We updated our materiality matrix

+2K hours of online training in ESG aspects

First exercise in analyzing impact through the UNEP-FI Portfolio Impact Tool

The involvement of our stakeholders is crucial to achieving our long-term goals.

Our current sustainability strategy’s model is sustained by three pillars: Environment, Social and Corporate Governance. These converge into a central pillar called Sustainable Finance.

Initiatives aimed at mitigating the environmental impact of our operations through resource use efficiency and a culture of environmental care inside and outside of the institution.

Social programs created to improve quality of life for our employees and for the communities where we have a presence.

Principles and standards to ensure the proper functioning of the institution’s governance body, complemented by solid risk management and efficient decision-making.

(ESG) factors integrated in evaluating risk in our portfolios and in the products and services we offer, in order to create sustainable development.

102-44, 102-46, 102-47

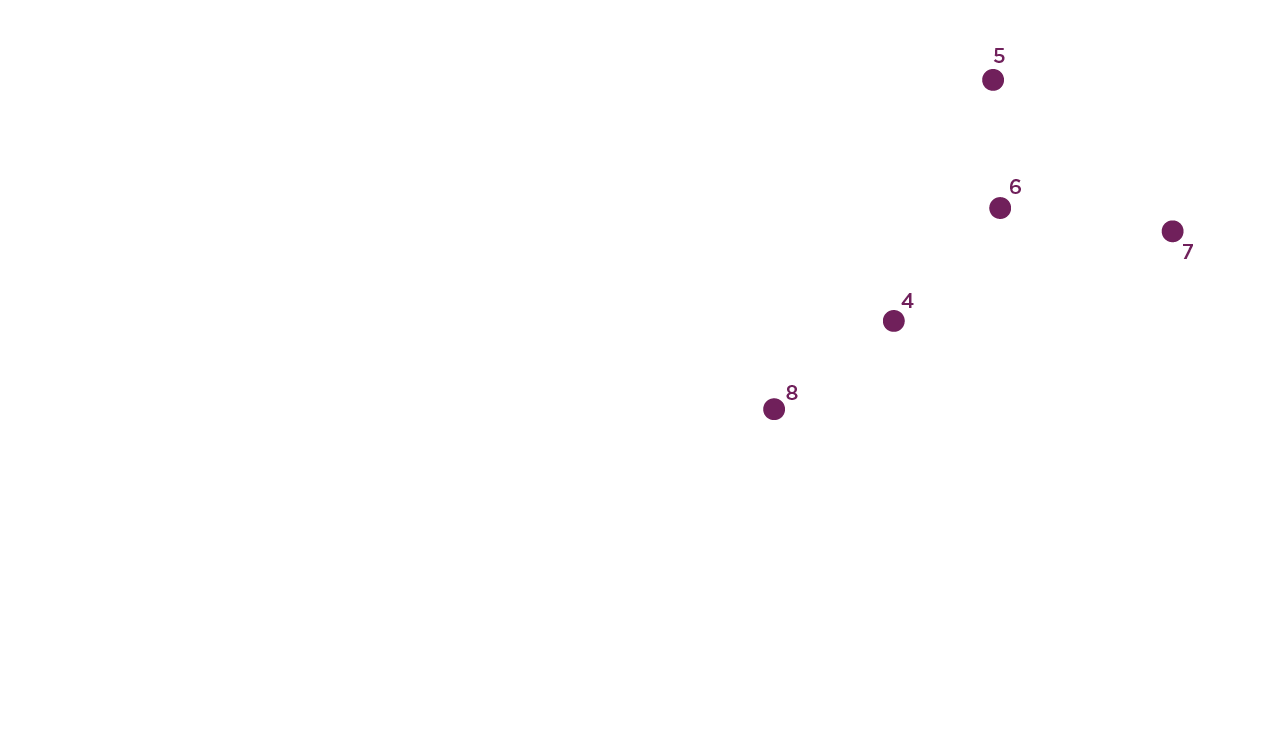

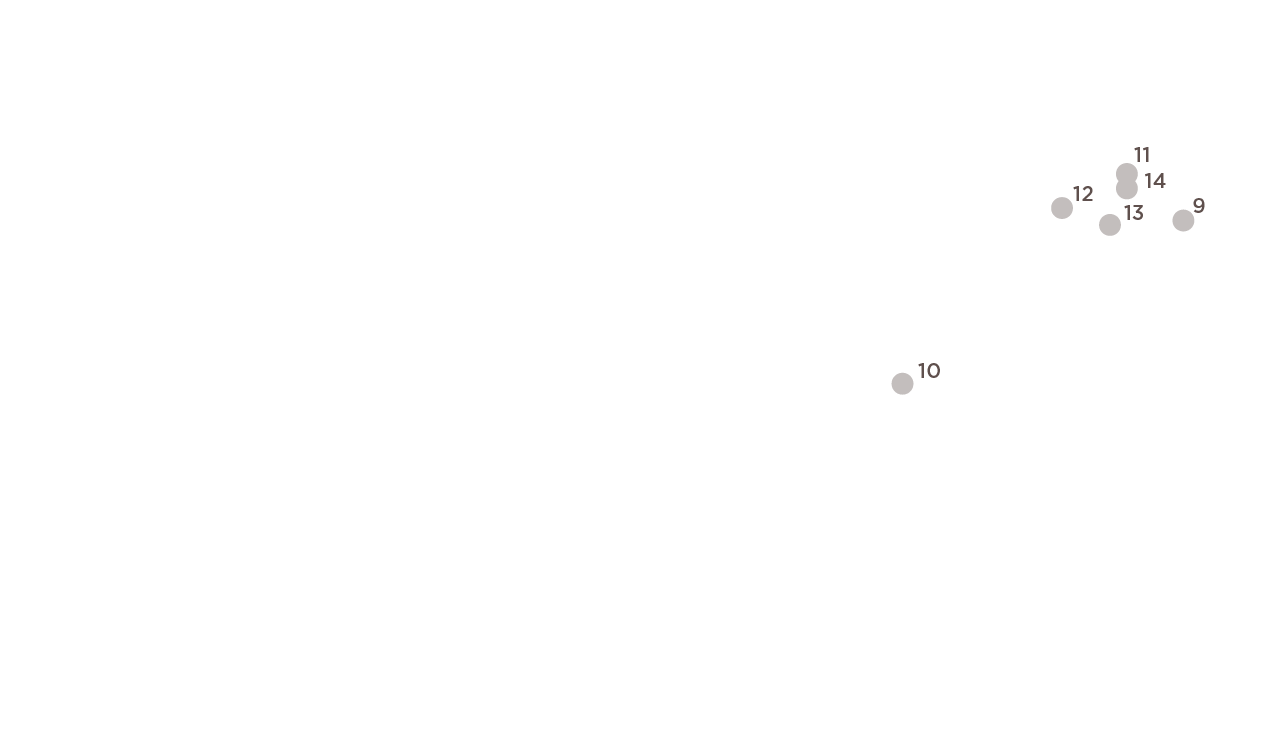

To stay informed of our stakeholders’ perspective and of global trends in our industry, in late 2020 we updated our materiality matrix. This exercise also enabled us to align our sustainability model with the issues most relevant to our company.

Methodology:

For more details on this exercise and its results, click on this link:  https://investors.banorte.com/en/sustainability/commitment-and-strategy/materiality

https://investors.banorte.com/en/sustainability/commitment-and-strategy/materiality

102-13, 102-21, 102-40, 102-42, 102-43

We at GFNorte recognize our stakeholders as fundamental in our relationship with and commitment to the world inside and outside of our organization, and we know that their involvement is crucial for achieving our long-term goals. With this in mind, we have identified our primary stakeholders and defined various dialogue channels that guarantee that we are continuously communicating with them and addressing their concerns.

102-12

Since 2009 we have participated in significant sustainability initiatives and indexes, nationally and internationally. These enable us to remain at the forefront of our industry in priority issues and to be agents of change in ESG matters.

We will always support initiatives that support sustainable development.

Contributions:

Various international rating agencies have consistently rated our performance in ESG matters, which have been increasingly important to investors around the globe. We know that delivering outstanding results in this regard enables us to be join and remain in sustainability indexes, which in turn allows us to attract and retain international investors.

| ESG Rating agency | 2018 | 2019 | 2020 | Membership in index |

|---|---|---|---|---|

| Bloomberg (1) | 47.8 / 100 | 47.8 / 100 | 44.3 / 100 | Bloomberg Gender Equality Index (GEI) |

| CDP (2) | C | B | A- | |

| FTSE Russell | 3.6 / 5 | 3.9 / 5 | 3.7 / 5 | FTSE4Good Emerging Markets Latam FTSE4Good BIVA |

| MSCI (3) | A | A | AA | MSCI ACWI ESG Universal MSCI ACWI Climate Change MSCI EM ESG Universal MSCI EM ESG Focus MSCI Mexico ESG Universal |

| SAM CSA | 65 / 100 | 61 / 100 | 62 / 100 | Dow Jones Sustainability Index MILA S&P/BMV Total Mexico ESG Index |

| Vigeo Eiris | NA | 45 / 100 | 44 / 100 | Best EM Performers Ranking |

| Banco Interamericano de Desarrollo (BID) | ND* | ND* | ND* | Index Americas |

*The IBD does not conduct its own assessment; it uses ratings from Vigeo Eiris.

102-12, 102-13, 102-15, FN-IN-410b.2

Firmly committed to the Sustainable Development Goals (SDG) and the Paris Agreement, we joined the Principles for Responsible Banking as founding members. After two years of work on implementing this vital set of guidelines, we are presenting a summary of the actions taken by Banorte, which are also discussed in detail throughout this document.

The full report in the official PRB format can be viewed at:  Banorte’s PRB Reporting and Self Assessment

Banorte’s PRB Reporting and Self Assessment

In 2020 we conducted our first impact assessment by applying the Portfolio Impact Analysis Tool developed by the United Nations Program for the Environment Financial Initiative (UNEPFI), by which signatories of the Principles for Responsible Banking can comply with the requirements of principle 2 (impact analysis). The methodology provides a resource map for tracking indicators relevant to various areas of impact and a point scale indicating their level of need by country, depending on the nature, content and geographic scope of their portfolios.

The purpose of this analysis is to evaluate how banks are performing at present and set targets that increase their positive impacts and reduce their material negative impacts. Our pilot test of this tool consisted of identifying and matching Banorte’s financing sectors with the International Standard Industrial Classification (ISIC). We then studied the breakdown of our portfolio as of the third quarter of the year and selected, in a first scope of analysis, Corporate and Commercial banking, which make up 42% of our total portfolio.

The actions taken and their results were as follows:

Based on this first assessment, we intend to establish goals aligned with the observations and broaden the scope of the pilot phase to Retail and Government Banking. We will also be making adjustments in our portfolio to strengthen sectors with positive impacts and better manage economic activities with negative impacts, to further the commitments of the business areas and our clients toward innovation that can further the transition toward a more sustainable economy in this country.

“

In 2020 we conducted the first exercise in analyzing impact through the UNEP-FI Portfolio Impact Tool.”

102-12, 102-13, FS-8

As signatories of the Principles for Responsible Banking, we are committed to the Sustainable Development Goals laid out by the United Nations Global Compact. For Grupo Financiero Banorte, these goals have served as a frame of reference for us to set business goals linked to social and environmental goals in Mexico toward the year 2030.

Accordingly, in 2021 we will participate in two initiatives in collaboration with the Global Compact which will allow us to create new business models to drive innovation and offer tangible solutions to meet our goals towards 2030.

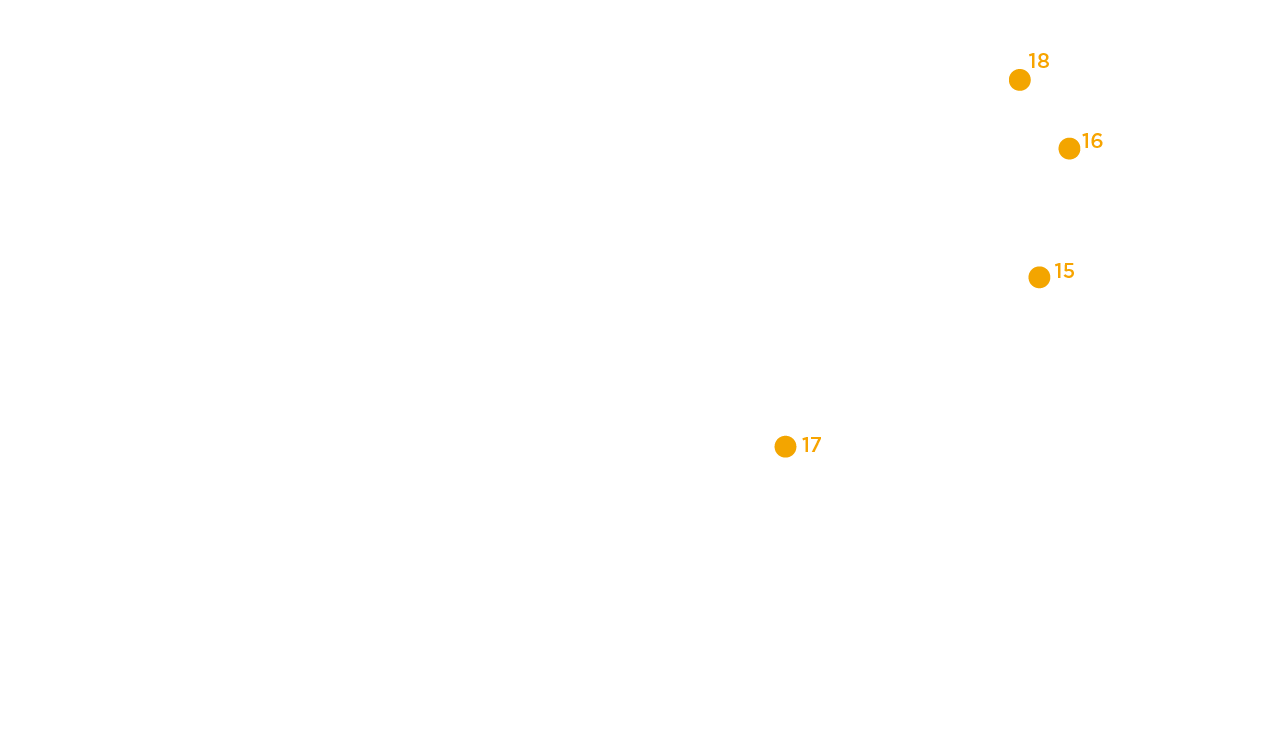

Starting in 2018, when we identified our contribution to each of the 17 Goals, every year we measure our performance in terms of ESG indicators to identify the progress GFNorte has made in sustainability.

“

As signatories of the Principles for Responsible Banking, we are committed to achieving the SDG of the United Nations Global Compact.”

| Degree of contribution |

HIGH

LOW

|

||||

| Material issues | |||||

| Competitiveness and Business Development |

Social and economic inclusion 214 hours of volunteer time 125 volunteers 10,914 beneficiaries 68 financial education workshops |

Sustainable We are part of the most important global sustainability indexes |

Energy Consumption 2.28 tCO2e/employee 17.04 GJ/employee 16.71 GJ/employee-energy-net income 2.24 tCO2e/Ps.mn net income |

Proper Waste Management 47.8 % of waste recycled 1,231.7 metric tons sent for recycling 105 metric tons of paper saved through digital initiatives |

Reforestation 7,500 trees with forestry maintenance 7.5 hectares with forestry maintenance |

| Product and service innovation |

Payroll and SMEs 7,180,161 payroll accounts 40,063 payroll companies 17,598 SME clients 609,923 jobs generated |

Physical and Digital Infrastructure 16,984 correspondents 1,193 branches 9,387 ATMs 2,946,732 Mobile Banking users 3,669,281 Online Banking users 51,124 Peper users |

Infrastructure Investment of Ps. 49.36 billion in social development projects: safety, mobility, urban complexes and public lighting |

Financial products by gender 47% credit cards for women 239,685 Mujer Banorte accounts 47% debit cards for women 57.7% remittance clients |

Major Medical, Personal and Life Insurance 663,600 MME policies 5,268,068 people with personal accident insurance 4,761,196 people with life insurance |

| Education and development |

Salaries and benefits 1.2% gender gap adminstrative workers, 12.8% gap middle management, 12.4% senior management |

Employee Training by Gender 390,510 hours of training for men 399,715 hours of training for women 50 hours average training per employee |

Education and Training 4 “Professionalize your talents” workshops 4 “Building and Growing” workshops 1,528 “A Thousand Dreams to Fulfill” scholarships |

Banorte Adopts a Community 134 homes built |

Agricultural Finance and Banking Ps. 4.89 billion in loans to small producers, businesses or communities 30,350 small producers benefited 366,747 hectares of cropland 6th in placement of loans |

| Socioenvironmental assessment of transactions |

Environmental and Social Risk Management 3,383 loans analyzed (54.1% of corporate portfolio and 61.1% of commercial portfolio) 17 projects evaluated under Equator Principles 8 under Performance Standards 1 under SEMS Assessment |

Home and Casualty Insurance 199,972 homes insured for casualty 5,157 offices insured for casualty 354 hotels insured for property loss 437,123 risks ensured for natural disaster |

Renewable Energy Ps. 8.89 billion in renewable energy project loans (Infrastructure and Energy Banking) 10 renewable energy projects financed in Infrastructure and Energy Banking Ps. 15.16 billion in SME Eco-Loans outstanding |

Emerging Risk Mitigation 4 internal reports on sargassum 1 article about water 5 articles about COVID-19 and ESG factors 404 recommendations |

|

| Ethics and integrity |

Internal Policies We encourage a culture of respect in our corporate offices and in attending to our clients.  Code of Conduct* Code of Conduct* Human Rights Policy* Human Rights Policy*

|

Corporate Governance We have a solid corporate governance that guarantees ethical, responsible management of the business. |

Integral Alliances United Nations Program for Development, Mexico Application of Impact Management Tool for Banorte remittances* Analysis of contribution to SDG in collaboration with SAP Platform* |

* Available information in our:  https://investors.banorte.com/en/sustainability/commitment-and-strategy/sustainable-development-goals https://investors.banorte.com/en/sustainability/commitment-and-strategy/sustainable-development-goals

|

|

102-21, FS4

Aware of the crucial need to transmit a sustainable culture throughout the Group, we created a network of sustainability ambassadors to disseminate good practices, updates on internal programs and the latest sustainability news. Today the network consists of more than 550 employees working out of Mexico City and Monterrey.

Ongoing training in the Credit, Commercial and Risk areas is a priority for building a culture of socioenvironmental risk management and sustainability at GFNorte. We are confident that we can better manage our impacts through awareness-raising and skill-building. With this in mind, in 2020 we strengthened our annual online training program, investing 2,031 hours in 1,358 employees.

| Topic | Topic Target audience Number of | Number of employees | Hours of training |

|---|---|---|---|

| Introduction to socio-environmental risk management | Commercial, Banking, Corporate and Credit | 42 | 42 |

| Do you remember what SEMS is? | Credit, Risk, Commercial and Infrastructure areas | 1,358 | 679 |

| The Equator IV Principles | Credit, Risk, Commercial and Infrastructure areas | 1,330 | 665 |

| Principles for Responsible Banking | Credit, Risk, Commercial and Infrastructure areas | 1,275 | 637 |

| Topic | Target audience | Number of employees | Hours of training |

|---|---|---|---|

| Monthly messages regarding socio-environmental risk cases and other news of interest | Sustainability Champions | 75 | 6.25 |

| Articles and recent research on the importance of sustainability and ESG factors in the time of COVID-19 | Risk and sustainability subgroup | 19 | 1.6 |

Every year, Banorte holds a Sustainability Week event for its employees, offering activities, talks and workshops in order to build awareness about environmental, social and economic issues.

Our 2020 Sustainability Week was attended by:

We also organized a Fair Trade Fair to publicize and promote the sale of merchandise from organizations that work on a fair trade basis.

In 2020, the sustainability and credit card teams worked together to create new sections in the Banorte Total Rewards catalog that promote causes like communities and the environment. Due to the public health emergency, the Fair Trade Fair this year was held online, by opening a space for employees to make responsible purchases from home.

“

Sustainability Week, an event aimed at employees consisting of activities, talks and workshops that build awareness about environmental, social and economic issues.”