Mexico remains a great option for investing. As we enter into a period of uncertainty about the future of bilateral relations between Mexico and United States, as a result of the new administration’s proposals in our neighboring country, macroeconomic stability - with an autonomous central bank, public finance and external accounts under control as well as a well capitalized banking system - make Mexico an attractive country for investment within the emerging economies. The opening of the energy industry, as well as the gradual implementation of structural reforms, are laying the groundwork for more robust growth in the medium term. According to our analysis, although we anticipated a slowdown in the pace of growth of 3.4% in 2016, to 1.1% in 2017, we also anticipate a rapid recovery of the economic dynamism in 2018 and acceleration towards sustainable growth rates between 3% and 4%.

The 2017 Labor Reform has led to formal employment growth at rates higher than the GDP.

The opening of the energy sector and progress of public-private partnerships allow channels to open for investment in infrastructure.

The residential sector has been recovering its rate of growth following the strong downturn in 2013.

At Grupo Financiero Banorte, we see the low credit penetration in Mexico as a great opportunity to support growth projects in the country.

The first projects in which Pemex partnered with a private company to carry out exploration and production processes (farm outs) were assigned in 2016.

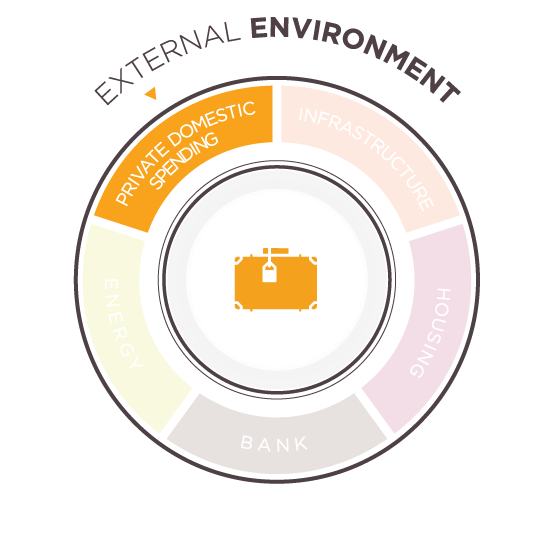

PRIVATE DOMESTIC SPENDING

Private spending has been one of the economy’s main drivers, thanks to higher levels of employment and a healthy expansion of bank credit. However, it is likely that temporary inflation pressures, coupled with the aforementioned uncertainty, will cause consumer spending to moderate its pace of growth this year, only to accelerate in 2018. The labor reform - approved in 2017- has led to growth rates of formal employment higher than the GDP, which has been key to boosting credit demand and raising growth rates for domestic spending in recent years.

INFRASTRUCTURE

The need to provide modern and efficient infrastructure in our country gives this sector significant potential and represents a huge opportunity for development. Unfortunately the pressure placed on public finances has resulted in cut backs on infrastructure projects in recent years. However, the opening of the energy sector and progress of partnerships are allowing channels for investment in infrastructure to open.

HOUSING

Housing needs in our country remain significant. The residential sector has been recovering its growth rate following the strong downturn of 2013.

BANK

The Mexican financial system is one of the world’s most robust and well capitalized. However, banking penetration remains relatively low - commercial bank loans to the non-financial private sector, for example, just barely over the GDP of 17%, one of the lowest ratios in Latin America.. And even if this low penetration could be explained by the high degree of informality of the country’s economic activity and the difficulty of banks to recover collateral, rapid technological advancement and financial reform could benefit the process of providing banking services to the population. At Grupo Financiero Banorte we see the low credit penetration in Mexico as a great opportunity to support projects for growth in the country, as well as fulfill the dreams of many Mexicans. Above all because we are a bank operated by Mexicans, for Mexicans.

ENERGY

Although the short-term trend towards declining oil prices has reduced the appeal for investing in the sector, the process of opening up to private investment continues. In 2016, the first projects were assigned in which Pemex partnered with a private company to carry out exploration and production process (farm outs) in 2016. The process of opening up the energy sector also continues to go forward. Finally, the Government has advanced the liberalization of the fuels market, although this has generated short-term inflationary pressures, we think that it will be an important factor in improving competitiveness and increasing investment, and that it will help reduce the pressure on public finances in the medium term. The process of opening up the energy sector to private companies also continues.

Gabriel Casillas Olvera

Deputy General Director of Economic Analysis

“According to our analysis, despite the 3.4% reduction in growth rate in 2016, and the anticipated 1.1% reduction in the growth rate in 2017, we anticipate a rapid recovery of the economic dynamism in 2018 and acceleration towards sustainable growth rates of between 3% and 4%.”

Gabriel Casillas Olvera

Deputy General Director of Economic Analysis