Our virtual assistant Maya is the first in Mexico to conduct monetary transactions

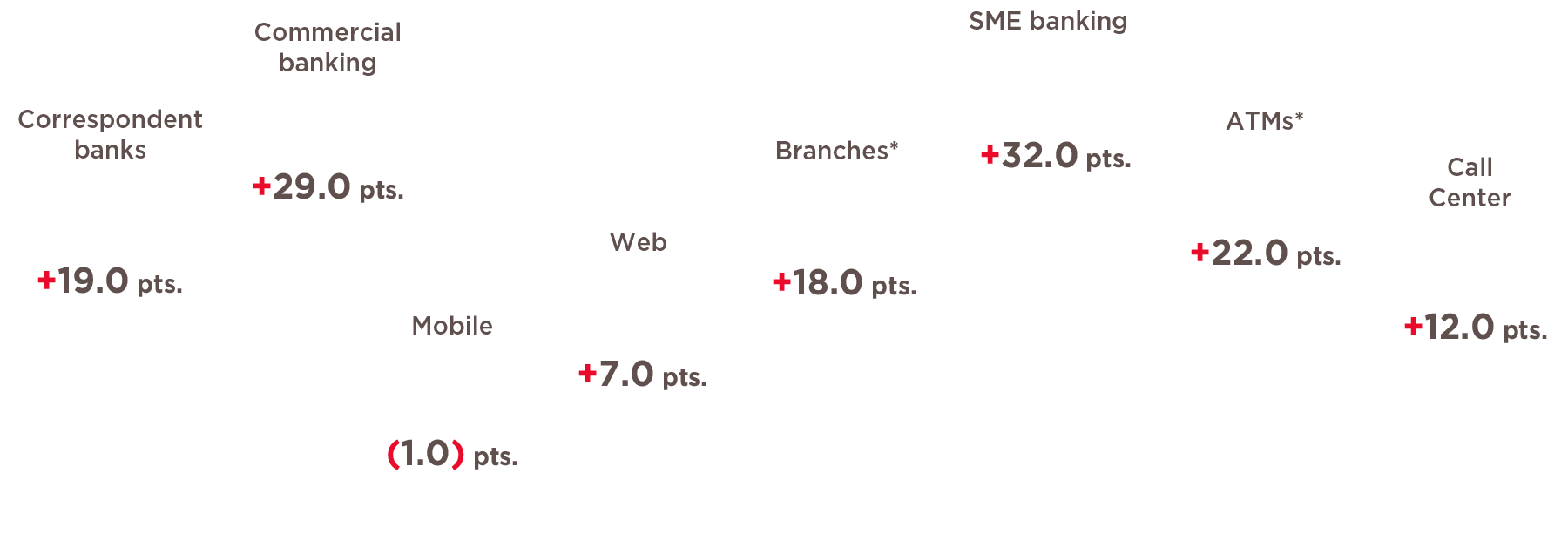

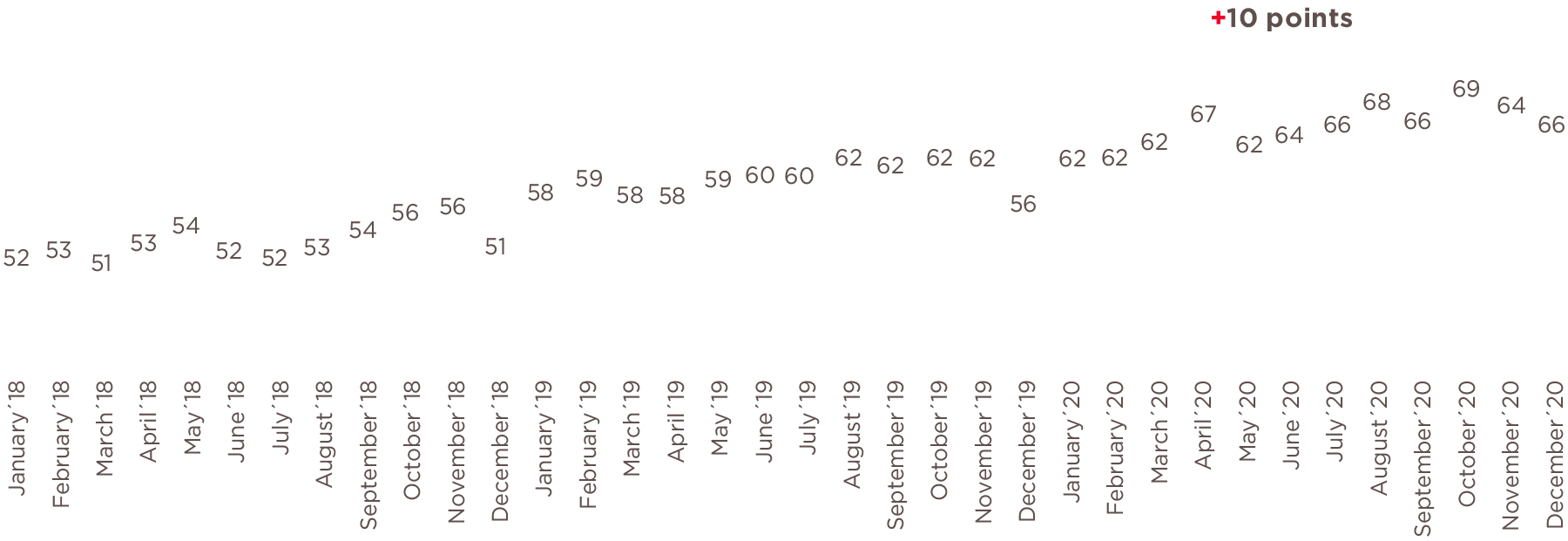

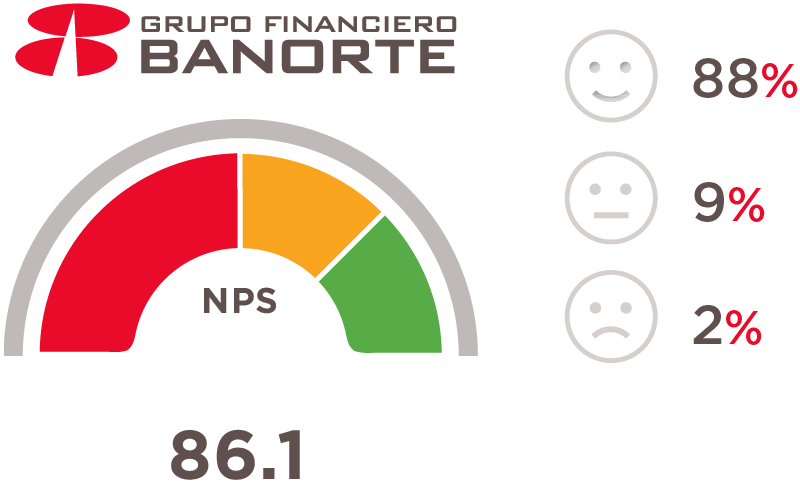

Double-digit increase in the NPS of experiences in digital and physical channels

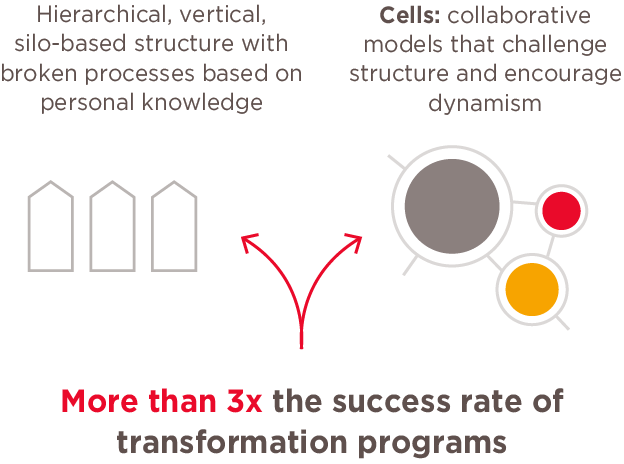

193% gain in productivity from the collaborative cell model

Employee NPS

grew by

19 points

Banorte is a better organization because of the use of data with a culture open to experimentation.

GFNorte’s global innovation strategy seeks to address the rapid pace of change taking place in the global financial industry.

The wave of digital transformation seen across all industries, and especially in the financial sector, obligates companies to make increasingly intensive use of technology. The most successful ones are those that can transform their processes to use the new technologies available on the market most efficiently.

2020 clearly brought a tremendous opportunity to further this process of digital advance in new products, and to strengthen those existing at the end of 2019, as our multi-channel sales platform, which manages the bank’s digital platform in all channels, continues to grow in scope and functionality.

These systems work in coordination with the bank’s Analytics area, so with the use of artificial intelligence techniques, we can develop campaigns more closely targeted to our clients.

The processes of digital campaigns and customer service, which encompass everything from the design phase through production on a single platform, are now available in almost all of our channels. Today, campaigns and customer service processes are already operating under this new model in mobile phones, on the web, in bank branches, call centers and tablets.

The campaign process was integrated with the contract-signing process, in order to provide clients with the best service, with preapproved offers and a simple experience that strengthens financial inclusion.

We continued developing our virtual assistant, the first in Mexico with the capacity to perform monetary transactions. This year we added new capacities, like submission of unrecognized charge claims, activation of interest-free installment payments, sending of account statements, and the ease of making transfers and payments using whatever aliases the client defines, among others. We also defined our digital assistant’s personality: a Gen-X woman named Maya, who speaks in a friendly, direct language. Today, Maya handles more transactions than any other virtual assistant in the Mexican market.

With the speed of change required by financial institutions today, an event-oriented platform is indispensable, in order to execute processes in real time, connecting to analytic and predictive systems. In this area, an event-based platform is being developed which automatically integrates the processes of customer service, sales and bank operations, to offer more transparency and greatly expedited response times.

The bank has continued to explore new technologies, calculation methodologies and the use of alternative information, both to provide a more personalized and efficient service to clients and to optimize and strengthen internal control processes. In this latter area, we are focusing on automated documentary analysis, news analysis, estimation of payment capacity and concentration limit controls, artificial intelligence for consulting regulations, and others.

We are also evaluating facial recognition technology using artificial intelligence to enhance security and improve the client’s experience by identifying them and meeting their needs in advance.

This year we created a space for learning with our “Ingenio 20|20” lecture cycle, the purpose of which was to promote a culture of innovation. Experts spoke on topics such as blockchain technology, open banking, new models, hybrid intelligence, cybersecurity, design of future scenarios, digital transformation, machine learning, sustainability and digital identity, among many others.

“

We conducted pilot testing with various institutions on the use of blockchain technology..”

In 2020, we focused our efforts on digitalizing and achieving a closer understanding of clients. As regards the first aim, various areas of the financial Group worked with other organizations like the Duke University Center for Advanced Hindsight, to eliminate barriers to the adoption of the bank’s mobile app. We also displayed more personally-targeted offers in digital channels, which translated into a more fluid communication with clients and a deeper, more lasting business relationship.

Closer understanding of our clients has been leveraged on three main aspects:

This has been instrumental in bringing them the right offers in terms of price and opportunity, and through non-intrusive channels.

Artificial intelligence applications developed by Banorte were recognized this year by the globally prestigious Alconics award.

Also during the past year, we adopted some broad-based experimental methods for accelerating our learning about clients. This has made Banorte a better organization through the use of data with a culture open to experimentation. This culture change owes much to a workshop given by the Analytics team on the use of data to improve decision-making processes in banking, with extensive involvement by GFNorte’s leaders. Various initiatives linked to this workshop were put in place in the second half of the year.

A number of indicators were developed using big data to arrive at a more timely and precise reading of the country’s recovery from the economic crisis unleashed by the pandemic. In collaboration with the Risks team, various models were developed that enabled us to assist clients whose risk profile may have been affected by the crisis sweeping the country.

In 2020, Grupo Financiero Banorte made further progress in adopting a culture that leverages data and is willing to experiment to better serve its clients.

“

More than 11K employees participated in the Ingenio 20/20 cycle of conferences.”

102-44, 416-1, 103-1, 103-2, 103-3, FS5, FN-IN-270a.4, FN-AC-270a.3

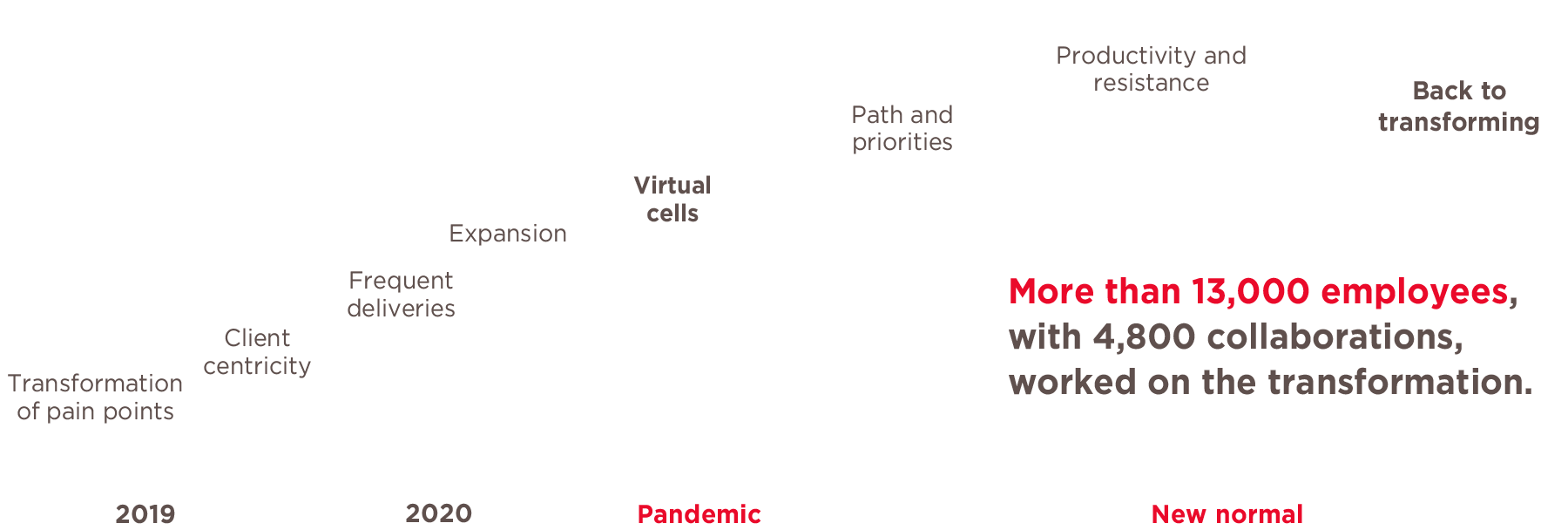

This year we reasserted our client-centric approach. This was made possible by the collaborative model for mass transformation of our processes and by the improvement of experiences. The model is based on two key factors: listening to the customer’s voice in all points of interaction with the bank, as measured by the Net Promoter Score (NPS) index, and process transformation, thanks to multidisciplinary teams, Banorte Cells, and the involvement of talent from the organization who, during the pandemic, accelerated the pace of value delivery through Virtual Cells, aligning it with the clients’ needs. As a result of the transformation, we recorded a double-digit improvement in NPS scores from clients on their experiences in digital and physical channels.

*Includes information from 2017.

Currently, a robust digital banking program and dedicated work team in the Cells enabled us to address their needs and continue our business, aligning processes with the new way of interacting with and serving our clients. This enabled us to migrate physical branch operations to digital channels, and to achieve a 45% growth in digital banking transactions over 2019.

The strategy of continuous, close and empathetic communication with clients and employees enabled us to act and adapt our processes immediately: changing interaction in branches, health protocols and digital advisory services, which were key to caring for our clients and employees. According to global experts in customer service, the top-performing brands in the pandemic grew their NPS by five points over 2019. Banorte grew its NPS score by more than 10 points.

“

Cells enabled the organization to focus on what was most urgent, and ensure business continuity.”

Cells are multi-disciplinary teams that bring together the talent of the entire organization, break down hierarchies and drive dynamism and innovation by transforming experiences. In Cells, people can analyze the gaps that need to be bridged to meet client needs and expectations, and through an agile methodology, develop and implement processes that bring value to clients and employees.

Cells work across the entire Group with a single directive: client centricity. In 2020, this collaborative, mass transformation model generated a 193 percent increase in productivity.

“

Cells are not just a way of working—they are a culture at Banorte that enables us to transform the service that clients require.”

During the year, Cells generated more than 1,400 value deliveries, making Banorte a benchmark in service and driving a 23 point increase in the competitive NPS score compared to 2017.

Their success lies in their focus on results, the participants’ commitment, the rotating leadership, pride in achievement, sense of belonging and talent of each employee.

In this new reality, we assist and guide clients in the use of digital channels, facilitating the digital experience supported by omnichannel technological architecture.

One example of this is the “Enlace Digital” account, which can be opened via digital channels, without having to go to a physical branch. So, the client can in a matter of minutes carry out Mobile Banking transactions, including the use of a digital charge for purchases and bill payments with maximum security.

Our virtual assistant, Maya, is an artificial intelligence robot who can handle transactions, information inquiries and disputed charges with a connection to executives in the call center to ensure the best experience. Maya earned us an increase of more than 25 points in the customer satisfaction index.

The availability of products and services through the digital channel and the ability to acquire products like promissory notes, mutual funds, credit cards, insurance, payroll loans and others, enabled us to improve relations with our clients and to protect them by giving them a range of banking options that did not require going to the branch. At the same time, they generated pleasurable experiences, as evident in the NPS.

As part of the “Customer’s Voice” effort, two programs were introduced to address employees’ needs.

Banorte is a solid bank

Banorte is a bank with social commitment

Banorte is focused on improving the client’s experience

Banorte is an innovative bank

Social media at Grupo Financiero Banorte represent an increasingly important channel for serving our clients, because they facilitate personalized contact.

Our social media, through which we serve our clients, today gather together more than a million followers, and in 2020 positive sentiment reached a peak. Some outstanding events included the launch of support programs, “El Buen Fin Banorte” and the launch of queuing on WhatsApp.

2020 was a year of challenges and changes, in which communication with the client, transformation and the adaptation of processes and new experiences, helped us to keep, and to strengthen, our value promise and their trust.

“

Our brand value: US$ 1.76 billion.”

In a matter of months, everything changed. Not just our lives but our way of working, our way of seeing the world. And once again, we proved what we mean when we talk about being Mexico’s Strong Bank.

2020 was a year marred by uncertainty, which is why we decided to reinforce our communication with clients. We wanted them to be absolutely sure about one thing: whatever happens, they can count on Banorte.

Since the pandemic broke out, we put ourselves in our clients’ place, multiplying efforts, because it wasn’t just about resolving the most pressing situations; we needed to react swiftly while transmitting calm at the same time.

We offered them the ability to address their needs securely through our digital channels and our alternative channels, minimizing any possible risk. At our branches, we applied protocols in order to maintain service while keeping everyone safe.

We were the first bank to offer clients the option of deferring their credit payments, benefiting more than 630,000 of them. Other banks followed suit, even at the urging of their own clients on social media. A Banorte action that reminded others of what it’s like when you work from the heart.

Reality brought a succession of surprises during the year. Before we could adapt to one change, another would follow hard on its heels. But we found new ways to help clients with their needs, through 100% secure digital processes and products like our Enlace Digital account.

We joined forces with Rappi to find new solutions, and with Marriot and Mastercard to support the healthcare professionals who have put their lives on the line to care for us all.

We made our best offers of products and services so that our clients never have to stop growing, adapting to the new reality, doing business and following their dreams. Because above all, we believe there is more to Mexico.

2020 changed our lives, but our commitment to 29,000 Banorte families, 11 million clients, and our love for Mexico, is as strong as ever.