are one of the main challenges in Human Resources management for coming years. In 2019, our efforts will focus on the following projects:

In 2018 we voluntarily filed a Report on Operations with a Gender Perspective to the Mexico delegation of UN Women, in order to communicate on the state of gender equity at Banorte. In this document we provide key figures on our human resource management, including matters such as wage parity, training hours, maternity and paternity leave, and breastfeeding rooms. We also report on our financial inclusiveness efforts through products like credit cards by gender, the “Mujer Banorte” product, receipt of wage remittances and social programs with a focus on women. Finally, we include Fundación Banorte’s strategy of promoting women who are educational leaders in Mexican preschools.

https://investors.banorte.com/~/media/Files/B/Banorte-IR/financial-information/annual-reports/es/2017/ropg.PDF

As one of our gender equity and diversity initiatives, we promote women’s talent through a pilot internal mentoring program, the purpose of which is to create a network of mentors made up of Group Directors to support women employees at the managerial and sub-director level with more than five years of experience, helping them to strengthen their management skills. The program lasts for nine months and consists of the following phases:

In May, with the participation of employees from our contact center and their families, we held the first “race with a cause” focused on empowerment of women and girls. Before the race, we distributed a message to raise awareness about the inequalities faced by women and girls in Mexico and in the world through various activities, like a commitment wall, the “woman I admire” campaign, and a cash donation to “Hagamos la Diferencia,” a nonprofit association committed to making a difference.

One of the biggest challenges facing the financial industry today is aligning with the goals of an increasingly demanding global society interested in companies whose operations incorporate the principle of sustainability.

For this reason, we at GFNorte are working to make sustainability a part of our strategies and operations, because we know that only by doing so can we fully achieve our “20/20 Vision”: to be the best financial group in Mexico, for investors, employees and customers.

Among our achievements of 2018 in the area of sustainability were the launch of a new institutional sustainability program at GFNorte: Banorte Sustentable (Sustainable Banorte), the purpose of which is to communicate to our employees, investors and other stakeholders that sustainability is an integral part of all our operations, which will enable us to be the new bank that Mexico needs.

Sustainable Banorte is the foundation for all the initiatives we will take throughout the bank, organized into three pillars:

To strengthen the Environmental pillar, we installed institutional signage in our office buildings to raise employee awareness about the importance of turning off lights an equipment when they are not in use; using only the water needed in kitchenettes and bathrooms; avoiding the use of disposable containers and using thermoses and mugs; reporting out-of-order bathroom equipment and separating waste according to the signage installed at recycling stations.