At Banorte, our challenge is being a bank whose clients can connect and operate in a digital world.

Technology is not a competitive advantage per se; it’s all in how it’s used. The challenge is being prepared to be a bank whose clients can connect and operate in a digital world.

The digital movement isn’t being driven by banks —it comes from society and trends. Today’s new generations, and everyone who wants to sell to them, are migrating toward digitalization. But there are also clients that prefer traditional channels that provide one-on-one attention.

This in turn presents a challenge: finding the balance between this kind of personalized attention to our clients, and working for financial inclusion for all segments of society.

At Banorte, we don’t want to be a digital bank, we want to develop our ability to do banking in a digital world. We are focusing technological processes to enable our clients to do their banking with a single click. We want to stay ahead of the trends, so we’re working to develop projects focused on what clients need, when and where they need it, by using both digital and non-digital channels, whether on their own or with the assistance of our staff.

“Digital Transformation is not a question of technology; it’s a question of customer relations.” Charlene Li, independent writer and graduate of the Harvard University Business School.

Over the course of 2018, we made great strides in the area of digital banking, introducing more than 60 new functions to reposition Banorte’s mobile banking app, which resulted in a significant increase in our service volume and indicators. For example, the number of app users increased by 35% and the number of transactions rose by more than 80%, to 35 million. At the same time, our Net promoter Score (NPS) rose 2.5 points to a total score of 71.7, positioning us as leaders in the market.

In 2018 we set the following goals for the Technology area:

Today, our clients prefer to operate through Mobile Banking. Over the course of the past year, we worked on maturing our information security processes and continuously training employees in cyber-security issues, while fostering greater confidence and enhancing protection.

A breach of Mexico’s electronic payment system (SPEI) in the month of April 2018 affected the entire banking system and with it Banorte, which had a significant operating and reputational impact on the Bank. The incident convinced us even more of the need to expand our focus on incident attention to incorporate both preventive and reactive processes.

Before reconnecting with the SPEI, we executed a comprehensive process of remediation that included implementation of controls and security mechanisms in both our technological infrastructure and our applications, which was evaluated and authorized by regulatory agencies.

Also last year, we successfully completed plans for an internal security program in which various processes were improved. The result was the “armoring” of 40% of our applications with robust practices. The next steps, to be taken in Phase II, will involve a permanent strategic program for oversight and security protection in applications through a model of governance to monitor and adjust execution as necessary. This will require substantial investment over the next five years, but it underscores our commitment to protecting the institution’s assets.

Our human IT team is made up of more than 500 employees who are deeply committed to the institution, which is reflected in a low turnover rate of 12%. To keep up with the fast-changing technological environment we provided around 5,700 hours of training and workshops for our staff. We continue to encourage a healthy life-work balance with initiatives like flex time and home office, involving around 33% of our employees.

Digital Hub

To enter and position ourselves in a climate that encourages innovation and attracts young talent, we participated as founding members of the Monterrey Digital Hub, a driving force for digital transformation in Mexico which brings together leading companies, academic institutions, and entrepreneurs in growth and digital talent, committed to revolutionizing organizations and communities through digital technology and models. Monterrey Digital Hub wants to create the first ecosystem in which training and workshops in digital skills, specialized mentoring and open and corporate innovation programs can build a community of knowledge transfer and experience.

The Financial Group’s transformation toward digital operation has implications and consequences, and in the area of Infrastructure we have seen a substantial increase in our transaction volumes. Offering our clients more options means more transactions, which means we need to grow our infrastructure as well. For example, overall transactional volume grew 16% last year, but the increase was even greater in some specific channels, particularly the digital ones.

The installation of components to handle new functionalities in our productive environment entailed more than 8,000 changes in 2018, almost 25 changes a day. Maintaining the highest level of service and standards in an environment of such constant change is a real challenge, and we made sure to take action to mitigate the risks involved.

The following are just some examples of our infrastructure growth:

Among the highlights of our actions last year were:

Implementation of operating optimization tools, documenting best operating practices, introducing information security review policies and practices, and emergency response services.

To adapt our technological infrastructure and ensure that it is modern, agile and able to keep up with the pace of change demanded by digitalization, we are readying new Data Centers in Querétaro and Monterrey, which are expected to be open and operating in 2020, while upgrading technology in most of our technical components to ensure high availability, redundancy and short recovery times in the event of contingency situations.

All our technology-related projects and efforts ultimately aim at giving our clients new ways to do their banking, releasing new functionalities that give value to our business as well as to our customers. We have done this through a 10% increase in work-hour production. We have increased our capacity by four times over, and released more than 1,900 value deliveries.

In 2019 we will work to stabilize the pace of work and prioritize the technological solutions we introduce. We will measure the success of our efforts by how efficiently we use our resources in carrying out strategic projects.

One of the most important projects last year was the technological and operating integration of Interacciones, which began in mid-2017 and concluded in the third quarter of 2018. This process, which involved migrating close to one million records, was executed without affecting operations for all those clients who became Banorte customers overnight.

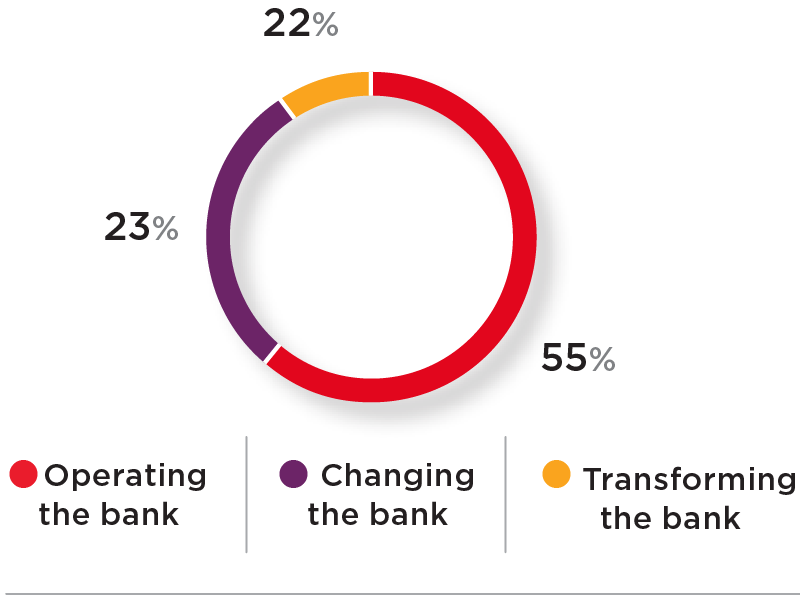

FOCUS OF TECHNOLOGY PROJECTS

FOCUS OF TECHNOLOGY PROJECTS

Technology programs and projects are classified into the following categories: Operating, Changing and Transforming the bank. In 2018, productive capacities were assigned as follows:

Looking ahead to 2019, and convinced that technology is key to the development of our business, GFNorte will continue to work on innovation and execution of new trends through our digital transformation strategy. Our focus this coming year will be on:

We created strategies to ensure a better and more efficient use of our budget:

In this process of technological change, Banorte has always placed a high priority on meeting existing commitments, fostering a culture of cooperation and permanent service availability, and recognizing the emotional component of interaction with our clients.

The key to evolution lies in reimagining models, business processes and customer service, as well as the use information, always keeping the client at the center. The new challenge in the market is called personalization, and the trade or market name today is hyper-personalization; GFNorte is working to meet this challenge.

We have a vocation for continually exceeding our clients’ expectations of the service we offer. At GFNorte we develop information-based solutions to provide them with an experience that fully satisfies their needs.

-The Analytics team is in charge of knowing and understanding our customers, transforming this information into value both for them and for GFNorte. With this process of analysis, we pursue two purposes:

In order to develop comprehensive solutions, Analytics works with most of the business areas, executing cross and vertical sales campaigns, along with projects aimed at reducing the cost of risk as well as operating and financial costs. In 2018, these solutions contributed significantly to creating value for GFNorte; specifically, the present value of associated direct profits in 2018 increased 46%.

This effort has allowed us to make significant improvements in processes that were already successful. Five examples of this are: i) cross sale of credit cards, which last year accounted for 27% of new cards purchased and activated; ii) payroll loans, which accelerated with the support of advertising campaigns, increasing 32%; iii) activation of credit cards with a first purchase got a substantial boost from the use of automated contact with clients, resulting in a 15.5 percentage point increase in the success rate; iv) clients’ adoption of mutual funds, also strengthened through cross-selling efforts, which doubled the impact over the previous year; and v) the use of a statistical tool to reduce cost of risk saved the bank more than Ps. 1.7 billion, more than double what was achieved through these initiatives in 2017.

Analytics also enabled us to have a more positive impact on our clients, because they can now receive offers based on their needs, with better credit conditions and through non-intrusive channels. Some examples of this are credit cards placed through cross-selling to existing clients, exempting them from the payment of annual fees.

In 2019, the Analytics team will work to continue increasing its contribution to value generation at GFNorte, through three overall efforts:

Today we have gone from the age of information to the age of focus on the client, a change that requires full concentration on their needs and expectations. But we also know that true, sustained business growth goes beyond satisfying clients’ needs; we need to also earn their trust and loyalty. For this reason, one of the Group’s strategic priorities is to improve customer experience, so we can continue to be the best financial group for Mexico and for Mexicans.

From the Client Experience area, we will build loyalty for every one of our clients by placing them at the center of our operations, for the purpose of designing and transforming our products and services to meet their financial needs.

In 2017 and 2018, we introduced tools for hearing and responding to our clients’ voices in real time, so we can understand what they want, need or expect, in every one of their interactions with the bank. We want these interactions to generate emotions and memories that shape their future decisions and their loyalty.

One of the main objectives of our Customer Experience effort is to implement a transformation program, a digital tool which, through quick and simple methodologies, involves client and employee together in a process of interaction.

The process begins at the moment the client’s voice is heard; immediately their needs and expectations are analyzed, which triggers a number of internal processes to detect the gap. Once detected, that last phase involves making the improvements or designs necessary, aligning internal processes to ensure positive experiences.

This transformation program involves more than 270 initiatives focused on customer service and self-service.

With the help of a series of methodologies, we place the client at the heart of the design and improvement of our processes.

Toward the end of 2017, Banorte began the Customer Voice Management Program, which consists of a series of questionnaires applied to clients through digital channels, using the Net Promoter Score (NPS) methodology. This methodology tells us to what extent our clients would recommend us, and their level of satisfaction with our products, services and channels.

The NPS Score is based on one basic question: How willing would you be to recommend Banorte to others? On a scale of 0 to 10, 9 and 10 are service-supportive clients, 7 and 8 are passive clients, and 0 to 6 are unsatisfied clients, who would not be at all willing to recommend us.

Today, we have more than 2 million customer feedbacks from 40,000 points of interaction with Banorte. This information has enabled us to design and transform processes, products and services to improve the customer’s experience.

In the words of some supportive clients:

“They attend to you quickly and then they ask you in a helpful tone if there’s anything else you need, and I answered, that’s all for today, thanks! And they respond, have a nice day. Imagine— they take care your money, attend to you quickly, and send you off with blessings… that’s my bank!”

“Keep working efficiently. When we work with love and enthusiasm, we help build a world of harmony and security.”

By making a map of a customer’s experience, we can identify points of difficulty in their interactions with the bank, which need to be transformed. We designed a methodology consisting of seven factors for measuring the degree of usability, simplicity and self-service of each process, application or interaction with the customer.

Through this methodology we succeeded in transforming more than 4,000 key moments in interactions with our customers.

In 2018, Banorte installed a “Customer Chamber,” a specially designed Gesell chamber in which customers and employees can work together to design and improve processes.

We have a laboratory for guaranteeing the experience and quality of the functions, processes and services we develop, before they’re released into production. This enables us to guarantee the customer’s experience and involve both employees and clients in assessing new advances.

Some examples of this are biometric applications, processes for opening accounts through various channels, tools like the shift assignment module at branches, or new mobile banking apps and online banking options.

Our service model establishes the foundations of a client-centric culture, to provide them with personalized solutions and options, a better relationship and an opportunity to experience unique and memorable moments. In 2017 and 2018, we trained more than 10,000 employees throughout the country, which resulted in substantial improvement in our branch staff in areas like customer service, friendliness and knowledge. It also resulted in an improvement of between 68% and 80% in positive customer sentiment.

We have 160 multi-disciplinary teams called “Cells” which involve the entire organization in continuous improvement processes. These teams work according to a versatile methodology consisting of more than 290 high-customer-impact initiatives that build value in the short term.

The process of transformation within Banorte, and the use of methodologies, as well as a client-centric culture, has resulted in a significant improvement in the NPS of various channels, products and services.

| NPS IMPROVEMENT BY CHANNEL/SEGMENT | |

|---|---|

| Channel/Segment | % Growth in NPS |

| Branches | 18% |

| Preferred Segment | 26% |

| Online banking | 21% |

| Mobile banking | 13% |

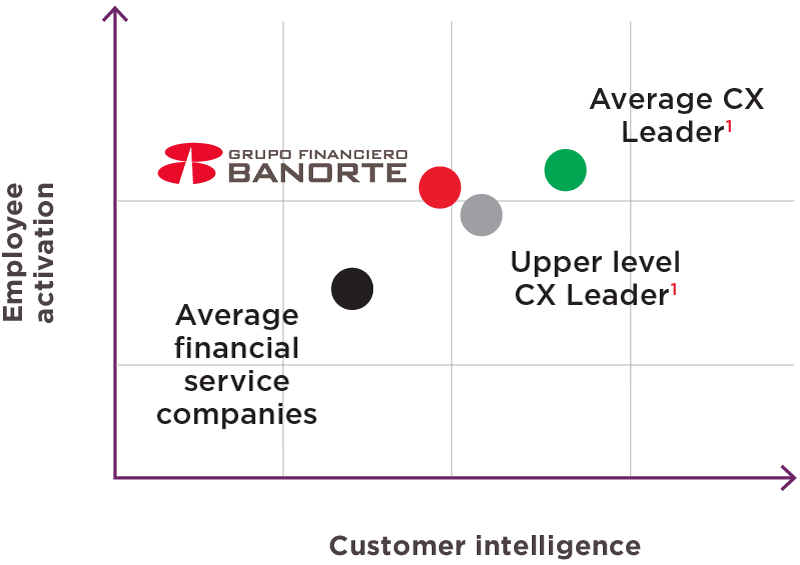

Recent studies attest to Banorte’s evolution and maturity in customer experience, ranking us within the average ranges of the world’s leading companies.

BANORTE’S MATURITY IN OECM* VS. LEADERS

Banorte is now at the “CX Leader” level, having attained it more rapidly than most companies.

Source: Medallia® Copyright 2018

*Organizational Customer Experience Management

1Customer Experience

These are some of the transformation projects that have been most valued by Banorte customers:

Banorte Virtual Assistant: At the end of 2018, we released an interactive chat and virtual assistant service based on Artificial Intelligence (AI): through this, our clients can perform monetary transactions and receive a quick answer to their questions, in a language familiar to them.

Mobile Banking: In the last nine months, the mobile banking cell has redesigned more than 60 services, designed 15 new functions and 25 improvements. This enabled us to move up three positions in the competitive ranking of Mexico’s financial industry, and increase the number of monetary transactions and inquiries through mobile banking by 210%.

In-branch customer origination: We have a platform at our branches for fully digital client activation. The efficiency of this system has made it easier for us to offer products to customers and improved their satisfaction, increasing the number of products per client from 1.4 to 3.5.

Banorte has a flexible, multi-channel technological architecture that creates unique experiences in every point of contact with the bank. These guarantee value for our clients, because they are intuitive, highly usable, self-service processes. Based on client information and data, we can pinpoint campaigns and offers, significantly increasing acceptance levels.

Thanks to technological transformation, our new clients are 100% digital, and our online origination and the products and services offered through these channels, are a clear sign of Banorte’s vocation for the digital experience.

As a result of all these digital transformation strategies, the customer effort index went from 2% in 2016 to -22% in 2018, meaning that Banorte offers its customers increasingly efficient, easy-to-use channels to do their banking.

We have a system for quickly and clearly answering questions and resolving inquiries.

Our NPS in customer inquiries improved by 200% thanks to improved customer response and attention times. In 2018, we completed 97% of pending claims and resolved 80% of inquiries within 72 hours.

By installing cutting-edge technology in Banorte’s call center, we were able to reduce call duration by 20% and improve average wait times.

The new mobile service menu provides personalized attention to customers from the moment the call begins, with better navigation and improved self-service. This change resulted in an 18% improvement in the NPS of first-contact resolution (FCR).

Currently, our contact center is focusing on projects that will make us one of the modern, efficient call centers in Mexico.