Ps. 811 bn total portfolio

+Ps. 11 bn in sustainable

project finance

+Ps. 91 bn in

sustainable investments

Banorte ICAP

20.18%

Banorte is known for its solid capital adequacy index which exceeds the regulatory minimum, and low leverage ratios that reflect the solidity of its balance sheet.

Ps. 811 bn total portfolio

+Ps. 11 bn in sustainable project finance

+Ps. 91 bn in sustainable investments

Banorte ICAP 20.18%

Banorte is known for its solid capital adequacy index which exceeds the regulatory minimum, and low leverage ratios that reflect the solidity of its balance sheet.

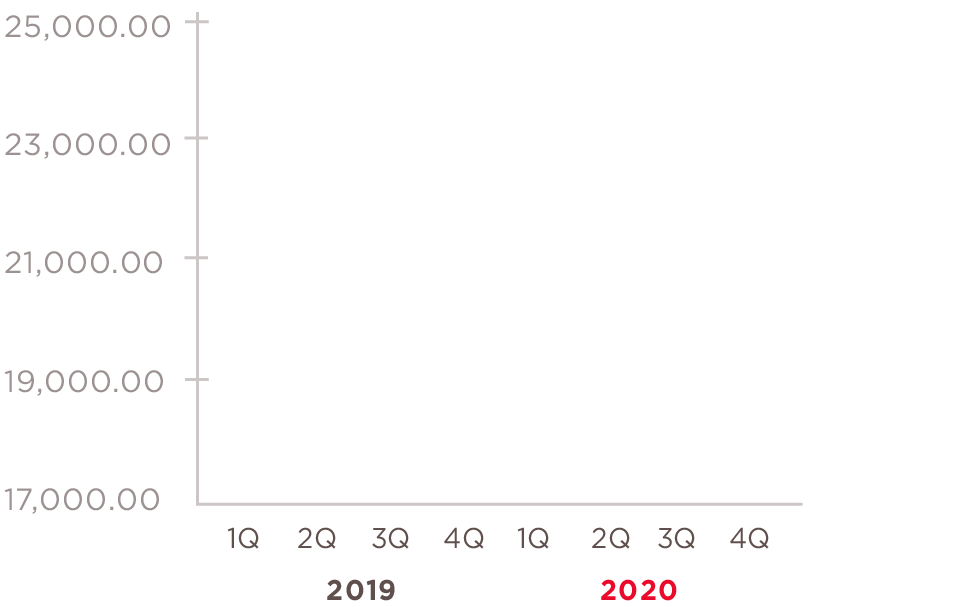

In 2015, we defined our 20/20 Vision, which was to become the best financial Group for our clients, investors and employees, based on an ambitious set of goals that would guide our growth. Although our results for the year 2020 reflected the impact of the pandemic, the dedication and coordinated work of our team enabled us to reach these goals in various areas, one year ahead of the promised date.

| Commitment 2020 | 2019 | 2020 | |

|---|---|---|---|

| Net income* | 30,456 | 36,528 | 30,508 |

| EPS | 10.98 | 12.66 | 10.58 |

| ROA | 2.2% | 2.3% | 1.8% |

| ROE | 20.0% | 20.1% | 14.8% |

| NIM | ~ 6% | 5.6% | 5.3% |

| Efficiency | 37% - 39% | 39.1% | 41.4% |

| Crossed sale | 2.2 | 2.02 | 2.04 |

*Figures in millions of pesos

201-1, FN-IB-410a.2

Banorte was named Bank of the Year 2020 in Mexico by The Banker, in recognition of its profitability and results, which we owe to our firm foundations in digitalization and service personalization.

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Balance Sheet | |||

| Assets under management | 2,607,083 | 2,771,604 | 2,975,753 |

| Total portfolio | 790,455 | 775,448 | 811,069 |

| Total assets | 1,620,470 | 1,580,010 | 1,787,904 |

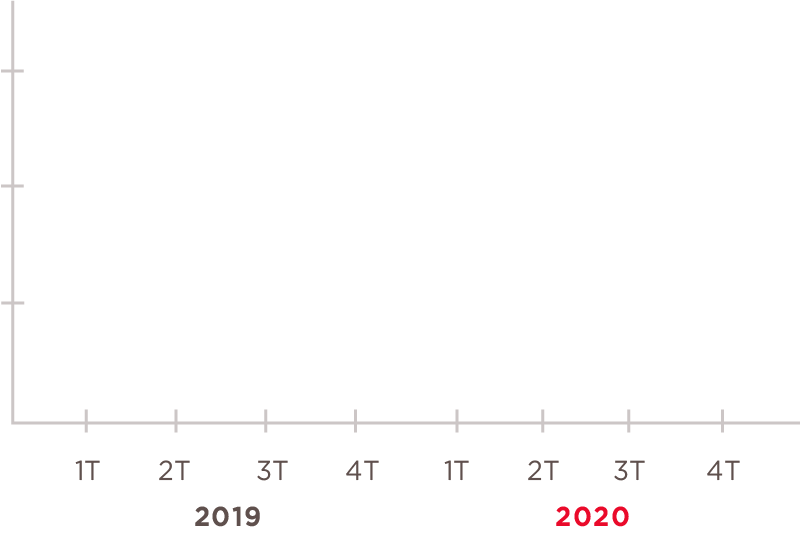

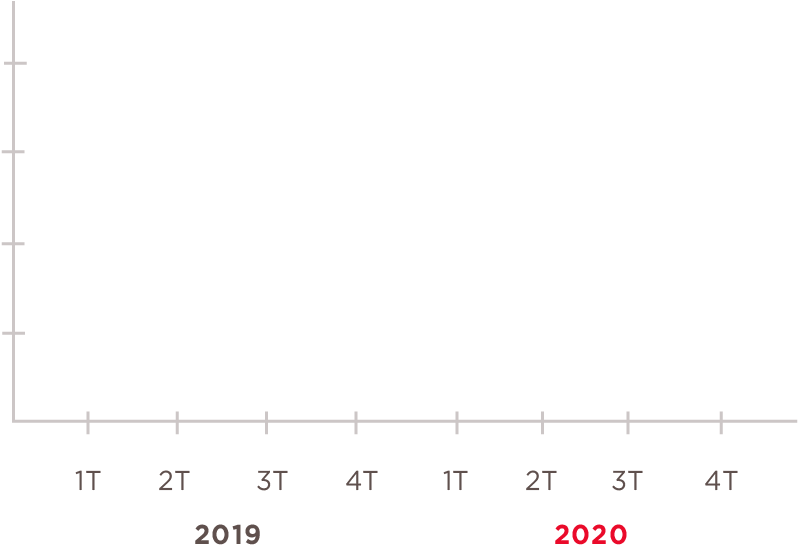

| Total deposits | 756,301 | 724,490 | 821,712 |

| Shareholders’ equity | 174,464 | 195,998 | 225,104 |

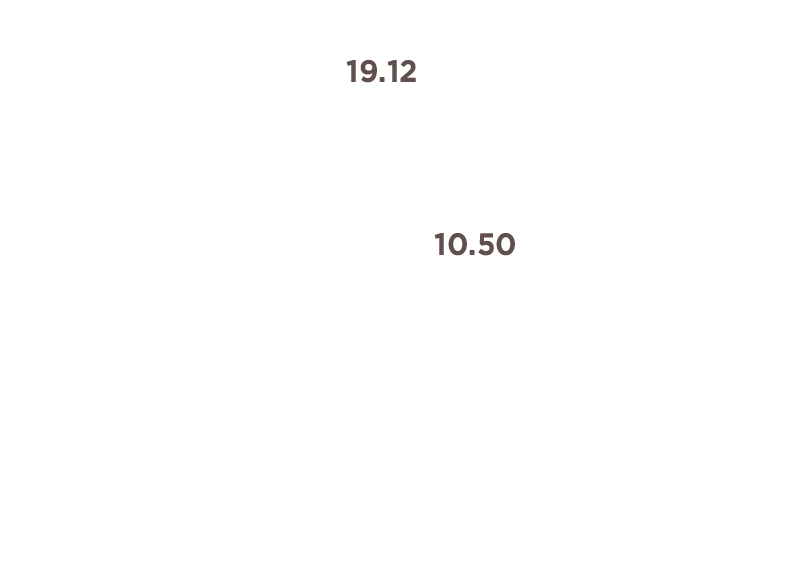

| Capitalization Ratio (%) | 17.17% | 18.54% | 20.18% |

| Banorte brand value (USD million) | 1,418 | 1,745 | 1,758 |

| Asset Quality | |||

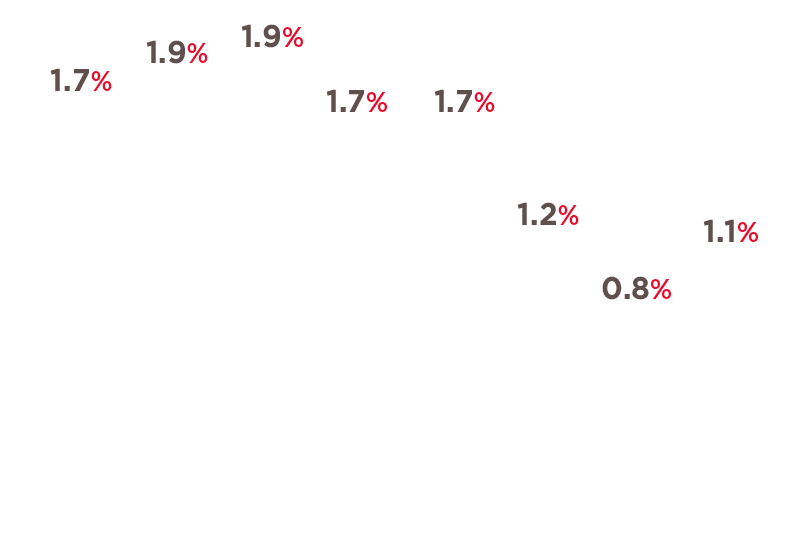

| NPL ratio (%) | 1.68% | 1.65% | 1.10% |

| Coverage ratio (%) | 142.08% | 137.74% | 223.98% |

| Cost of Risk (%) | 2.31% | 1.98% | 2.75% |

| Net Income | 31,958 | 36,528 | 30,508 |

| Profitability | |||

| Return on equity (ROE) (%) | 20.28% | 20.06% | 14.78% |

| Return on assets (ROA) (%) | 2.18% | 2.30% | 1.76% |

| Net interest margin (%) | 5.63% | 5.62% | 5.30% |

| Efficiency ratio(%) | 39.03% | 39.06% | 41.40% |

Figures in millions of pesos

Net interest income excluding the annuities and insurance businesses grew 2%, largely due to funding cost efficiencies that reduced our interest expense by (31%) and increased our portfolio interest income by 1%. Our total portfolio grew by 5% in the year.

Our NIM excluding insurance and annuities shrank by (28pb) to 5.3% at the close of 2020, mainly due to the adjustment in the price of floating-rate products which was in turn caused by a steep drop (259pb) in the average benchmark interest rates (the 28-day TIIE) during the year.

NII for the insurance and annuities businesses rose 8% due to a 22% increase in interest income, despite the impact on technical results, which reflects a growth of Ps. 4.31 billion in revenues from premiums, which was not offset by the growth in technical reserves (primarily annuities) or the 17% increase in claims.

All in all, net interest income for GFNorte grew by a substantial 3% in the year, and because of the climate of lower rates, NIM fell by only (32pb) in the year, to 5.3%, while the benchmark rate established by Banco de México declined (300pb) to close 2020 at 4.25%.

In a year complicated by the COVID-19 pandemic, which caused a sharp contraction in economic activity and a substantial rise in unemployment, Banorte acted in advance to stave off an erosion of its portfolio, booking additional reserves in the second and fourth quarters of the year which totaled Ps. 7.27 billion, Ps. 5.0 billion of which were additional reserves and Ps. 2.27 billion were advance write-downs for various products in the portfolio. Compared to 2019, total reserves rose by Ps. 6.58 billion, or 43%.

Compared to 2019, non-interest income shrank by (11%) due mainly to the entry of a non-recurring gross income of Ps. 1.66 billion because of conversion effects at Banorte USA in the first quarter of 2019; eliminating the extraordinary gains, the contraction would have been just (4%). Additionally, non-interest income was affected by the reduction in net fees linked to the effects of the pandemic and lower trading revenues attributable to a smaller position in securities and derivatives.

Non-interest expense was up 6% year-to-year, partly because of the impact of severance pay on personnel expense, relating to the restructuring of operations to cope with the pandemic, as well as higher honoraria and rental expense. Excluding restructuring expenses, the growth in non-interest expense would have been 4.6% year-to-year.

Figures in millions of pesos

At the bottom line, Banorte reports a (16%) contraction compared to 2019 due to the entry of additional reserves applied in the year. Based on recurring figures (excluding the extraordinary gain from Banorte USA in the first quarter of 2019 and the additional reserves booked in 2020), accrued net income in 2020 would have grown 1%, despite the steep economic downturn and reduction of benchmark interest rates.

ROE was 14.8% in 2020, reflecting the advance provisioning as well as the concentration of capital resulting from a temporary suspension of dividend payments, in keeping with recommendations by the authorities. Based on recurring figures, ROE would have been 17.1% for the year. ROA was 1.8% (2.1% on a recurring basis).

“

Banorte was recognized as Bank of the Year 2020 by The Banker, for its profitability and results.”

Amid rising uncertainty, a preference for liquidity and the need to support consumers and small businesses, our performing loan portfolio grew by 5% during the year. Excluding loans to governments, the portfolio grew 9% annually, with an advance in practically every segment except for credit cards, as could be expected given the circumstances of the year. This growth drove a 108bp growth in our market share.

| Performing Loan Portfolio | 2019 | 2020 | Change |

|---|---|---|---|

| Mortgage | 170,086 | 187,736 | 10% |

| Car Loans | 26,669 | 28,165 | 6% |

| Credit Cards | 39,700 | 36,651 | (8%) |

| Payroll Loans | 51,311 | 51,668 | 1% |

| Consumer | 287,766 | 304,220 | 6% |

| Commercial | 172,729 | 192,927 | 12% |

| Corporate | 128,159 | 143,429 | 12% |

| Government | 173,988 | 161,563 | (7%) |

| Total | 762,642 | 802,138 | 5% |

| Total Performing Loans ex Govt. | 588,654 | 640,576 | 9% |

Figures in millions of pesos

In 2020, the balance of past-due loans shrank by Ps. 3.87 billion due to the combined effect of advance write-offs totaling Ps. 3.35 billion applied during the year, and because the total effect of the pandemic (from our borrower support programs) was not as severe as we expected. Non-Performing Loans (NPLs) improved by 55pb over 2019 due to this effect.

Compared to 2019, deposits grew 13%; time deposits fell by 5% while demand deposits rose 22% because of efforts focused on increasing client balances and the resulting reduction in the higher-cost funding. This was consistent with our strategy to increase our margins.

Figures in millions of pesos

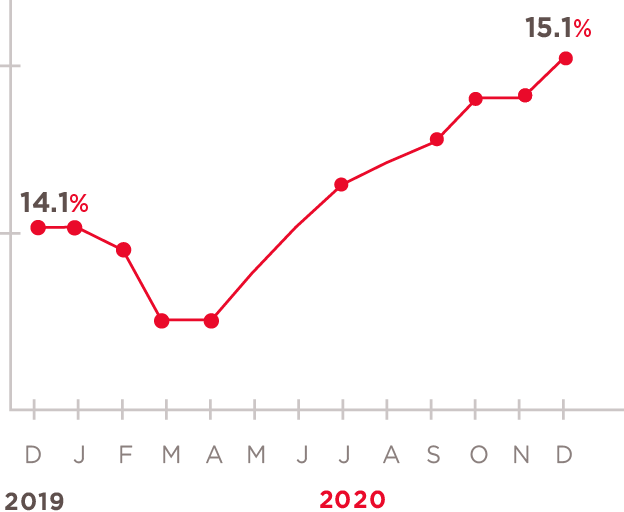

The performing loan portfolio grew 5.2%, against a reduction of (2.3%) in the overall Mexican banking system, which increased our market share by 108 bp, to 15.1 percent.

At the close of the year, the balance of loan-loss reserves stood significantly higher than the previous year because of the entry of extraordinary additional reserves totaling Ps. 4.87 billion in the second quarter of the year, and Ps. 2.41 billion in the fourth quarter, in anticipation of a likely deterioration of portfolio because of the pandemic. Without the pre-emptive write-downs of the second and fourth quarters, the balance of reserves would have been close to Ps. 25 billion.

Our reserves coverage index was 224% at year end, well above the previous year’s, combining the effects of higher provisions and advanced write-downs.

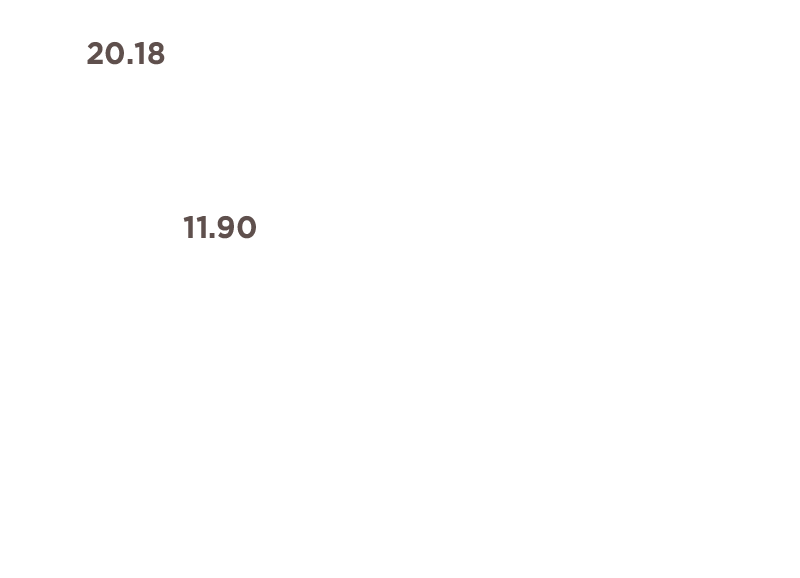

Banorte has done outstandingly well at keeping a solid capital adequacy ratio (CAR), well above regulatory minimums, with low leverage ratios that reflect the solidity of its balance sheet.

We have applied the capital adequacy requirements established most recently by the Mexican authorities and by international Basel III standards, in effect since January 2013.

“

More than 630k credit accounts signed up for support programs.”

At the close of 2020, our capital adequacy ratio (CAR) was estimated at 20.18%, incorporating credit, market and trading risk, and 26.69% considering only credit risk. The tier 1 capital ratio was 13.90%, basic capital was 19.23% and complementary capital was an additional 0.95 percent.

Excluding the special accounting criteria authorized by the CNBV for the deferral of some credit accounts due to the COVID-19 public health emergency, the overall capital adequacy ratio would have been 20.10%, with a basic capital ratio of 13.85 percent.

We strengthened our capital, despite the difficulties brought by this extraordinary year, through the following measures:

207-1, 207-2, 207-3

Committed to transparency in all of its tax obligations, GFNorte’s fiscal strategy is embedded in our system of corporate governance, which establishes the policies, principles and values that guide us in this regard. This system extends to all of the institution’s personnel, which means compliance is of the utmost importance to us.

To verify compliance with the Group’s tax obligations, we have various tax risk control procedures, and our head tax counsel is in regular contact with government agencies to keep them informed on a timely basis of GFNorte’s primary tax issues and measures adopted to manage tax risk.

Our current tax strategy involves:

According to the Mexican income tax law, our income tax rate for 2020 and 2019 and subsequent years is 30%.

The reconciliation of the legal income tax rate and the effective rate expressed a percentage of profit before income tax is as follows:

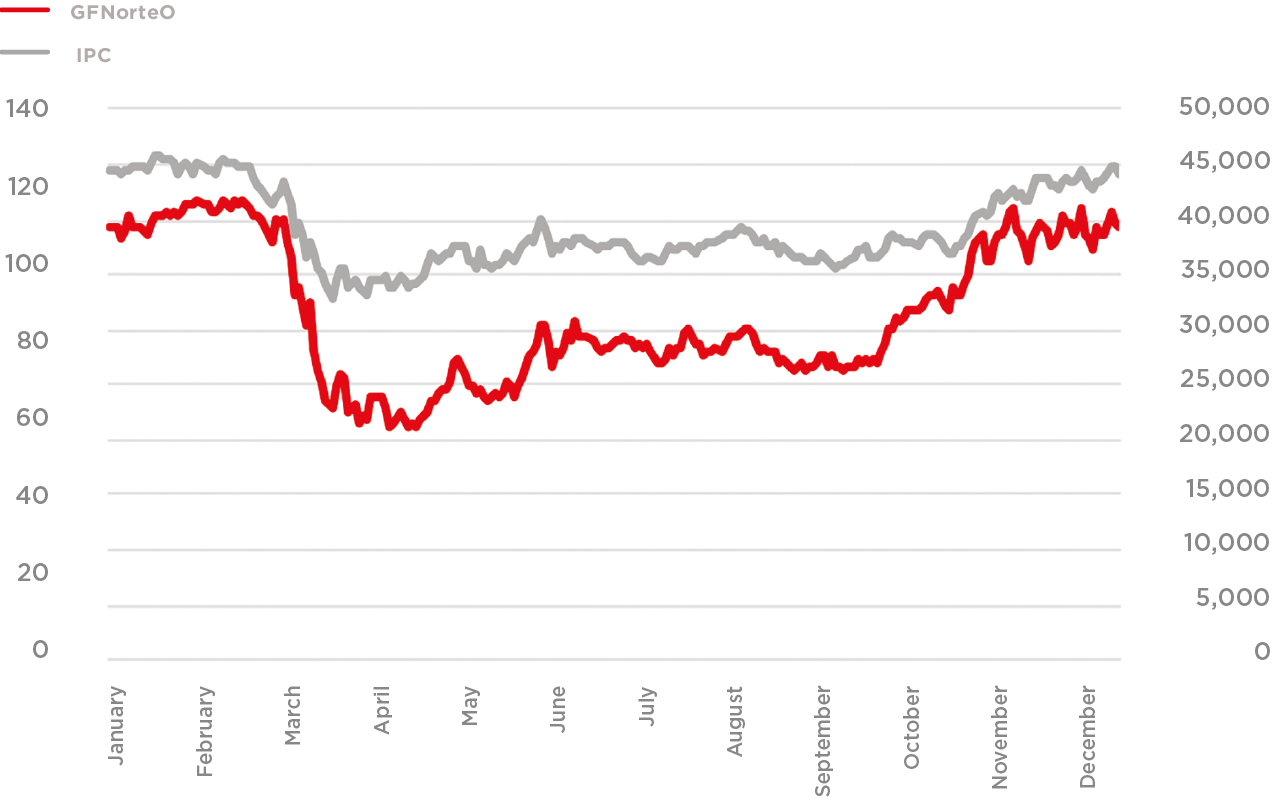

As one of Mexico’s most widely recognized publicly-traded companies, we are committed to applying the highest standards of corporate governance, information disclosure and communication with the investment community and our stakeholders. Grupo Financiero Banorte has a globally diversified shareholder base made up of individual and institutional investors. Throughout the Group’s process of institutionalization, we have developed various strategies to expand our shareholder base and remain an option for those seeking long- or short-term investment, or simply following our dividend policy.

Regarding shareholder compensation, no dividends were paid in 2020, in response to the recommendation by the authorities given the uncertain climate created by the pandemic.

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Shares outstanding at close of year (millions) | 2,883.46 | 2,883.46 | 2,883.46 |

| Average trading volume (shares) | 7,477,514 | 6,909,501 | 8,392,292 |

| Average value traded 1 | 855.82 | 732.72 | 728.00 |

| Highest quote 2 | 136.38 | 123.69 | 117.12 |

| Lowest quote 2 | 83.63 | 90.83 | 59.07 |

| Stock price 2 | 95.78 | 105.65 | 109.93 |

| Book value per share 2 | 59.75 | 67.18 | 77.07 |

| Diluted earnings per share 2 | 11.09 | 12.69 | 10.70 |

| Market cap 1 | 276,177.00 | 302,763.00 | 316,978.38 |

| Dividends per share 2 | 3.45 | 5.54 | * |

| Dividends paid 1 | 9,563.00 | 15,979.00 | * |

| Dividend yield | 3.60% | 5.25% | * |

Continuing our Level 1 American Depositary Receipts (ADR) program (GBOOY), where each ADR represents five shares, we closed the year with 8,683,164 ADRs outstanding; an 82% increase over 2019.

We are a financial Group that listens to and is concerned about its shareholders. In 2020, the Department of Investor Relations, Sustainability and Financial Intelligence was active in a number of forums, serving more than 700 investors through a little over 200 virtual meetings, conferences and calls.

* Includes only institutional investors

102-15, 102-30

At GFNorte, risk management culture is one of the institutional pillars, and fundamental in how we define and execute our strategies. The Group’s decisions are made to maximize the risk/return balance based on informed decision-making.

Therefore, this culture is key to achieving strategic objectives in terms of profitability, asset quality, liquidity and solvency.

In 2020, we overcame challenges arising from the COVID-19 pandemic and its impact in our clients as well as our employees and investors.

Among all of us we worked to mitigate these emerging risks in order to deliver the performance our shareholders expect of us.

Risk management requires a comprehensive approach and a forward-looking vision based on the desired risk profile, as well as compliance with the regulatory framework and support for corporate governance.

“

Our Risk Management Culture is fundamental for achieving our strategic goals of asset quality, profitability, liquidity and solvency.”

![]() Corporate governance

Corporate governance

In our model, the Board of Directors is the highest risk management body, responsible for determining the limits on risk appetite. To fulfill these duties, the Risk Policies Committee authorizes risk management models, policies and limits, and the Comprehensive Risk Management Unit is in charge of managing and monitoring them.

![]() Internal and regulatory compliance

Internal and regulatory compliance

We have clear and up-to-date procedures and policies to ensure regulatory and legal compliance with the highest standards. We place a priority on prompt disclosure of information to investors, analysts and rating agencies.

![]() Forward-looking vision

Forward-looking vision

We apply a prospective vision to define and apply models, tools and policies that help us anticipate and mitigate risk. We also work to grow our assets according to the established risk profile

![]() Desired risk profile

Desired risk profile

Our desired risk profile framework is aligned with strategy for the Group and for each business area. We also ensure actions are taking to stay conform to and strengthen the established risk profile.

The following are some of the main types of risk that the Group manages:

Quantifiable risks

Risk of losses due to income volatility, caused by the creation of reserves for asset impairment and potential losses for payment default by a borrower or counterparty.

To mitigate it, we define policies, strategies and procedures for healthy origination. We continually track portfolio performance and work closely with the Business and Recovery teams.

Associated with revenue volatility caused by changing market conditions, which affect the valuation of positions in lending or borrowing transactions or give rise to contingent liabilities, like interest rates, spreads, exchange rates, price indexes, etc.

We manage these risks through models and methodologies like potential loss, retrospective analysis, sensitivity analysis and stress tests.

Liquidity Risk: Risk of losses from being unable to roll over liabilities or acquire new ones under normal conditions, because of the advance or forced sale of assets at unusual discounts to cover obligations. Managed through key indicators like the liquidity coverage coefficient, repricing gaps and liquidity ratios, as well as stress testing.

Balance-sheet risk: Risk resulting from impacts on net interest income, which is defined as the difference between interest income and financial costs. Changes in interest rates may have a positive or a negative impact under scenarios of rising or falling rates. Managed through a model of repricing gaps and NIM margin sensitivity.

Risk of losses originating from discrepancies or failures in processes, personnel, internal systems or external events. Includes technological risk and legal risk. Managed through a system that records events classified into various types of associated risks. Also monitored across the entire organization, watching for compliance with defined acceptable levels of tolerance.

In 2020, we adopted a particularly cautious approach to risk management in order to maintain a high quality, solid portfolio, while cooperating in key strategies to help deal with the economic and financial effects of COVID-19.

Our ability to manage risk is also strengthened by an institution-wide culture in which every employee is involved.

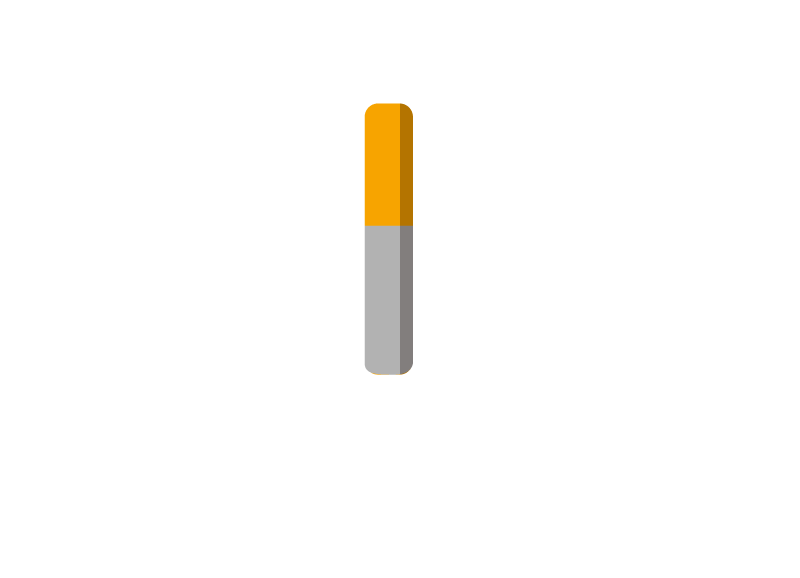

Our balance sheet was buttressed last year by the addition of preemptive reserves, which included Ps. 4.3 billion for potential impairment loss, raising our coverage index to 224% and the cost of risk to 2.75 percent.

2018

142.1%

2019

137.7%

2020

224.0%

2018

2.32%

2019

1.98%

2020

2.75%

Our loan delinquency index was reduced to 1.10% in 2020 due to various initiatives, among them the preemptive write-down of around Ps. 4.9 billion in accounts in the business, SME and consumer portfolios.

We also placed a priority on controlling non-performing loans by extending support programs, through prompt identification and close tracking and resolution of at-risk cases, all of which resulted in solid portfolio quality indicators.

Loan delinquency rate = 1.10%

With all these actions we were able to maintain the highest credit quality ratio among our closest competitors.

Coverage ratio = 192.5%

Our strategy for managing liquidity risk focused on keeping our indicators within appropriate ranges in consideration of the prevailing circumstances. We decided to preserve liquidity levels through a structure of funding with our clients.

Leverage (bank) = 12.15%

102-12, 102-13, 102-15, 102-29, 102-30, 102-31, 201-2, FS2, FS3, FS5, FS10, FS11, FN-CB-410a.2, FN-IB-410a.3

GFNorte is convinced that the most resilient companies are those that consider risk prevention and management as an essential part of their operations. We are also certain that including environmental, climate and social elements among the risks to be addressed is fundamental everywhere in the world to guarantee balanced, safe and prosperous economic development.

Our Social and Environmental Risk Management System (SEMS), first implemented in 2012, was developed to identify, categorize, analyze and track the risks and impacts of our lending in the corporate, infrastructure and commercial banking segments. SEMS is an integral part of the Bank’s lending process and it is based on the national legal framework, institutional rules, the socio-environmental risk policy and the Equator Principles, the highest standard for risk management in the financial industry.

“

The Special Area for Socio-Environmental Risk has been an active member of the Central Credit Committee and the National Credit Committee.”

During this analysis, we identify the potential risks and impacts of our financing, and apply our exclusion list. We classify risks into categories: A (for high risk), B (for medium risk), and C (for low risk), according to the magnitude of impact and possibilities for mitigation.

We then evaluate the projects’ compliance with the Equator Principles, the IFC Performance Standards and the domestic legal framework (SEMS Assessment). Finally, we regularly follow up on projects, providing advice and contributing value to our clients.

SEMS is handled by the Special Area for Socio-Environmental Risk (ARSA), which since January 2020 has been an active member of the Central Credit Committee and the National Credit Committee, with the approval of the Risk Policies Committee. SEMS is also supported by our “sustainability champions,” a group of staff members from the Credit area who serve as a liaison between ARSA and the bank’s regional offices, ensuring that appropriate socio-environmental risk management is applied nationwide.

Stakeholders with questions or comments are welcome to write to sems@banorte.com

GFNorte works to ensure that the projects we finance have the least environmental impact possible, are developed in a socially responsible manner and apply rigorous environmental practices. In 2020 we examined 3,383 loans—54.1% of the corporate portfolio and 61.1% of the commercial portfolio—for socio-environmental risk.

The categorization process revealed that more than half of our loans were classified as low-risk, meaning they represent no risk at all, or the risks can be mitigated.

We assessed 26 new projects, primarily in the manufacturing, construction and tourism industries, with a total value of Ps. 7.46 billion.

| Evaluation framework | Category A | Category B | Category C | Total |

|---|---|---|---|---|

| Equator Principles | 0 | 17 | 0 | 17 |

| Performance standards | 1 | 7 | 0 | 8 |

| SEMS Assessment | 0 | 1 | 0 | 1 |

| Total | 1 | 25 | 0 | 26 |

Additionally, we analyzed 404 lesser-impact projects that were managed through recommendations of the IFC Industry-Specific Environmental, Health and Safety Guidelines.

Following worldwide safety and health guidelines, we did not make any on-site visits in 2020, but we did conduct regular annual tracking of 34 projects that had already been assessed, using documentary review and reputational monitoring.

In 2019, Banorte took part in implementing the Natural Capital Protocol for the first time in Mexico, as part of the activities of the alliance for Biodiversity and Business (AMEBIN). With the support of the German Agency for International Cooperation (GIZ), Reforestamos México and PwC for applying the methodology, Banorte focused the study on quantifying climate risks in the tourism industry, with the collaboration of one of our best clients. The results were presented in 2020 to the Credit, Business and Risk team, which was the driving force behind the project, confirming the importance of environmental aspects in financial industry decision-making.

You can view the report at:  https://investors.banorte.com/~/media/Files/B/Banorte-IR/sustainability/Documents/Banorte_Protocolo%20de%20Capital%20Natural.pdf

https://investors.banorte.com/~/media/Files/B/Banorte-IR/sustainability/Documents/Banorte_Protocolo%20de%20Capital%20Natural.pdf

Banorte participated in the TCFD-UNEP FI 2021 program for banks, in which we involved various business areas (Risk, Insurance and Innovation) in the task of developing capacities to identify, manage and disclose climate-related risks and opportunities.

At GFNorte, we know that deforestation, invasion of habitats and climate change have altered the balance of nature. The COVID-19 pandemic and climate emergency warn us of the need for long-term vision, with strategies for responding to the systemic risk created by zoonotic diseases, climate crises and environmental degradation.

Because economic and social activities depend on healthy ecosystems, WWF Mexico and Banorte have formed a working partnership to enhance the bank’s capacities to understand, apply methodologies and address the financial risks related to the loss of nature, which are incorporated into its SEMS system.

In partnership with The Economics of Ecosystems and Biodiversity for Agriculture and Food (TEEB AgriFood) and UNEP, and with the support of the European Union, the Capitals Coalition, AMEBIN and GIZ, agribusinesses were offered a series of training sessions on protecting biodiversity and making the agrifood industry more sustainable. This training is part of a global strategy involving seven countries that are allies of the European Union—Mexico, Brazil, China, India, Indonesia, Malaysia and Thailand—to guide investment and inform decisions that can transform the global food system.

Banorte participated actively in training sessions for Mexico, and by applying the TEEB AgriFood Operational Guidelines for Businesses we carried out a capitals assessment of agricultural industry activities. This assessment of impacts on various capitals—natural, social, human and produced—allows Banorte to identify its role in promoting a sustainable agricultural industry in Mexico, for example boosting production of food without deforestation and laying the groundwork for a business project that will be continued in 2021 jointly with the Specialized Agriculture, Risk and Sustainability areas.

Among our engagement and cooperation efforts with Mexican regulatory agencies, GFNorte participated in the Climate and environmental risks and opportunities in the Mexican financial system report, published in 2020 by Bando de México and the United Nations Environmental Program Financial Initiative (UNEP FI).

The study involved a survey applied to development banks, commercial banks and asset managers to learn about their experiences in handling socio-environmental risks and their importance in their decision-making.

Currently more than half of global GDP depends on nature. But environmental depletion and biodiversity loss are increasingly threatening global economies and finance. Aware of the growing uncertainty and risk, an informal work group was created in 2020 called the Task Force on Nature-Related Financial Disclosures (TNFD), the largest nature-related risk disclosure initiative in history.

The TNFD is catalyzed through a partnership between Global Canopy, the United Nations Development Program (UNDP), the United Nations Environment Program Finance Initiative (UNEP FI), and the World Wide Fund for Nature (WWF), with the support of 74 organizations on five continents, 49 financial institutions and private businesses, 17 think tanks and eight governments from around the world.

The goal of TNFD is to create resilience in the global economy by reducing the flow of funding to activities negative for nature and persons, and increase funding to nature-positive activities, in keeping with the Paris Agreement, the Post 2020 Biodiversity Targets and the Sustainable Development Goals (SDG).

Banorte co-chairs this initiative, along with the French bank BNP Paribas and the Green Finance Institute of the UK, guiding framework development and promotion through its planned launch in 2021.

102-2, 102-15, FN-AC-410a.1, FN-AC-410a-2, FN-AC-410a-3

Our pension fund manager, Afore XXI Banorte, is the first and only asset owner to obtain an A+ rating in the PRI questionnaire for the second year in a row, in recognition of its investment strategy and corporate governance practices.

Afore XXI Banorte has a series of  internal policies that provide the guidelines for incorporating ESG factors associated with each asset class. In 2020, the Investment Committee added the following obligations in the area of responsible investment:

internal policies that provide the guidelines for incorporating ESG factors associated with each asset class. In 2020, the Investment Committee added the following obligations in the area of responsible investment:

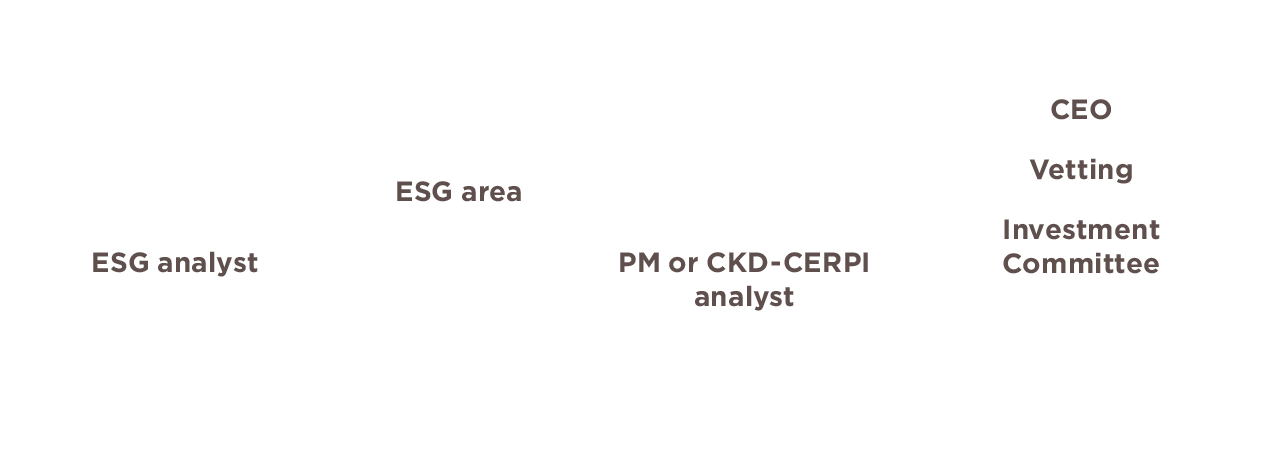

Afore XXI Banorte has a team responsible for incorporating ESG factors into investment analysis. The team consists of three analysts engaged in ESG assessment, four portfolio managers and six fundamental analysts. We also trained 37 employees in responsible investment and ESG aspects over a total of 140 hours.

To complement our internal strengths, we have an internationally-renowned ESG services provider.

During the ESG assessment process, the ESG team analyzes and assesses information disclosed by the company or the investment proposal using an internal methodology approved by governance bodies.

The internal methodology covers around 10 issues that include more than 40 indicators, broken down by their materiality in each sector. The information comes primarily from the ESG compliance questionnaire, which must be completed in order for the issuer or instrument to be eligible.

We also follow up on disputes involving issuers included in the portfolio.

This methodology yielded the following results in 2020:

By applying this methodology, we arrive at an ESG score that reflects the level of commitment by the issuer/investment project to incorporating ESG criteria.

In managing ESG in alternative instruments, we take the following into account:

“

Afore XXI Banorte is the first asset manager to obtain an A+ grade in the PRI questionnaire two years in a row.”

In keeping with our commitment to mitigating climate change, and aligned with the Nationally Determined Contributions (NDC), we defined the following medium- and long-term goals for managing GHG emissions: The first, for 2025, with at least 20% of the portfolio of alternative instruments in the real-estate sector; and the second, for 2030 with at least 50%.

|

|

M1 |

Esg Management ESG policies, programs or projects implemented |

|

|

M2 |

Sustainable Buildings

Buildings with environmental certifications |

|

|

M3 |

Carbon Footprint Incorporation of clean and/or renewable energy to reduce the carbon footprint |

|

|

M4 |

Climate Change Strategies

Strategies and processes to mitigate the risk relating to climate change |

|

|

M5 |

Reports and Targets ESG Reports, risk documentation and/or opportunities by the final decision-making body |

|

|

M6 |

Hedges Hedges against climate change damage or green investment that contribute to climate change adaptation |

|

|

M7 |

Risk Management Incorporating climate change and resulting events into risk analysis; identification of zones vulnerable to climate change |

|

|

M8 |

Engagement Engagement with tenants, training on eco-efficiency, water, and measuring energy and water consumption |

This commitment makes Afore XXI Banorte the first asset manager in Mexico to join the Climate Action 100+, a five-year initiative supported by more than 450 global investors which together manage USD 41 billion AUM, seeking to engage 160 of the world’s most systemically important greenhouse gas emitters to promote a low-carbon energy transition and meet the goals of the Paris Agreement.

The goal of engaging these companies is to improve climate governance, strengthen climate-related financial disclosures and set short-, medium- and long-term goals for emission reduction, in order to achieve the target of zero emissions by 2050.

As part of our proxy voting, Afore XXI Banorte participated in around 200 general and/or technical committee meetings in 2020, in which we voted on more than 300 resolutions.

In favor

284

Abstention

26

Against

23

ESG issues were involved in 36% of the resolutions: corporate governance 35%; and environmental resolutions 1%.

Toward the end of the year, the Mexican Association of Retirement Fund Managers (AMAFORE) created a Sub-Committee on Responsible Investment, which works to establish an industry-wide common front for interpreting and adopting ESG criteria. Afore XXI Banorte chairs this Sub-Committee, which underscores our support for standardization and disclosure of ESG information by harmonizing pension fund managers’ interests regarding information requirements for stakeholders.

| General meetings in which AXXIB voted | 78% |

| Technical committee meetings in which AXXIB voted | 99% |

| Number of events in which AXXIB was represented by a custodian | 56% |

| Number of total resolutions in general meetings | 258 |

| Number of total resolutions in technical committees | 93 |

Afore XXI Banorte (AXXIB)

In the interests of developing a formal strategy on responsible investment, our asset manager, Operadora de Fondos Banorte, became a signatory of the UNEP-FI Principles for Responsible Investment (PRI).

As required by this initiative, we have a Responsible Investment Policy for incorporating ESG criteria into our investment activities. The Policy includes an exclusion list that prohibits investment in certain sectors and activities.

We have also updated our methodology for evaluating locally listed equity assets, in order to analyze issuers’ ESG performance and transparency according to the most material indicators for their respective industries. This methodology is aligned with SASB and GRI standards as well as the CDP (previously Carbon Disclosure Project) climate change questionnaire. Additionally, we monitor ESG disputes involving these issuers and their impact on reputational risk.

During the year, we analyzed 94.4% of the equity portfolio under both methodologies based on public documents, information provided by an ESG services supplier, and CDP climate change questionnaires.

In terms of climate change, our methodology evaluates 29 indicators relating to corporate governance, climate risks and opportunities, greenhouse gas emissions (GHG) and reduction targets. With this information, we calculated 105,005.32 tCO2e corresponding to 94.4% of the locally listed equity assets, based on the GHG Protocol methodology for Scope 3 emissions (associated with investments).

Furthermore, in conjunction with the CDP initiative, we worked on an exercise to measure global temperature, which covers 43.5% of total equity assets. In line with the operational targets (scopes 1 and 2) and value chain (scope 3) of the issuers included, the result was a projected rise of global temperature between 2.3°C and 2.9°C by the year 2100, compared to preindustrial levels.

We made a first outreach to the issuers evaluated through a questionnaire to support our analysis, with a 43.2% response rate. As a complement, we led the CDP’s Non-Disclosure Campaign (NDC) in Mexico, which encourages companies to report their actions against climate change, deforestation and water stress through its questionnaires. The request went out to 24 issuers, 58.3% of which agreed to participate.

Within the range of products offered by Operadora de Fondos Banorte, our NTESEL fund is a relatively-managed mutual fund whose investment strategy is determined by a quantitative model involving ESG criteria, among others, as part of a positive screening process.

All of our external asset managers are PRI signatories, which guarantees comprehensive application of responsible investment strategies.

We are members of the PRI Advisory Committee for Latin America, which meets twice a year to support the development of events and workshops in the region in order to educate and offer tools for strengthening responsible investment practices, represent the PRI at local events, and learn about the strategy and work program. Our participation culminated in a set of recommendations issued during the committee’s meetings.

Among our efforts to promote and raise awareness about responsible investment (Principle 4), we participated in 45 forums that included webinars, workshops and training for various stakeholder groups. These events focused on issues such as sustainable finance, corporate social responsibility, human rights and gender perspective.

In late September 2020, the Green Finance Advisory Board (CCFV) issued a request to issuers regarding disclosure of ESG data, signed by 80 investors and firms that operate in the Mexican financial market which together account for Ps. 6.31 billion in assets under administration—equivalent to 25.5% of Mexico’s GDP. The request basically suggests that companies disclose ESG information in a consistent and standardized form, based on TCFD recommendations and SASB standards.

102-2, FS8, FN-IB-410a.1, FN-IN-410b.2, FN-IB-410a.3, FN-IN-450a.3

In 2020, our Sustainability and Credit Card departments worked together to create new sections in the Banorte Total Rewards catalog, where cardholders can choose to donate their reward points for causes that support communities and the environment.

Sustainable finance has become a core issue in the global financial industry, as a way to mobilize capital toward economic activities that positively impact society and the environment. GFNorte wants to be a part of this effort, so we regularly identify and quantify these impacts in our sustainable and climate portfolios.

At the close of the year, the value of our sustainable portfolio in corporate and commercial loans was estimated at Ps. 11.96 billion, which was invested in projects in the following areas:

Our climate portfolio, which includes only renewable energy financing, totals Ps. 8.16 billion.

* The sustainable and climate portfolios were obtained using portfolio values analyzed by SEMS.

We recognize the importance of clean energy as a primordial way to transition toward a low-carbon economy and thus to mitigate climate change. We have complete confidence in the potential of Mexico’s renewable resources, which is why, despite current uncertainty over energy industry legislation, we continue to support financing for wind, solar and other sources of clean energy generation. As of December 2020, our ten renewable energy projects totaled Ps. 8.89 billion in financing and accounted for 1.10% of Banorte’s total portfolio.

At Afore XXI Banorte, investment in clean energy projects totaled Ps. 9.45 billion in AUM. This includes investment in five solar energy projects, and thirteen wind farms, which together can generate up to 3,000 MW, accounting for 4.0% of Mexico’s energy capacity, 30% of its solar and wind capacity and 12% of its renewable energy (including hydroelectric projects).

Paralleling our efforts to identify and classify sustainable projects, the Sustainability and the Special Real-Estate departments drew up a diagnosis of construction industry’s opinions and interests regarding sustainable housing and building certification. This first exercise revealed some of the current challenges in the industry and identified a substantial portion of our portfolio that is interested in earning green certifications and learning about what is needed to do so. This presents a tremendous opportunity to continue exploring this issue and making decisions that benefit our clients.

In 2018, Banorte was one of the first banks to sign up with NAFIN’s Green SME programs to provide loans to SMEs looking to improve energy efficiency in their operations, or to use renewable energy through Energy Efficiency Eco-Loans and Interconnected Photovoltaic Solar Systems programs.

Energy Efficiency Eco-Loans finance the acquisition or replacement of equipment and installation expenses in support of more efficient new technologies, or which allow the user to produce the same amount with less energy.

Interconnected Photovoltaic Solar System loans fund the acquisition and installation of solar systems under the distributed clean industry scheme. This initiative has recently expanded its list of authorized suppliers and improved its offer by lowering the interest rate from 14.5% to 13%.

As of December 30, we had an active portfolio of Ps. 15.16 billion, reflecting our continuous effort to build sustainable finances in the SME segment.

Aware of new needs and expectations among investors around the world, early in 2020 we developed a green bonds framework, aligned with  Green Bond Principles and market best practices. This framework provides the general guidelines for issuing green bonds in the categories of renewable energy, energy efficiency, natural resources and biodiversity, sustainable mobility, and water management. The bond is backed by a favorable second-party opinion from Sustainalytics.

Green Bond Principles and market best practices. This framework provides the general guidelines for issuing green bonds in the categories of renewable energy, energy efficiency, natural resources and biodiversity, sustainable mobility, and water management. The bond is backed by a favorable second-party opinion from Sustainalytics.

“

The value of our sustainable portfolio in Business and Commercial banking closed the year at Ps. 11.96 billion.”

In 2020, Banorte acted as lead underwriter for the second reopening of the AGUA 17-2X sustainable issue totaling Ps. 1.6 billion, bringing the total issue amount to Ps. 4.0 billion. The bond received ratings of mxAA- and AA/mex from S&P Global Ratings and Fitch Ratings, respectively. The bond proceeds will be invested primarily in developing countries (80%) where the company provides services, and the remaining 20% in the United States and Canada. Water and wastewater treatment projects will take up 78.1% of the proceeds, and the other 13.7% will go to fresh water supply projects.

As active investors in financial instruments that ensure a positive impact on society and the environment, Banorte reiterates its support for sustainable development. Afore XXI Banorte and Operadora de Fondos traded the following amounts in ESG-focused assets in 2020:

Around 30% of the alternative instruments of Afore XXI Banorte cover projects that contribute to the SDG; we have investments in renewable energy farms, agroindustrial cropland, health and education centers and women’s empowerment programs, among others.

| SDG Category | Type of impact | % Invested |

|---|---|---|

| Agroindustry | Environmental | 4% |

| Wind farms | Environmental | 6% |

| Solar farms | Environmental | 6% |

| Schools | Social | 2% |

| Public and private hospitals | Social | 3% |

| Fresh water supply Social | Social | 1% |

| Road construction and repair | Economic | 7% |

| Microloans for women | Economic | 1% |

The services we offer through our subsidiary Seguros Banorte include catastrophic coverage for hydrometeorological events, associated in part with the effects of climate change. The events covered by this type of insurance are avalanches, hail, frost, hurricane, flooding, flash floods, storm surges, snow and high winds.

This coverage is considered additional to the fire insurance branch and is offered on all the products included in that branch (fire), for example homes, civil construction and assembly, electronic equipment and agriculture, among others. It applies to any area of business or to individuals, as well as the projects we finance in various industries, including tourism and real-estate.

We also have parametric coverage against damage to beaches, marinas and coral reefs in the state of Quintana Roo, which incorporates the coastline of Isla Mujeres, Benito Juárez, Puerto Morelos, Solidaridad, Tulum and Cozumel. The coverage has payment trigger parameters that depend on the direction and speed of the wind, scaled at 100, 130 and 160 knots, which determine the maximum liability limit. These parameters are modeled on the official records of the National Hurricane Center of the National Oceanic and Atmospheric Administration (NHC-NOAA).

“

Afore XXI has a team dedicated to incorporating ESG factors into investment analysis.”

When a disaster occurs and one of the previously-established parameters is triggered, the commitment is for payment in no more than 72 hours, regardless of whether or not there was any damage in the ensured zone. The resources are managed by a trust for comprehensive management of the coastal zone. At the same time, the technical subcommittee evaluates the impacts of the hurricane and allocates the resources placed in that trust to carry out the work and necessary activities to restore coastal ecosystems in the affected area.

Complementing this product was an additional advisory service to strengthen the institutional capacities of the government of Quintana Roo, consisting of three training sessions for state officials. This trainings, given by experts in the field, covered the basics of parametric insurance as well as the technical-operating elements needed to respond in the event of an incident.

In light of the negative impact on various economic activities caused by the epidemic, Banorte decided to support clients through a number of programs, which were open for registration between March 25 and July 31, 2020. The products covered by these support programs were credit cards, payroll loans, personal loans, car loans, mortgages and SME credits.

For more details, see:  https://investors.banorte.com/~/media/Files/B/Banorte-IR/financial-information/quarterly-results/en/2020/q4/4Q20.pdf

https://investors.banorte.com/~/media/Files/B/Banorte-IR/financial-information/quarterly-results/en/2020/q4/4Q20.pdf