![]() SRS 102-14

SRS 102-14 ![]() SRS 102-15

SRS 102-15 ![]() SRS 102-19

SRS 102-19 ![]() SRS 102-20

SRS 102-20 ![]() SRS 102-21

SRS 102-21 ![]() SRS 102-27

SRS 102-27 ![]() SRS 102-29

SRS 102-29 ![]() SRS 102-30

SRS 102-30

![]() SRS 102-44

SRS 102-44 ![]() SRS 102-46

SRS 102-46 ![]() SRS 102-47

SRS 102-47 ![]() SRS 102-49

SRS 102-49 ![]() SRS 103-1

SRS 103-1 ![]() SRS 103-2

SRS 103-2 ![]() SRS 103-3

SRS 103-3

![]() SRS 102-14

SRS 102-14 ![]() SRS 102-15

SRS 102-15 ![]() SRS 102-19

SRS 102-19 ![]() SRS 102-20

SRS 102-20 ![]() SRS 102-21

SRS 102-21 ![]() SRS 102-27

SRS 102-27 ![]() SRS 102-29

SRS 102-29 ![]() SRS 102-30

SRS 102-30 ![]() SRS 102-44

SRS 102-44 ![]() SRS 102-46

SRS 102-46 ![]() SRS 102-47

SRS 102-47 ![]() SRS 102-49

SRS 102-49 ![]() SRS 103-1

SRS 103-1 ![]() SRS 103-2

SRS 103-2 ![]() SRS 103-3

SRS 103-3

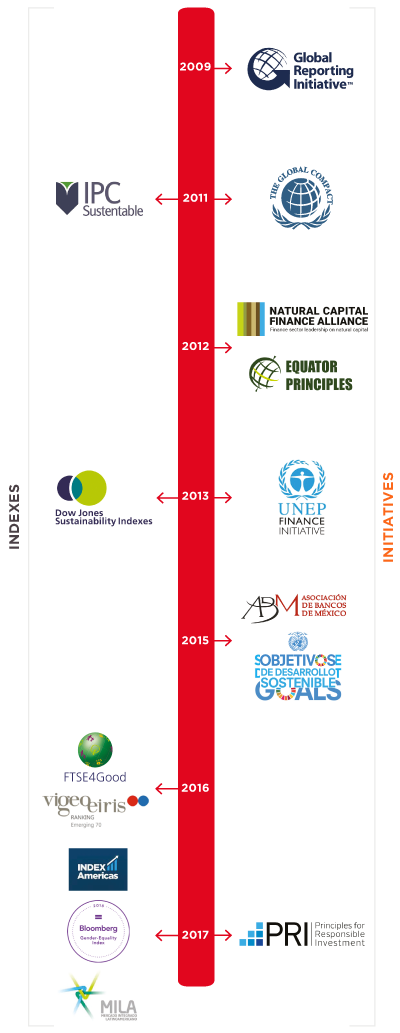

At GFNorte we believe that as a financial institution we play a key role in the development of a prosperous Mexico. For this reason, we integrate sustainability into our operations as a guiding principle to maximize profitability and growth, protecting at all times our financial, social and environmental capital.

Our objective is to generate value for all stakeholders, so we focus our sustainability strategy on four fundamentals:

The area responsible for implementing this strategy is Sustainability and Responsible Investment depending on the Executive Management of Investor Relations, Sustainabillity and Financial Intelligence who, in turn, depends on the department of Finance.

Sustainability and Responsible Investment is comprised of the Environmental Risk Management area in credit and investment activities and of Social Value. Environmental initiatives are administered in conjunction with the Directorate of Material Resources, with the objective of achieving a strong integration between operational processes and sustainability.

We continually strive to improve the Group’s performance, so in 2017 we updated our sustainability model in order to provide a clearer representation of our strategic pillars as well as our works areas. In this way we express the commitments and actions we have defined to meet the Objectives of Sustainable Development (ODS) proposed by the United Nations.

“ We integrate sustainability into our operations as a guiding principle to maximize profitability and growth, protecting our financial, social and environmental capital at all times.”

![]() Sustainable finance

Sustainable finance

We consider environmental, social and corporate governance factors in our offering of products and services in order to contribute to environmental protection, social balance and the economic development of our country.

![]() Transparency

Transparency

We maintain a bilateral relationship with our stakeholders providing accurate and updated information on our practices and results, allowing us to obtain constructive feedback for the continuous improvement and participation in investment markets globally.

![]() Environmental footprint

Environmental footprint

We carry our initiatives to generate a culture of environmental protection within the institution, as well as to measure and reduce our consumption of resources and generation of pollutants, in order to mitigate the direct and indirect impacts of our operations.

![]() Actions for the community

Actions for the community

We implemented various social programs that involved our employees and the communities in which we operate, in order to apply practices that improve the internal and external conditions of the institution, creating a better quality of life.

![]() SRS 102-43

SRS 102-43 ![]() SRS 102-47

SRS 102-47

In addition, we believe that as engines of economic development we have the responsibility of promoting attention in topics whose characteristics represent unprecedented challenges on a global scale and for Mexico. Thus, we have determined that human rights, climate change and biodiversity are priorities within our processes.

Mexico is one of the countries with more human rights observers’ visits due to the number of cases involving serious and systemic violations of vulnerable peoples and communities. Aware of this situation, we diagnose, assess and ensure respect for human rights within our activities, in line with the guidelines of the UN’s Universal Declaration of Human Rights.

Climate change is one of the 21st century’s major problems. According to the World Bank, Mexico is one of the most vulnerable countries, so our territory, population and economy are exposed to adverse consequences. Therefore we consider essential to get involved in initiatives that identify opportunities and provide consistent and efficient solutions to the risks of climate change. Promoting interest in the transition to a low-carbon economy, market resilience, mitigation of the impact of natural disasters among other issues, is paramount to GFNorte.

Mexico is the fourth most megadiverse country in the world; home to between 10% - 12% of all plant and animal species on the planet. However, more than half is under some category of risk due to anthropogenic causes. Therefore, it is essential that the activities and projects in which we intervene seek to protect animal and plant species, their habitats and ecosystems in order to preserve the balance and the natural wealth of our country.

![]() SRS 102-40

SRS 102-40

Our stakeholders are a key factor in achieving our business objectives. We believe that it is essential to maintain a constant, open and transparent communication to fulfill our commitments and strengthen the ties that unite us.

The frequency of interactions depends on the channel established with each group; however, our approach focuses on satisfying their requirements.

“ As engines of economic development we have a responsibility to promote attention in subjects whose characteristics represent unprecedented challenges on a global scale and for Mexico.”

![]() SRS 102-40

SRS 102-40 ![]() SRS 102-42

SRS 102-42 ![]() SRS 102-43

SRS 102-43 ![]() SRS 102-46

SRS 102-46

Workforce development (continuous technical training as a model to enhance skills and leadership among employees), labor practices and retention of talent.

Corporate governance; coverage, expansion, and business ethics; financial information; risk management and aspects of sustainability (socio-environmental contributions and impacts).

Integrity of the business operation, monitoring and adherence to financial regulations, transparency and opportune reporting, anti-corruption, offer and promotion of products and services in accordance with regulations.

Accessibility to financial products and services, clear information regarding them, monitoring of satisfaction and quality of service (attention and advice).

Requirements and standards, selection of goods, creation of value, environmental and social policies adopted by the institution.

Access, dissemination and transparency of the Group’s information; opportune and comprehensive media coverage; consistency and fluidity of internal and external messages.

Impact on climate change and natural capital, human rights, Economic or in-kind support, strategic alliances and participation in work teams

Management of social responsibility, natural resources, business ethics, cooperation with communities in which we operate, strengthening of relations and opportunities to rebuild the social fabric.

Compliance with legislation, compensation agreements with unionized employees, environmental management (in topics such as water and waste, impacts on biodiversity, emissions to the atmosphere) and participation with social impact.

Frequency of meetings with stakeholders:

![]() SRS 102-47

SRS 102-47 ![]() SRS 102-49

SRS 102-49

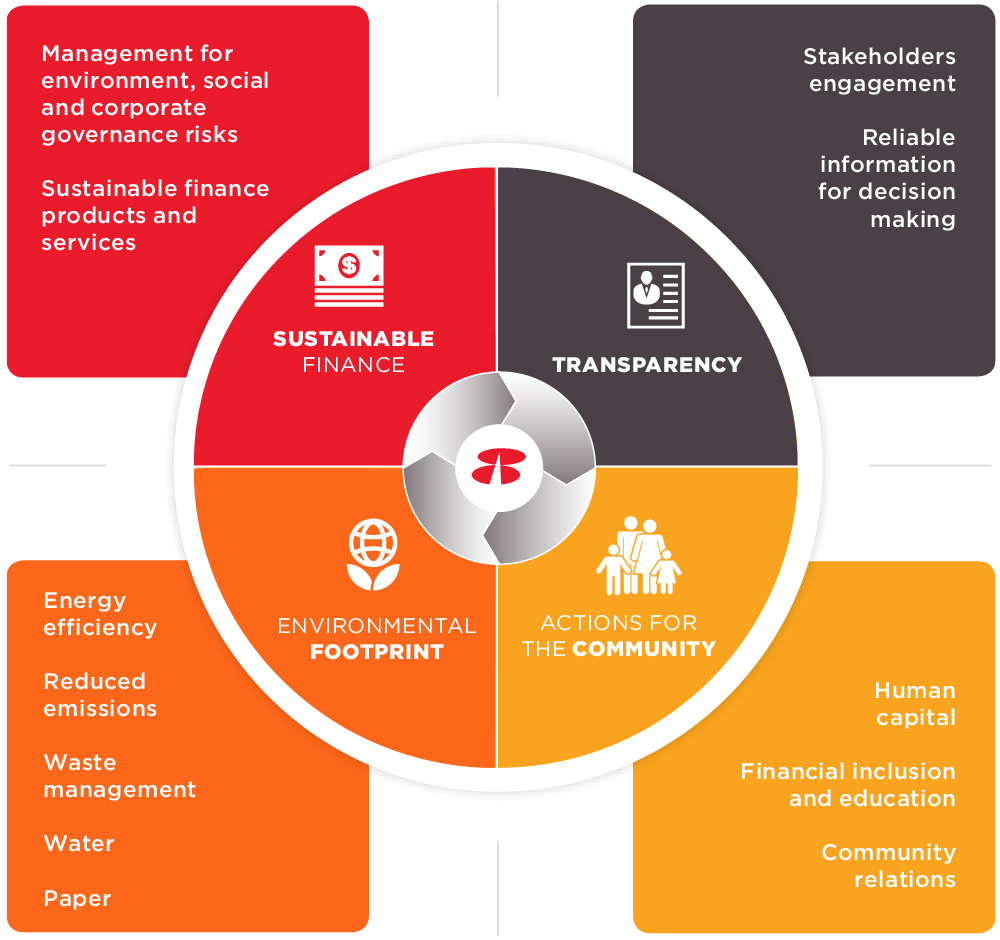

In GFNorte we are interested to know our stakeholders’ concerns about sustainability. For this reason, we developed a matrix of materiality with internal and external feedback, that allows us to see the relevance of the different issues that we address in our activities.

From the results of this exercise, we prioritize the topics that are most relevant for all, in order to define and implement actions that contribute to improving our performance.

We are working on various initiatives to align them to the objectives established in the 17 Sustainable Development Goals (SDG), of the United Nations Development Program (UNDP) 2030 Agenda.

![]() SRS 102-11

SRS 102-11 ![]() SRS 102-12

SRS 102-12 ![]() FS-2

FS-2 ![]() FS-3

FS-3 ![]() FS-5

FS-5

Recognizing the importance of respecting human rights, the care of natural resources and the mitigation of climate change, GFNorte is committed to prevent, minimize, restore and compensate for adverse impacts. For this reason, a vital aspect within our investment and financing operations is the management of social and environmental risks.

Following our new model of sustainability we seek to implement different strategies to handle the potential environmental, social and governance (ESG) risks of our business. In this regard, in March 2017 we became the first financial group in Mexico to form part of the Principles for Responsible Investment (PRI). As signatories of this initiative, we are committed to integrating ESG criteria in our investment process to support decision-making and the transition to a low-carbon economy covering the needs of the current economic model, and in addition, generate a positive financial impact on our investment portfolio.

The PRI derive from the United Nations Environment Program Finance Initiative (UNEP-FI) and the Global Compact, in order to improve the ability of investors to fulfill commitments with beneficiaries, as well as to align investment activities with the broader interests of the society, following six principles:

In this first year of adherence, we focused efforts on the fourth principle, and promoted the acceptance and the implementation of all the principles.

Additionally, in July 2017, GFNorte joined the group of 390 global investors representing $22 billion dollars in assets, so that the G20 leaders honor their commitments to the Paris Agreement.

The investors called on global leaders to:

In October of the same year, in conjunction with the PRI, Ecovalores, Moody’s Investors Services and WBCSD, we held the Introduction to Responsible Investment and Roundtable events for the purpose of disseminating practices of responsible investment in Mexico, exploring the international scene and promoting adherence of more financial institutions to the PRI. We received the support and participation of 44 representatives from different financial institutions, private sector companies and CSOs.

![]() SRS 102-12

SRS 102-12 ![]() FS-5

FS-5

Since 2012, we have used our own Social and Environmental Risk Management System (SEMS) to analyze social and environmental risks and impacts arising from activities that we fund.

The SEMS is based on the most important global risk management standards, such as the Performance Standards of the International Finance Corporation (IFC) and the Equator Principles.

In this way, we encourage that projects from our loan portfolio have the least possible impact, and are developed in a socially responsible manner and apply rigorous environmental practices.

The SEMS complies to a process of identification, categorization, evaluation and risk management that operates in parallel to credit procedures and which currently includes Corporate Banking, Business Banking and Structured Financing portfolios.

Throughout our analysis process we detect potential environmental and social risks of loans by using our exclusion list, classifying them according to their degree of impact and selecting those that meet the criteria to be evaluated. Thus, financing of more than $1 million dollars are examined under performance standards, and transactions whose amounts exceed $10 million dollars are analyzed under the Equator Principles.

During the evaluation of projects, we check that they comply with national legislation and international guidelines. In addition, we follow-up on higher risk projects with annual reviews of customers’ plans of action, provide periodic advice, monitor reputation and make field visits.

The area responsible for the SEMS is Socio-Environmental Risk (ARSA), that pertains to Sustainability and Responsible Investment and is comprised of a team of four people with training and experience in environmental and social issues such as:

In addition, the SEMS is supported by the Sustainability Champions, a group of employees from the credit and business area who serve as a link between the ARSA and the bank’s business areas to promote the proper management of risks and impacts at a national level.

The following email address is at the disposition of stakeholders: sems@banorte.com

![]() FS-5

FS-5 ![]() FS-10

FS-10 ![]() FS-11

FS-11

In 2017, we conducted a thorough review of the social and environmental risk analysis process to redefine operation procedures and criteria to increase efficiency.

| 2017 CREDITS ANALYZED | |

|---|---|

| Socio-environmental risk (category) | Credit |

| High | 21 |

| Medium | 1,646 |

| Low | 2,093 |

| Total | 3,760 |

| 2017 PROJECT ASSESSMENTS | ||||

|---|---|---|---|---|

| Evaluation framework | Projects | |||

| Category A | Category B | Category C | Total | |

| SEMS Evaluation | 0 | 5 | 0 | 5 |

| Performance standards | 1 | 11 | 103 | 115 |

| Equator Principles | 4 | 11 | 33 | 48 |

| Total | 5 | 27 | 136 | 168 |

| FINANCING APPROVED BY SECTOR AND EVALUATION FRAMEWORK | ||||

|---|---|---|---|---|

| Sector | SEMS Evaluation | Performance Standards | Equator Principles | Total |

| Mining | 0 | 1 | 0 | 1 |

| Oil and gas | 0 | 1 | 2 | 3 |

| Chemicals | 1 | 1 | 1 | 3 |

| Construction | 2 | 88 | 27 | 117 |

| Manufacturing | 0 | 3 | 2 | 5 |

| Agribusiness | 0 | 14 | 2 | 16 |

| Energy | 0 | 0 | 4 | 4 |

| Forestry | 2 | 3 | 0 | 5 |

| Infrastructure | 0 | 2 | 3 | 5 |

| Tourism | 0 | 2 | 7 | 9 |

| Other | 0 | 0 | 0 | 0 |

| Total | 5 | 115 | 48 | 168 |

Pursuant to our testing criteria, we produced 32 rigorous due diligences for projects classified as Category A and B. All Category C projects were managed through IFC recommendations to customers, based on sectoral environmental, health and safety guidelines. We issued a total of 361 recommendations, mostly for the construction, agribusiness and infrastructure sectors.

Similarly, in 2017 we consolidated 15 on-site visits of projects, in conjunction with the credit and business areas, which reflects the interest of our decision makers in risk management, as well as the ever more noticeable participation of the ARSA in business processes. The dominant sectors in project financing were construction, agribusiness and tourism.

| 2017 PROJECT MANAGEMENT | |

|---|---|

| Due diligences | 32 |

| Recommendations | 361 |

| On-site visits | 15 |

“ We issued a total of 361 recommendations mostly for the construction, agribusiness and infrastructure sectors.”

![]() FS-4

FS-4

The Credit and Business area plays a key role in environmental and social risk management for GFNorte. Therefore, raising awareness and developing expertise in these areas is essential. Addressing this need, Banorte’s own ARSA provided face-to-face training for analysts, executives and directors in person, online and by telephone. And for the second consecutive year, we have published the monthly informative newsletter SEMS in Brief, reaching 15,278 employees.

| SEMS TRAINING 2017 | |||||

|---|---|---|---|---|---|

| Method | Resource | Duration (hours) |

Number of employees | Public | Frequency |

| Face-to-face | Presentations | 2 | 12 | Sustainability Champions | Annual |

| 1 | 117 | Business and Credit Area (new entity) | Quarterly | ||

| Virtual | SEMS e-learning | 2 | 211 | Business and Credit Area | Annual |

| Via telephone | ARSA background and experience | 0.25 | 353 | Business and Credit Area | Daily |

| Total | 5.25 | 693 | |||

We trained 375 employees investing more than 571.75 hours in reviewing issues with:

The Credit and Business area, as well as having a crucial participation in the social and environmental risk analysis process, is one of the major stakeholders concerns. Credit committees are responsible for the decision-making for financing, so effective communication of findings from the proceedings carried out is important.

With the support of our principal ally, the area of Selective Credit, we incorporated a section called Socio-Environmental risk within the Study of Credit for Financing, in order to report the results of this analysis, as well as the recommendations and conditions established by ARSA. With this, we improve interaction with decision-makers and guarantee the adequate and opportune flow of information.

![]() FS-8

FS-8

GFNorte is actively involved in the financing of the generation of electrical energy from renewable sources since 2012. We have funded 11 projects with a capacity to generate 1,190 MW, of which 647 come from wind energy, 433 from photovoltaic energy and 110 from natural gas open cycle cogeneration plant. These projects represent a total investment of $1,087 million dollars, of which GFNorte has funded $479 million dollars, equivalent to 44% of the investment. Our strategy is to seize the opportunities that the energy reform has generated for the electricity market, for which we have consolidated our relationship with investors, the federal government and banking institutions, with a firm commitment to extend financing and investment in clean energies.

In 2017 Banobras placed the first Sustainable Bond in Latin America in the Mexican Stock Exchange (BMV) for Ps 10 billion, for projects that benefit the environment and society. Banorte, through the Investment Bank Casa de Bolsa Banorte Ixe, served as one of three intermediary underwriters, providing consultancy and distributing the instrument on the market with investors in general.

Without a doubt, this initiative demonstrates the joint commitment of the financial system to boost mitigation of climate change and improve the social wellbeing of Mexico.

![]() SRS 102-12

SRS 102-12

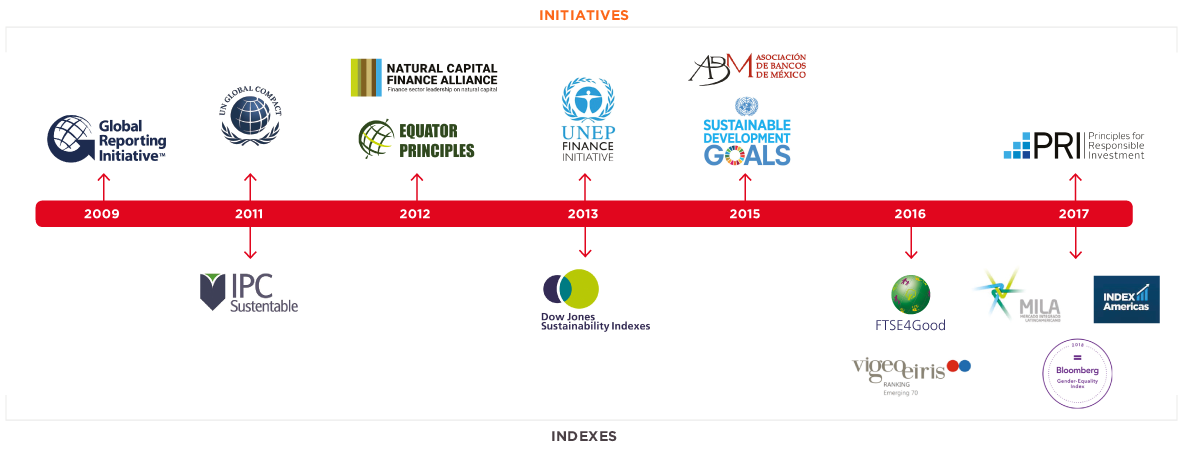

As leaders in sustainability, at GFNorte we want to promote good practices for the financial sector, supporting projects and keep updated on issues of national and international relevance; therefore we are actively involved in various initiatives.

“ GFNorte has been actively involved in the financing of the generation of electrical energy from renewable sources since 2012.”

![]() SRS 102-12

SRS 102-12

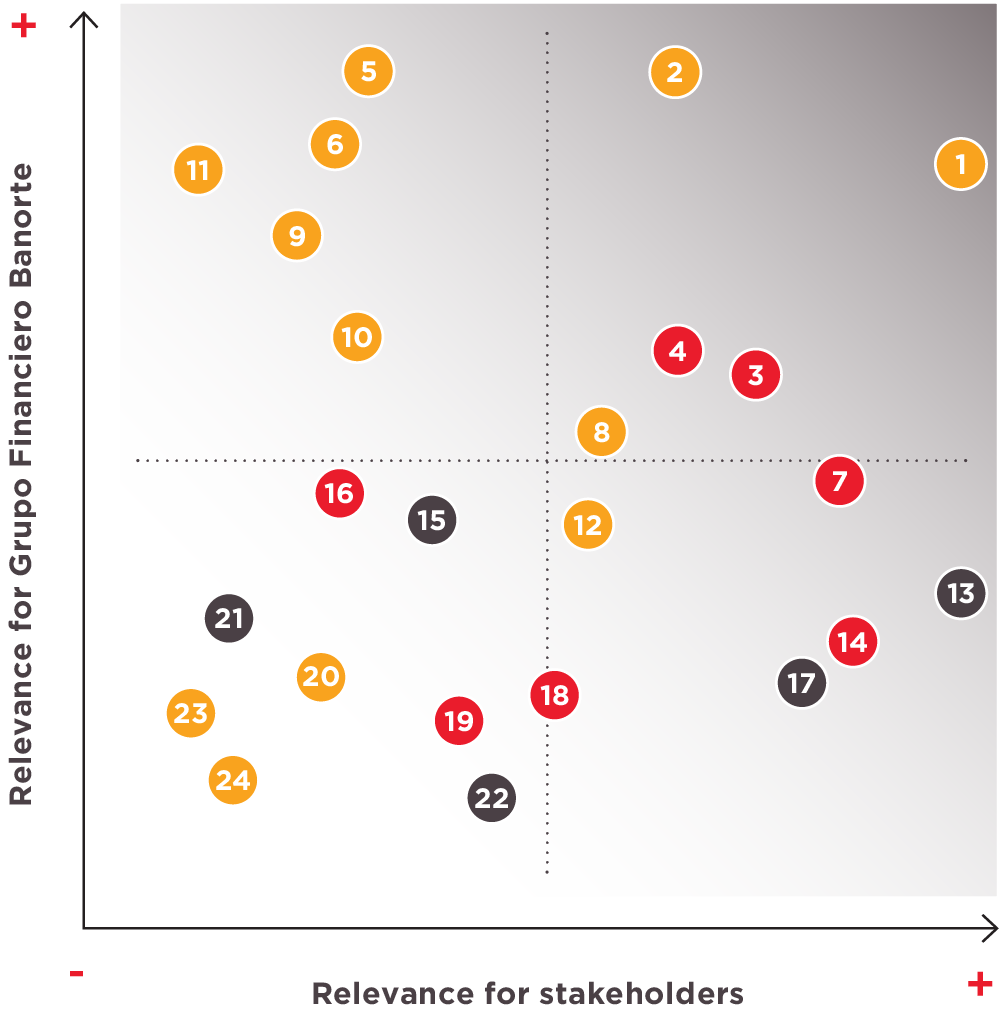

The depth and scope of the implementation and disclosure of our practices has positioned us as a leader in sustainability in Latin America, which is why we have been honored with multiple awards that have placed us in different national and international indexes.

“ The depth and scope of the implementation and disclosure of our practices has positioned us as a leader in sustainability in Latin America.”

We obtained the following awards in 2017: