![]() SRS 102-7

SRS 102-7 ![]() SRS 102-8

SRS 102-8 ![]() SRS 102-45

SRS 102-45 ![]() SRS 102-48

SRS 102-48 ![]() SRS 103-1

SRS 103-1 ![]() SRS 103-3

SRS 103-3 ![]() SRS 401-1

SRS 401-1 ![]() SRS 405-1

SRS 405-1

The development of human talent is key to fulfilling our business strategy. In Human Resources, we have the challenge of maintaining an efficient organizational culture, focused on business results and guided by the institution’s leaders, by enabling new models for the attraction, performance and retention of personnel.

Our main focus on Human Capital has been the management of change through sustainability and the supply of talent in the organization. We have focused on the development of a result-oriented culture, generating new leaderships and promoting skills oriented towards new digital and disruptive innovation trends.

We have over 29,000 employees evenly distributed by gender with 50.4% male and 49.6% female staff.

| GRUPO FINANCIERO BANORTE NUMBER OF EMPLOYEES TO DECEMBER 31ST, 2017 |

||||||

|---|---|---|---|---|---|---|

| Business | Full-time | Fees | Total | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | |

| Banking Sector | 20,960 | 21,875 | 7 | 3 | 20,967 | 21,878 |

| Bank | 18,559 | 19,250 | 0 | 3 | 18,559 | 19,253 |

| Warehouse | 10 | 52 | 0 | 0 | 10 | 52 |

| Leasing and Factoring | 91 | 110 | 7 | 0 | 98 | 110 |

| ASPE | 2,300 | 2,463 | 0 | 0 | 2,300 | 2,463 |

| US Businesses | 571 | 174 | 0 | 0 | 571 | 174 |

| Inter National Bank (1) | 414 | - | 0 | - | 414 | - |

| Uniteller | 135 | 152 | 0 | 0 | 135 | 152 |

| Banorte Securities | 22 | 22 | 0 | 0 | 22 | 22 |

| Long term savings (2) | 6,382 | 7,854 | 9 | 9 | 6,391 | 7,863 |

| Afore | 4,436 | 5,823 | 3 | 4 | 4,439 | 5,827 |

| Insurance | 1,756 | 1,831 | 6 | 5 | 1,762 | 1,836 |

| Annuities | 190 | 200 | 0 | 0 | 190 | 200 |

| Total | 27,913 | 29,903 | 16 | 12 | 27,929 | 29,915 |

Banking sector data.

| WORKFORCE BY AGE RANGE AND GENDER | |||||

|---|---|---|---|---|---|

| Gender | Age range | 2015 | 2016 | 2017 | Var. % 2017 vs 2016 |

| Female | < 30 years | 4,199 | 4,909 | 5,371 | 9.4 |

| 30 - 50 years | 5,152 | 4,721 | 4,790 | 1.5 | |

| > 50 years | 571 | 626 | 678 | 8.3 | |

| Total females | 9,922 | 10,256 | 10,839 | 5.7 | |

| Male | < 30 years | 4,360 | 5,007 | 5,325 | 6.4 |

| 30 - 50 years | 5,039 | 4,521 | 4,532 | 0.2 | |

| > 50 years | 1,141 | 1,183 | 1,182 | -0.1 | |

| Total males | 10,540 | 10,711 | 11,039 | 3.1 | |

| Total | 20,462 | 20,967 | 21,878 | 4.3 | |

| WORKFORCE BY OCCUPATIONAL CATEGORY AND GENDER | ||||

|---|---|---|---|---|

| Category | Female | Male | ||

| Employees | % | Employees | % | |

| Upper | 106 | 1 | 417 | 2 |

| Middle | 2,286 | 12 | 3,191 | 17 |

| Operational | 7,285 | 38 | 5,965 | 31 |

| Total | 9,677 | 50 | 9,573 | 50 |

One of the most important programs implemented in 2017 was the Success Factors platform, developed for better management of our Human Capital through the following modules:

In this first year of implementation, this tool has allowed us to evolve the human resources management process to make employee work hours visible and to obtain punctual follow-up to performance, in line with business objectives.

We determine the contribution of talent in GFNorte through the intersection of performance results of employees with the level of potential to contribute to the objectives and obtain positions with greater responsibility. We refer to this as our Matrix of Talent.

The potential of an executive is determined by their capacity, commitment and aspiration, which is measured with standardized regulatory assessment tools, that when compared with Banorte profiles, show the appropriate potential classification. An executive with high potential is a person who demonstrates high performance, outstanding potential, commitment and aspirations to succeed in positions of greater responsibility.

We initiated the Executive Succession Process with the Management Committee, who identifies successors for senior management positions that were validated by each Managing Director. Successors emerged from talent and leadership assessments, considering candidates in positions where they report directly to each general manager, peers, and positions that report directly to their counterparts.

We started a new long-term incentive plan to strengthen compensation, providing continuity to the strategy of attraction and retention of key executives. The new plan is aimed at recognizing performance and achievement of objectives of each employee as well as in promoting fulfillment of the Group’s goals.

![]() SRS 201-3

SRS 201-3 ![]() SRS 401-2

SRS 401-2 ![]() SRS 405-2

SRS 405-2

We have transformed the comprehensive attraction of talent process with the implementation of technology platforms that have allowed us to streamline recruitment functions and provide new applicants with an experience of digital accessibility.

We redesigned the Young Talent program, focusing on projects that add value to the business in which young people with high potential, from national and international universities, have access to a platform that allows them to demonstrate their skills and complement their professional development.

For GFNorte, the key factors in the decision to attract talent are capacity, skills and the knowledge of applicants, always based on equality to make the decision to hire a new employee, with which we avoid discrimination for any reason.

One of the most important issues of our human resources strategy is to maintain wage competitiveness among operating and executive salaries, using performance as an element to assess productivity and recognizing personnel with outstanding performance in achieving results with a higher salary percentage.

We continually work to offer our employees a comprehensive remuneration and benefits package that is competitive within the industry.

For the key senior management positions, whose responsibilities are associated with market, credit or policy risk, we have an annual bonus payment scheme and retention plan with different characteristics. The annual bonus is subject to the fulfillment of objectives and the performance of risk and human resources metrics, including adherence to regulations. Thus, 40% of this bonus is variable and its payment is deferred over three years. So we encourage our top executives make decisions based on profitability, vision and the creation of long-term value.

| EMPLOYEE REMUNERATION | |||

|---|---|---|---|

| 2016 | 2017 | Var. % 2017 vs 2016 | |

| Officers | 2,674,559,726 | 2,858,419,708 | 6.9 |

| Employees | 1,849,310,534 | 1,927,512,137 | 4.2 |

| Total | 4,523,870,260 | 4,785,931,845 | 5.8 |

| AVERAGE SALARY BY OCCUPATIONAL CATEGORY AND GENDER | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| General labor category | Average salary | Variation between average male and female wages | ||||||||

| Female | Male | 2017 Amount |

Ratio % | Var. % 2017 vs 2016 |

||||||

| 2016 | 2017 | Var. % 2017 vs 2016 |

2016 | 2017 | Var. % 2017 vs 2016 |

2016 | 2017 | |||

| Upper | 111,947 | 115,178 | 2.9 | 120,321 | 125,743 | 4.5 | 10,565 | 93.0 | 91.6 | -1.4 |

| Middle | 29,784 | 30,429 | 2.2 | 32,058 | 33,087 | 3.2 | 2,658 | 92.9 | 92.0 | -0.9 |

| Operational | 12,170 | 12,598 | 3.5 | 12,340 | 12,664 | 2.6 | 66 | 98.6 | 99.5 | 0.9 |

![]() SRS 404-1,

SRS 404-1, ![]() SRS 404-2

SRS 404-2

We incorporated new training models to optimize knowledge retention and improve employees’ performance. In addition, we created a breeding program in the commercial network in which we reinforce our training and development programs.

Similarly, we launched a multidimensional leadership program, based on 360° evaluations for retail banking territorial directors, which allowed executives to know their areas of opportunity in leadership and work with certified coaches.

| INVESTMENT IN TRAINING AND DEVELOPMENT | |||

|---|---|---|---|

| 2016 | 2017 | Var. % 2017 vs 2016 |

|

| Scholarships | 9.4 | 9.8 | 4.3 |

| Travel expenses for training | 24.6 | 33.2 | 35.0 |

| Courses and conferences | 98.1 | 108.6 | 10.7 |

| Total | 132.1 | 151.6 | 14.8 |

In 2017 each employee received an average of 35 training hours, over 20% more than in 2016.

| AVERAGE TRAINING HOURS BY GENDER | ||||

|---|---|---|---|---|

| Gender | 2015 | 2016 | 2017 | Var. % 2017 vs 2016 |

| Female | 29 | 30 | 30 | - |

| Male | 31 | 29 | 40 | 37.9 |

| Average | 30 | 29 | 35 | 20.7 |

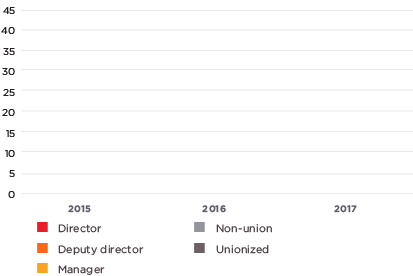

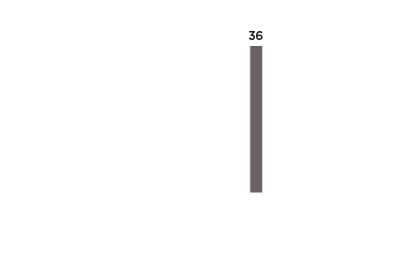

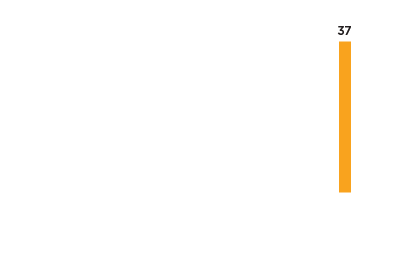

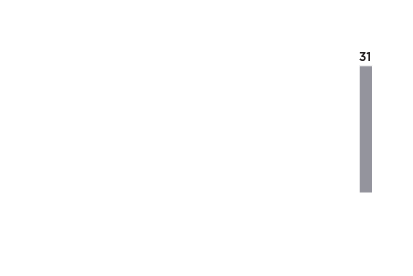

| AVERAGE TRAINING HOURS PER JOB CATEGORY | ||||

|---|---|---|---|---|

| Category | 2015 | 2016 | 2017 | Var. % 2017 vs 2016 |

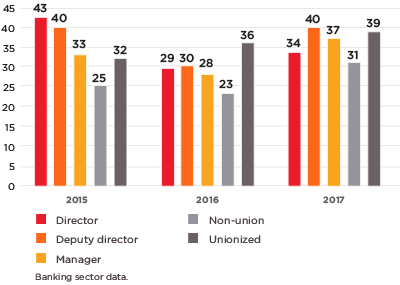

| Director | 43 | 29 | 34 | 17.2 |

| Deputy director | 40 | 30 | 40 | 33.3 |

| Manager | 33 | 28 | 37 | 32.1 |

| Non-union | 25 | 23 | 31 | 34.8 |

| Unionized | 32 | 36 | 39 | 8.3 |

Banking sector data.

Banking sector data.

| main benefits | |||

|---|---|---|---|

|

Obligatory annual christmas bonus |  |

Food stamps |

|

Savings fund |  |

IMSS subsidy |

|

Vacations and vacation bonus Comprehensive health system |  |

Comprehensive health |

|

Cash loans |  |

Insurance |

|

Car loans |  |

Aid for sports |

|

Loans for mortgages plans |  |

Annuities and retirement |

![]() SRS 201-3

SRS 201-3 ![]() SRS 401-2

SRS 401-2

The benefits we offer are mostly superior to those stipulated by law.

Grupo Financiero Banorte seeks to improve our employees’ quality of life through tools that promote a healthy balance between work and personal life.

In 2016 we launched the first pilot for working with flexible hours comprised of two modes:

Because Banorte has the technological tools required to work remotely (Jabber, VPN, Lync and lap tops), our employees have managed to achieve objectives while working away from the office.

In 2017, the pilot became a program. Employee participation with respect to the 2016 pilot grew 62%, from 117 to 190 participants. This represents a 31% of the total number of employees in the area of technology management.

The program gave us positive results associated with improvement to quality of life, motivation, recognition and flexibility; other aspects that had a positive impact related to the performance were:

In 2018 we seek to expand this program, incorporating new forms of flexibility, as well as a broader dissemination of this initiative and extend participation to other areas of the bank.

“ Grupo Financiero Banorte seeks to improve our employees’ quality of life through tools that promote a balance between work and personal life.”

![]() SRS 403-1

SRS 403-1

In 2017 we implemented an inspection protocol in accordance with the occupational health and safety regulation of Department of Labor and Social Welfare (STPS) in 300 Banorte branches in Monterrey, Guadalajara and Mexico City.

To ensure better medical care for our employees and their beneficiaries, we continue with tenders for the selection of hospitals in the country’s main cities, looking for high standards in quality and service. We established some agreements with national institutes, to improve response to highly complex and costly cases, and finalize agreements with the leading pharmaceutical chains and laboratories in the country.

We have our own Call Center with a greater resolution capacity and accompany the user with information about our services, especially in the use of the medical expenses policy.

In 2017, we started our own primary care clinic in the city of Monterrey, as a model to improve the quality of health care.

We restructured our medical network with three main axes: joining the network with the best doctors in each area; evaluating to qualify and encourage better performance; and approaching specialists to increase institutional identity.

We also implemented a psychological support program for victims of the September 19th earthquake, who suffered personal losses or their homes, which includes a 24-hour hotline and personalized session for those who need it.

In our corporate buildings, we conducted a screening of employees and initiated the Kiloton program, aimed at promoting a culture of weight control, as well as addressing risk factors facing personnel and their family members. The program has the support of a multidisciplinary team of bariatric doctors, nutritionists, health promoters, physical education professionals and psychologists. We can report the active participation of 2,855 employees who have managed to lose 2,343 kilos of body weight by the end of 2017.

We are proud to be the recipient of two awards from the Workplace Wellness Council Mexico: Leadership in Health and Wellness Programs and Responsibly Healthy Organization, in the consolidation phase.

We designed a new health service management platform, which provides multiple health services to beneficiaries through a network of over 5,000 nation wide medical services providers in a securely traceable manner and in real-time. We additionally started a biometric authentication program for doctors and patients to ensure the proper use of services and resources.

Among the most tangible results of this process, is the ease with which the service can be aligned to hospitalized patients by standardizing entering-staying-leaving processes for all our employees in any city, improving monitoring actions and streamlining care times.

We have also implemented a program for personalized attention to patients with a special pathology (catastrophic cases), which has improved the quality of care and treatment, and optimized response times.

Administratively, we have improved the quality of management information for decision making, with the participation of the company Administrative Engineering, as well as the time of payment to our suppliers of health for a term of not more than 20 working days, optimizing the times of billing by the service provider, as well as the tasks of medical review and payments.

![]() SRS 102-41

SRS 102-41

By virtue that the Federal Labor Law which includes the right for all workers in the country to join a union to protect their labor rights, Banco Mercantil del Norte, S.A. Institución de Banca Múltiple, Grupo Financiero Banorte, signed a Collective Labor Agreement with the National Union of Workers of Banorte in 1992.

This union has had structural autonomy since its inception and has a National Executive Committee, whose members are elected by the Bank’s union personnel.

Since 1992, annual reviews were conducted during the annual congress and ratified in the presence of the national union representatives, to be subsequently submitted to the Federal Council for Conciliation and Arbitration, without a summons to strike for any reason.

A total of 5,991 banking sector employees are members of the union, which represents 30.9% of the total employees in this sector.

![]() SRS 401-1

SRS 401-1

In 2017, the voluntary and involuntary turnover of personnel was 22.5%. We are one of the financial groups with the lowest rate of involuntary turnover in the sector, with 6.4%.

| AVERAGE PERSONNEL ROTATION BY AGE RANGE AND GENDER | |||||

|---|---|---|---|---|---|

| Gender | Age range | 2015 % | 2016 % | 2017 % | Var. % 2017 vs 2016 |

| Female | < 30 years | 11.9 | 10.7 | 13.5 | 2.8 |

| 30 - 50 years | 8.3 | 6.5 | 6.4 | -0.1 | |

| > 50 years | 1.4 | 0.4 | 0.7 | 0.3 | |

| Total female | 21.6 | 17.7 | 20.5 | 2.8 | |

| Male | < 30 years | 14.3 | 13.1 | 15.8 | 2.7 |

| 30 - 50 years | 9.9 | 7.2 | 7.0 | -0.2 | |

| > 50 years | 2.1 | 0.9 | 1.7 | 0.8 | |

| Total male | 26.3 | 21.2 | 24.5 | 3.3 | |

| Total | 24.0 | 19.5 | 22.5 | 3.0 | |

We are working redesigning the administration of wages and the incorporation of flexible benefits. We seek to create a new framework of wage administration that will facilitate decisions regarding the definition of the level of each position, as well as the management of Human Capital based on talent, merit and wage competitiveness.

Regarding flexible benefits, we will seek to improve the perception of the value of the remuneration package, identifying the real possibilities of improvement of employees’ liquidity without increasing compensation costs. This will contribute to improving our capacity to attract and retain talent, maximizing the money invested in current benefits.