102-10, 102-14, 102-15

Humanity faced a severe and unexpected public health crisis in 2020, the effects of which extended to many spheres far beyond health, including the economy and society. Governments were faced with a difficult dilemma and decided on controlling the curve of contagion through social distancing policies and partial lockdowns of activity, at the cost of economic performance. With this, in the second quarter of the year, the world saw its worst recession since the Great Depression of 1929, due to a two-edged shock: on the supply side, due to supply chains and global values disrupted, along with company closures; and on the demand side, due to a sharp drop in the income of both companies and families.

This complex situation required an unprecedented economic policy response around the world. Central banks cut interest rates in unison and carried out liquidity injection and credit programs. Governments undertook their most ambitious fiscal stimulus programs ever, close to 15% of global GDP according to the International Monetary Fund.

Hand-in-hand with families, authorities and businesses, we at Banorte joined in responding to the call, introducing measures that ranged from the deferral of payments on credit cards, car loans, payroll loans, small-business and personal credits for clients affected directly or indirectly by the effects of the pandemic, to extending through 2021 the comprehensive reconstruction program we began to help people recover from the 2017 earthquakes, called Banorte Adopta una Comunidad. Additionally, and always keeping the health of our clients and employees foremost, we introduced innovative systems for serving our users, like the ability to make appointments with branch executives using technological platforms.

Throughout the second half of the year, the world began to see a recovery spurred by the introduction of reopening programs and sanitary protection measures, the effects of economic policy measures and more promising prospects for the development of vaccines by various pharmaceutical companies. This situation was also reflected in the performance of international financial markets, which took something of a breather after the strong risk aversion and disruptions seen in the months between March and May.

In this highly complex climate, Mexico experienced a contraction of close to 8.5% in its GDP during the year, its worst since 1932, with a downturn in virtually every industry, although the most heavily affected were those associated with investment, consumption (particularly durable goods) and services (particularly entertainment and leisure, which depend more heavily on social interaction).

External demand was hardest hit at the outset of the pandemic, but recovered toward the end of the year, supported by fiscal and monetary stimulus programs in the United States and a reactivation of that country’s economy.

“

We have worked hard to strengthen our digital tools and thus to be closer to our clients. We will continue to move forward, to always honor our slogan: Mexico’s Strong Bank.”

In Mexico, the economic policy response came mainly from Banxico, which cut its benchmark rate by 300 basis points during the year, from 7.25% to 4.25%, and announced a series of measures or facilities to strengthen the financial position of companies and families. In general, the severe emergency of 2020 had markedly adverse effects on the economy, and its aftermath may last for some time, prompting structural changes that will require further adaptation and flexibility on the part of families, companies and governments.

At Grupo Financiero Banorte, we know that one of our competitive strengths is our thorough knowledge of clients’ needs. Because of this, in March we were the first bank in Mexico to start up a support program for consumer credit and small business loan customers. These support programs originally offered four-month grace periods, on average, and then further extensions of one or two months in particular cases. Approximately 630,000 clients signed up for the programs, the basic objective of which was to always be there for our clients, and to support them during the emergency.

Despite the difficulties of the situation, banking operations were unaffected, and more than 90% of our branches across the nation remained open to address the needs of clients, while maintaining firm safety procedures at all times. More than 80% of our administrative personnel continued their work from home, which revealed the remarkable strength and solidity of our security processes and systems, which for years have been a priority for this institution. Meanwhile, we also remained in close communication with our investors, with an uninterrupted program of virtual meetings.

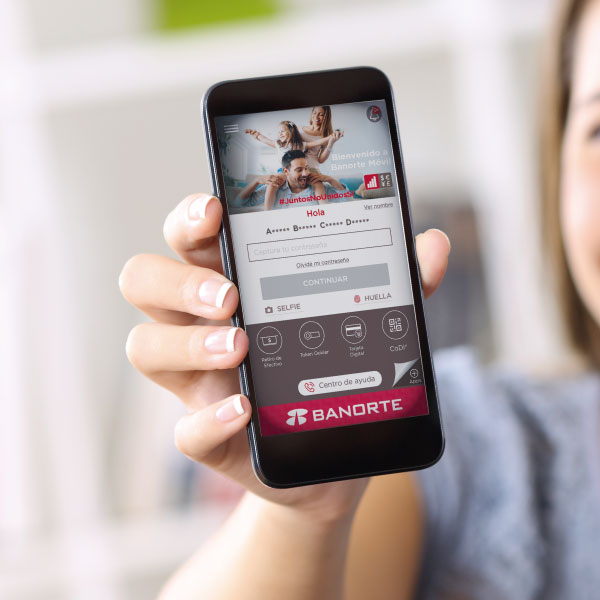

One of the most important of the trends seen last year, which has been a plus for our strategy, has been the growing adoption of digital channels in line with changing habits and client preferences, who have chosen to migrate much of their purchasing to online shopping, instead of going to traditional bricks-and-mortar stores. As result, today less than 4% of total transactions are carried out at our branches.

In the last 18 months, we have introduced ambitious efforts to strengthen our mobile channel, adding digital products and services and making the app easier to navigate, improving the client experience. Today our digital offering includes the opening of digital checking accounts, credit cards, payroll loans and mutual funds, all without having to visit a branch. We will continue to strengthen these services, listening closely to our clients through a steady stream of Net Promoter Score (NPS) surveys in all channels, and taking immediate action based on this feedback. To do this we will rely on our “Banorte Cells” system, an innovative system for working with multidisciplinary teams, which substantially accelerates execution.

Five years after establishing our 20/20 strategic plan, we are pleased to present the results one year early, thanks to the effort and commitment of all of us who make up the Banorte family.

Of course, the heavy impact of the global pandemic was bound to affect the results of the year. Although we did not meet all the goals established for the close of 2020, all of our indicators were better than we projected in 2019, thanks to the firm commitment of all of our stakeholders.

Looking ahead to the future, our strategic priorities will continue to be digitally transforming the bank, innovating, strengthening and adding functions to our web and mobile channels, and bolstering our offering of products and services through our new strategic partnership with Rappi. All of this in order to meet the needs of every one of our clients.

| Achievements | ||||

| 2014 | Commitment 2020 | 2019 | 2020 | |

| Net income* | 15,228 | 30,456 | 36,528 | 30,508 |

| EPS | 5.49 | 10.98 | 12.66 | 10.58 |

| ROA | 1.5% | 2.2% | 2.3% | 1.8% |

| ROE | 13.2% | 20.0% | 20.1% | 14.8% |

| NIM | 4.7% | ~ 6% | 5.6% | 5.3% |

| Efficiency index | 48.5% | 37% - 39% | 39.1% | 41.4% |

| Cross sale index | 1.79 | 2.2 | 2.02 | 2.04 |

*Millions of pesos

“

Our strategic priorities will continue to be digitally transforming the bank, innovating, strengthening and adding functions to our web and mobile channels.”

With regard to the loan portfolio, we intend to grow prudently, taking advantage of our analytical capacities to learn more about each client and offer them products efficiently.

We will continue to focus on maintaining cost discipline and improving our efficiency and profitability metrics. And last but by no means least, we will continue to strengthen our capital base, aligned with the vision of being the Strong Bank for Mexicans, and the best financial service company in Mexico.

With an eye to making sustainability an integral part of our operations, we have participated in a series of key national and international initiatives since 2009, which have kept us at the forefront in areas that are priorities for our industry, and have made us agents of change in environmental, social and corporate governance matters. In this regard, we will always support initiatives whose ultimate goal is sustainable development.

Firmly committed to the Sustainable Development Goals (SDG) and the Paris Agreement, in 2018, after two years of work drafting the Principles for Responsible Banking, we signed our adherence as founding members. Throughout this report, you will find an account of the actions we have taken to strengthen our commitment to a more sustainable economy.

I would like to express my deepest gratitude to our clients and investors for the confidence placed in us during this atypical, challenging year; to our Board of Directors, local and regional board members, and to each and every employee, who once again proved their dedication and commitment to coming out ahead despite difficult circumstances.

Thanks for being part of the Great Banorte Family!

Marcos Ramírez Miguel

Chief Executive Officer of Grupo Financiero Banorte