![]() SRS 103-1

SRS 103-1 ![]() SRS 103-2

SRS 103-2 ![]() SRS 103-3

SRS 103-3 ![]() SRS 417-1

SRS 417-1

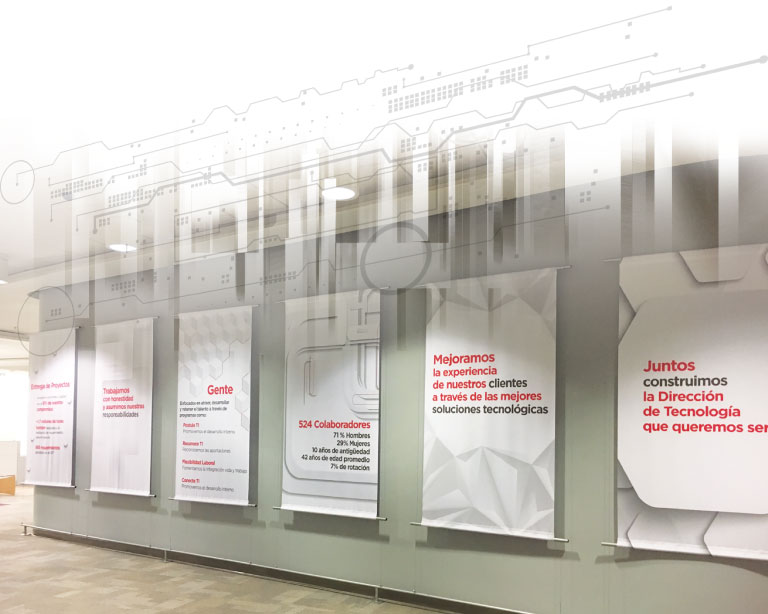

We remain at the forefront of technology in order to make the transformation to a digital world, where customers have access to easier and more convenient methods of doing business between each other and with their bank, through the implementation of reliable solutions that are easy to use and provide security in financial operations.

At GFNorte we continue promoting the use of innovative technological tools to add value to our customers and users through solutions that anticipate their needs in a practical, simple and secure way.

The development of projects in the area of technology is oriented to execute tasks and activities in a more simple and effective manner. To do this, we have evolved the way in which we manage our operation and execution methods, our relationship with suppliers and our performance measurement model. This has allowed us to become more efficient and produce 2 million hours in technological solutions, 17% more than in 2016, which has positioned us as a strategic business partner and has strengthened us in the face of the competition.

Our programs and projects of technology are classified into the following categories: Operating the Bank, Change the Bank and Transform the Bank.

In 2017, productive capacities were assigned to our portfolio in the following manner:

Now we are more efficient

and produced

2 million hours

in technological solutions,

17% more

than in 2016.

Now we are more efficient and produced 2 million hours in technological solutions, 17% more than in 2016.

Convinced that technology is the key to the development of our business, at GFNorte we continue to work on innovation and the implementation of new trends. These are our plans for the projects that are already underway:

“ Convinced that technology is a key element for the development of our business, at GFNorte we continue to work on the innovation and implementation of new trends.”

At Grupo Financiero Banorte, innovation is essential to continue our transformation, keep us abreast of customers’ needs and offer them the best service.

EGFNorte is seeking to anticipate customers’ needs and increase their satisfaction with our services, through innovation. For this reason, we have an area dedicated to innovation to develop ideas, prototypes and projects that are then tested with the end user.

We focus on three main themes:

In this way we seek to meet the changing needs of our customers, to whom we offered multiple upgrade options in 2017, including:

“ At GFNorte we anticipate our customer’s needs and increase their satisfaction with services through innovation.”

In addition, we pioneered a program in Latin America together with the Instituto Tecnológico de Estudios Superiores de Monterrey (ITESM) and IBM to contribute to the development of new technologies and education in Mexico. The program consists in using Blockchain as a core part of two projects, both developed by computer engineering students from ITESM, using IBM’s Bluemix platform.

It is the best-known and most popular program among our employees in terms of innovation. Since 2010, this program has become one of the main promoters of innovation among GFNorte employees.

In 2017 we decided to put a twist on this initiative and challenge the internal innovation process to improve it by changing the platform, the rules and the manner in which it is managed.

One of the main features of Banorte’s Ingenuity Program is that it allows open innovation, i.e., employees can go beyond boundaries and work with colleagues from different areas or external professionals to innovate in a more distributed way, participative and decentralized, generating new networking among participants.

The program works with a mixed model that includes internal crowdsourcing using an institutional collaboration tool for the registering, enrichment, voting and selection of the best ideas, and internal crowdfunding through what we call the Ideas Market. During the year, 1,200 employees invested in previously selected proposals to select the winning ideas.

With the objective of determining whether the ideas presented could be feasibly implemented, more than 60 employees used Design Thinking and other innovative tools to test them using a non-functional prototype.

These actions strengthen innovation and consolidate it as a continuous process in the organization, to inspire, encourage and motivate our employees to think beyond the usual.

“ We pioneered a program in Latin America, together with the Instituto Tecnológico de Estudios Superiores de Monterrey (ITESM) and IBM to contribute to the development of new technologies and education in Mexico.”

At Banorte we seek to position ourselves as the Group that provides the best customer service and experience, setting the example for being avant-garde and innovative. Therefore, in 2018 we will promote the following projects:

“ At Banorte we seek to position ourselves as the Group that provides the best customer service and experience, setting the example for being avant-garde and innovative.”